How to Read Candlestick Charts

Candlestick charts are regularly used by investors and traders in order to identify changes within the market across stock prices. In trading, candlestick charts are price charts that identify trends and reversals, with prices denoted by candlesticks. This method of price representation found its origins in Japan, where it first was used as far back as the 1700s, when the concept originated with Munehisa Homma (a rice trader), who used candlestick charts in the rice futures market. He used each candlestick to graphically represent the four dimensions of price within a trading period: the open, the high, the low and the close.

What are candlestick charts?

In the present time, candlestick charts are used as a tool to track trading prices across financial markets, including forex, commodities, treasuries, indices and the overall stock. While stocks represent the largest kind of traded financial instruments, all of these markets are tracked alongside each other, with the prices these instruments are traded at recorded and visually displayed within candlestick charts. These tools have risen in prominence, and are now one of the most prevalent methods of representing prices across varying markets.

Investors who are looking to build their trading skills can turn to the skill of candlestick chart analysis as one method of investment development. Within a candlestick chart, the prices of financial instruments are plotted through technical analysis. These charts can then be interpreted through individual candles and their patterns. Bullish and bearish candlestick patterns can both be monitored, with bullish candlestick patterns used to initiate long trades, and bearish candlestick patterns used to initiate short trades.

History of Candlestick Charts

Munehisa Homma was a wealthy Japanese businessman who first developed the candlestick chart method in order to analyze the price of his rice contracts. He began trading on the local rice exchange in Sakata, Japan around 1750, keeping records of the market psychology in order to boost his profits. Homma was focused on identifying the factors that led to increased prices for his rice, refraining from rushing into trades, and instead looking to the candlestick chart method he developed in order to identify opportunities for further profitability.

Today, Homma is viewed and respected as the grandfather of candlestick charts, thanks to his research on price pattern recognition. While the trend originated in Japan, it soon became widespread, and now is an essential tool for investors around the world in analyzing trends and reversals on the stock market.

What do candlesticks tell us?

Candlesticks provide investors with instantaneous snapshots across whether a market’s price movement has been positive or negative, and to what degree. Candlesticks vary in the timeframe they represent, with users able to set them to longer or shorter in order to gauge market movements within relevant windows.

However, candlestick charts are useful in revealing more than simply the movement of price over time. Experienced traders use candlesticks to identify patterns, gauging market sentiment and building predictions about what may happen next in the market.

Astute investors learn to recognize the signs of candlestick charts, feeding that data and information into their investment strategies accordingly.

If a candle has a long wick at the bottom, this could mean that traders are actively buying that asset as its prices fall. This may indicate that the asset is on its way up, increasing in price. If a long wick is at the top of a candle, on the other hand, this may indicate an appetite for profits within traders, which can signal a mass-scale potential sell-off on the horizon for that stock.

If the body occupies almost the entire candle and it has either short wicks or no visible wicks on either side, this can indicate a strongly bullish sentiment (when on a green candle) or a strongly bearish sentiment (when on a red candle).

When investors study candlesticks in order to develop context across a particular asset or during certain market conditions, this is a part of a trading strategy called technical analysis. Here, investors are looking to use past price movements to find future trends and opportunities.

Candlestick Components

Candlestick charts have a number of components, which are all relevant in understanding what their data is reflecting. Understanding these components is the first step in making use of candlestick charts in your investment journey.

Body

A candlestick’s body is drawn as a rectangle which marks the open and close of a given time period, depending on the investor’s specifications of which time period they’d like to investigate.

Color

Different trading platforms will alter the color of their candlesticks. Often, a down candle is shaded red instead of black, while up candles are shaded green rather than white, providing investors with easily digestible signals within the design of the candlestick charts.

Wicks

Wicks on a candlestick are drawn as two vertical lines - one above and one below the candle’s body. The wick marks both the high and the low that the price has reached within the defined period. The overall candlestick range is defined by the extreme high of the top wick and the bottom wick’s low.

Candlestick vs Bar Charts

Bar charts are similar to candlestick charts, as they reflect similar data: open, close, high and low prices. However, there are a number of slight differences between them, with the most obvious one being the visual look of the bar chart itself. Bar charts are made up of vertical lines, with short horizontal lines coming out of either side of the vertical line.

Both bar and candlestick charts can be useful in telling the volume of the market with their heights, as opposed to line charts, which don’t provide insight into this data.

Bar charts place more emphasis than candlestick charts on the closing price of the previous period than the opening price of a given period. While this is a key difference, it often doesn’t have a large impact, as more often than not, the opening price of a certain period is the same as the closing price of the previous period.

Forex candlestick trading patterns are largely drawn from candlestick charts, rather than bar charts. Candlestick charts are preferred as these patterns are developed specifically based on them.

Bar charts are at times preferred by investors who want more precision when drawing trendlines and zones on the chart, simply because bar charts are solely lines, while candlesticks have bodies that take up space. While the difference may be negligible, professional traders may opt for one over the other in order to inform their trading decisions.

