Australian Trading App moomoo Launches Free 24-Hour US Trading, a First in Australian Market

Sydney, Australia - moomoo, the AI-powered Australian trading app, is excited to announce the introduction of 24-hour US trading, enabling investors to trade selected US stocks and ETFs 24 hours a day, five days a week. This move, a first in the Australian market, marks a significant expansion of the technology platform's capabilities and opens new opportunities for investors who want to trade outside of Australian trading hours.

With the introduction of 24/5 US trading, moomoo users now have access to trading hours that cover the entire day, from 10am Monday to 10am Saturday (AEST). This means that investors in Australia will be able to trade a list of 165 US stocks and ETFs during Australian daytime hours, as well as night. This move will provide more flexibility for investors and allow them to take advantage of market-moving events that occur outside of Australian trading hours.

“When investing in US markets from Australia, some old-school brokers make you place your orders by 11am or 2pm, and then you wait until the next day to see whether you have traded. Lots of things can happen during that time and you can miss big market moves,” explains moomoo Australia Chief Market Strategist Matt Wilson.

“Moomoo has access to market makers that provide live prices 24 hours a day, five days a week. So, you can take advantage of market moves during Australian hours and while the US is asleep. You get instant trade confirmation, without the need to wait 24 hours to see whether you have dealt or not.”

The expanded trading hours affords moomoo users greater access to the US markets, which is critical for those looking to diversify their portfolios, manage risk robustly and take advantage of opportunities in global markets.

“Australia makes up less than 2 per cent of global equity markets, so if you are limiting your investment horizon to local stocks you are missing out on a lot of investment opportunities,” Wilson says.

“Investors love stocks they are familiar with and that’s why it’s important to have access to some of the world’s most well-known brands like Apple, Google, Meta (Facebook), Amazon, Tesla, Disney, Microsoft and Nvidia, as an example. These stocks are powerhouses driving the global economy, so why not invest in them?”

Moomoo is committed to improving the financial literacy and wealth of Australian investors of all experience levels by providing users with free access to advanced technology and educational resources. 24/5 trading for selected US stocks and ETFs is available on moomoo Australia now. For more information on moomoo's 24/5 US trading, visit the website here

It's important to note that the overnight session belongs to the next trading day (T+1). For instance, if you trade during the overnight session on Monday night (EST), it will fall into a trade placed on the trading day of Tuesday (EST).