Open, high, low and close

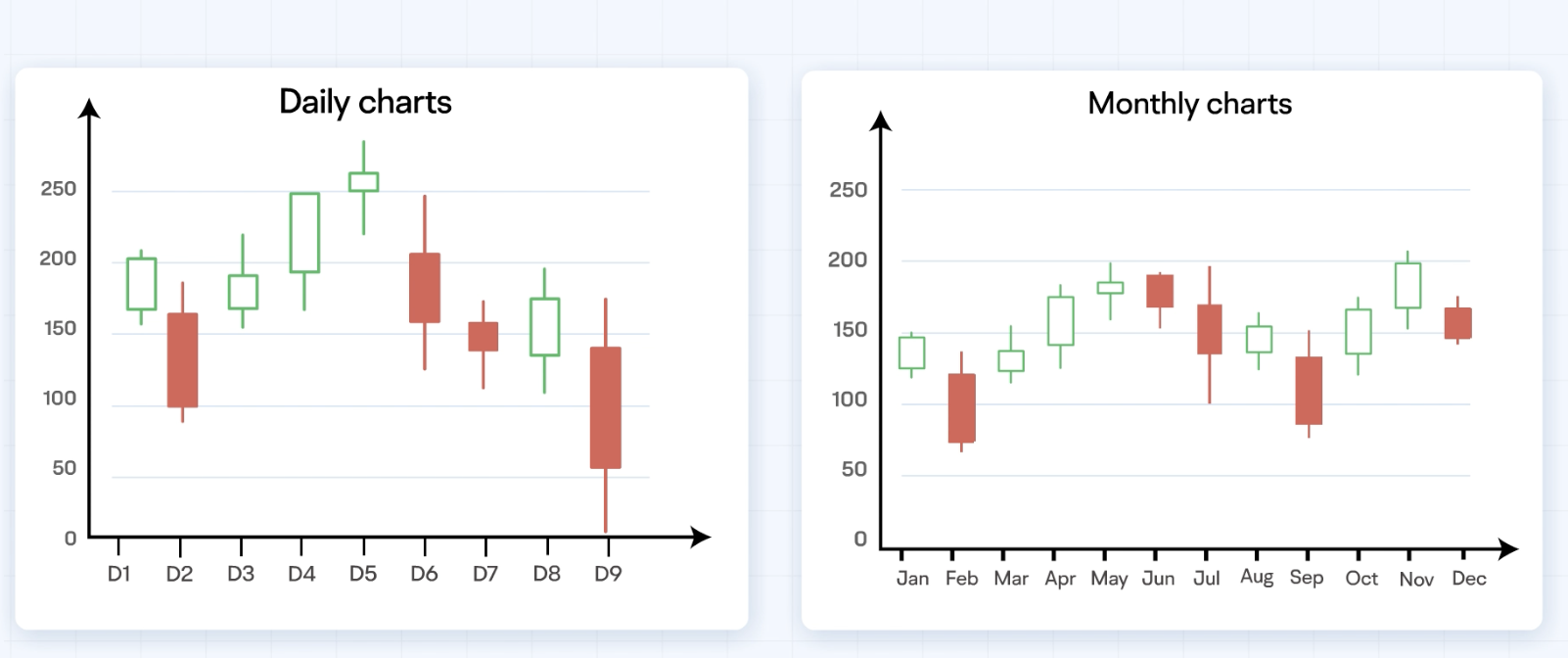

Daily candlesticks show the market’s open, high, low and close price for that trading day. The ‘real body’ of the candlestick refers to the wide part. This represents the price range between the open and close of that day of trading. If the real body is black, or filled in, it means the close was lower than the day’s open. If it’s empty, it means the close was higher than the day’s open.

What is candlestick trading?

Candlestick patterns all reveal information about how stocks are performing, with the different parts of the candlestick speaking to different indicators. While shapes, colors and directions of candlesticks can appear random, they can reveal patterns over time in order to build meaningful data insights for investors. This information then informs their investment strategies over the course of time.

Candlestick patterns are useful in revealing areas of support and resistance, giving traders insights they need to confirm whether their predictions about future market movements are accurate, or whether they need revision. Astute investors use candlestick patterns alongside other forms of technical and fundamental analysis to confirm their assumptions about overall trends, drawing on candlestick charts to inform candlestick trading.

How to read candlestick charts

While it may take some time to get used to candlestick charts, with some time and consideration, they can become valuable tools for all kinds of investors.

Key features

When reading a candlestick chart, there are three specific points to review: open, close and wicks.

The candles’ open and close prices work to identify where the price of an asset begins and concludes over a specified period. These work together to form the body of the candle. This allows candles to depict the price movement for certain periods as required by the investor when using the chart.

The open price indicates the first price traded at the formation of the new candle. If it begins to trend upwards, the candle will turn green or blue, with colors dependent on the chart’s specific settings. If it declines, it’ll turn red.

The top of the upper wick notes the highest price traded during the candle’s period. If there isn’t what, it means the open price or close price was the highest price achieved within that period.

The lowest price traded is evident at the bottom of the lower wick, or shadow. If there isn’t one, then the lowest price traded during that period is equal to the close price (or the open price when in a bullish candle).

The close price indicates the final price traded during the period over which the candle was formed. If it’s below the open price, the candle will turn red. If it’s above the open price, the candle will be green or blue.

The wick, which is also referred to as a shadow, demonstrates the extremes in price across a specific charting period. They’re easily identifiable as they’re thinner than the body of the candlestick. Wicks allow traders to note market momentum outside of the static of price extremes, providing visual indications as to the direction of growth.

The direction of the price is indicated by the candlestick’s color, with green indicating a rising price, and red indicating a falling price.

The difference between the highest and lowest price of a candle creates its range, which can be calculated by taking the price at the top of the top wick and subtracting it from the price at the bottom of the low wick.

This data allows traders to use candlestick charts to identify trends, price patterns and Elliot waves.

Size of the body

The size of the candle’s body indicates the absolute body height of a candle within each interval. Whether or not you’re reading a bullish or bearish candle, this value is always positive.

Lengths of shadows

Many technical analysts believe that a tall, or long, shadow indicates a future turning or reversal of stock. It’s also common for analysts to believe that a low, or short, shadow speaks to a coming rise in price. Tall upper shadows often indicate a coming downturn, while tall, lower shadows indicate a future rise. The lengths of these shadows can help investors to make informed decisions across their investment strategy.

Volume

Volume candlesticks give investors another dimension of information through the width of the candle. Higher trading volumes equal wider candlestick bodies, while low-volume days create skinny candlesticks. By examining the volume of a candlestick, chartists can identify various shapes and patterns that speak to the expected direction of stock prices.

Candlestick Patterns

Candlestick charts reveal various patterns which can be useful in forming investment strategies. It’s important for investors to understand what each of these patterns indicate.

Hammer Candlestick

A hammer candlestick pattern takes the form of a short body with a long lower wick, found at the bottom of a downward trend. Hammers reveal selling pressures throughout the day, with a strong buying pressure ultimately resulting in the price driving back up by the close. Green hammers speak to a stronger bull market than red hammers.

Shooting Star Candlestick

Shooting star candlesticks take the same shape as an inverted hammer, but take an uptrend, with a small lower body and a long upper wick. This indicates a market that has a gap slightly higher on opening, which will reach an intra-day high, before closing at a price that’s sitting just above the open, shaped like a shooting star returning to the ground.

Doji Candlestick

Candlesticks can resemble a cross or plus sign when the market’s open and close are sitting at similar price points. This doji’s pattern points to a struggle between buyers and sellers, resulting in no net gain for either party. On its own, a doji is a neutral sign, but it can also be found in reversal patterns, including the bullish morning star and bearish evening star.

Bullish Engulfing Candlestick

A bullish engulfing pattern is formed with two candlesticks, with the first taking the form of a short red body that’s engulfed by the second, a large, green candle. Even though the second day opens lower than the first, the bullish market will push the price up, creating a win for buyers.

Bearish Engulfing Candlestick

A bearish engulfing pattern occurs towards the end of an uptrend, when the first candle, which takes the shape of a small green body, is engulfed by a subsequent long, red candle. This speaks to a peak, or a slowdown of price movement, pointing to an impending market downturn. The lower the second candle reaches, the more significant this downturn may be.

Hanging Man Candlestick

A hanging man candlestick is a bearish version of a hammer, with the same shape, except that it appears at the end of an uptrend. A hanging man shape speaks to significant sell-off throughout the trading day which was turned around by buyers pushing the price up again. This large sell-off often indicates that bulls are losing control of the market.

Dark Cloud Cover Candlestick

A dark cloud cover candlestick speaks to a bearish reversal, a ‘black cloud’ over the optimism of the previous day. It takes shape across two candlesticks, with a red candlestick opening above the previous green body and closing below its midpoint. This signals that the bears have taken control in order to push the price sharply lower.

How to read ‘one-candle’ signals

As traders often only focus on one candle within a short timeframe, it’s important to understand their key signals. These include a long upper shadow, which could indicate a bearish trend, a long lower shadow, which could be a bullish signal, a doji candle, which speaks to indecision in the market, and red umbrellas, which often mean assets are receiving significant buy action, speaking to a future increase in price. Green umbrellas signal sellers may be ready to reverse the up cycle.

Getting started with candlestick trading

If you’re ready to dive into the world of candlestick trading, moomoo has all the tools you need to learn, invest and strategies. Sign up today and make the most of moomoo’s low fees and advanced analysis tools.