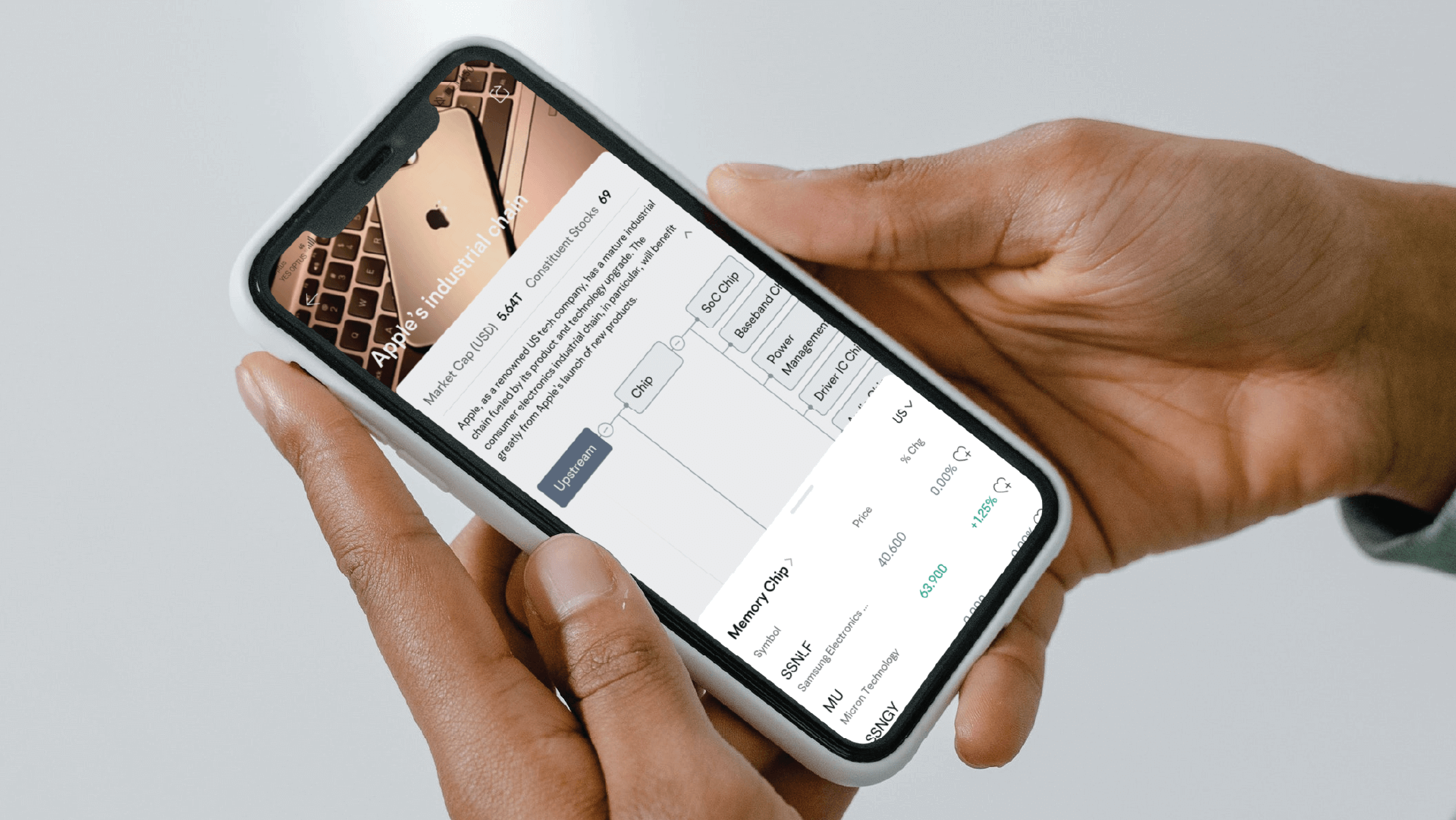

How to place an order during the overnight session

1. To see if the stock you are interested allows for overnight trading, search and select the stock ticker using the search bar.

2. Select the stock hit the ‘Quotes’ header on the top left.

3. Scroll down until you see ‘Sessions’. If there is an ‘Overnight Trading’ option, you can trade this stock 24/5.

About moomoo

Based in Sydney, Australia, moomoo AU is part of Futu Holdings Ltd, a Nasdaq-listed (NASDAQ: FUTU) advanced Silicon Valley fintech company with a market cap of US $6bn as of 12 May 2023. Moomoo’s mission is to redefine the way Australians trade and invest in stocks by incorporating artificial intelligence and institutional trading tools into an affordable and accessible, yet powerful platform. Futu Holdings Ltd was ranked second in Fortune magazine’s 100 FastestGrowing Companies list in 2022.

Moomoo aims to provide all investors with an intuitive and powerful investing platform, built with proprietary technology. We leverage our deep technological R&D capabilities and client-centric operating model to constantly improve our clients' experience and drive industry-wide innovation.

Futu, moomoo’s parent company, is a Hong Kong-based digitised brokerage and wealth management platform serving more than 19 million users in more than 200 countries. The founder, Leaf Li, was one of the first product managers at the tech giant Tencent. Li founded Futu in 2011 after growing increasingly frustrated at the limited brokerage choices there were available for him to invest with and the high fees most brokerages charged. Li took a page out of Tencent’s book and invested heavily in the research and development of the platform and continues to do so today with around 70% of all staff in R&D roles. Moomoo was founded in Palo Alto in 2018 with a strong customer and technology focus.

For more information, please contact:

Chantal Walsh

Communications Manager, moomoo Australia

pr@moomoo.com

0424 943 85

Trade like a pro with moomoo

Get free stock and start your professional trading today

Open Account Terms and conditions apply-

Moomoo Market Strategist Jessica Amir on Biztech Asian Midday Market Watch

Moomoo Market Strategist Jessica Amir speaks with Biztech Asia’s Brian Fernandez on Asian Midday Market Watch on investing opportunities amid China’s stimulus. She also covers the risks with El Nino, yet how investors can take advantage of higher crop and commodity prices. Watch the full interview above.

2023/08/04

Read More -

Share trading: five things to look for in your trading platform

Online investing has become popular amongst Aussies looking to grow their wealth. But that doesn’t mean all share trading platforms are born equal.

2023/07/05

Read More -

Digital share trading powers Australian investors

As online share trading grows rapidly in Australia, with investors turning in increasing numbers to digital platforms, they must first carefully consider which platform to use, based on criteria around risk, features, innovation and technology.

2023/07/05

Read More