On-Balance Volume (OBV): What Is It?

The on-balance volume (OBV) indicator is a type of technical trading momentum that analyzes the flow of volume to forecast stock price changes. In his book published in 1963 titled Granville's New Key to Stock Market Profits, Joseph Granville is credited with being the inventor of the OBV measure. [1]

Granville believed that volume was the driving force behind markets; thus, he developed OBV to predict when significant market movements would occur based on changes in the volume. According to his book, OBV's forecasts feel like "a spring being coiled tightly." He thought that the stock price would either spike upwards or fall down in the long run if the volume continued to climb without a dramatic change in the price.

Calculating OBV

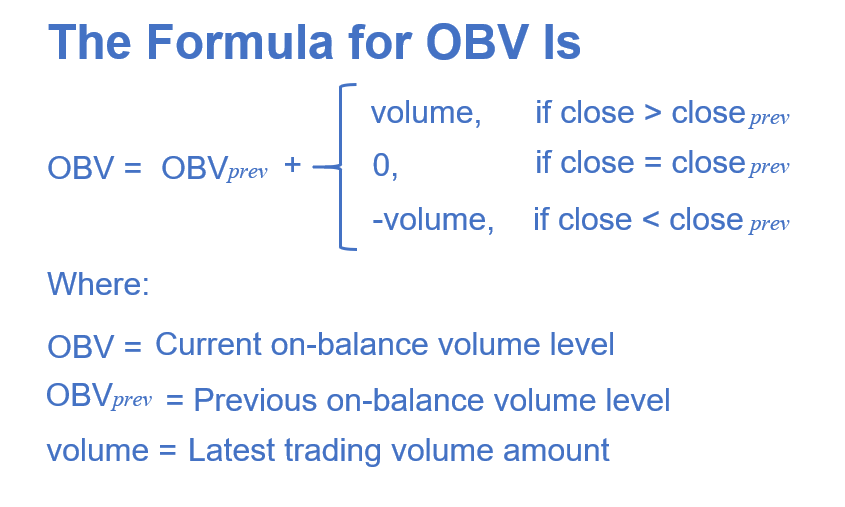

The on-balance volume offers a cumulative total of a stock's trading activity and shows whether this volume is moving into or out of certain securities or currency pairs. Volume may also indicate if an asset's trading activity increases or decreases over time. The OBV is a measure that combines all of the volumes (positive and negative). When determining the OBV, three different rules are taken into consideration. They are as follows:

1. If the price at which trading ended today is greater than the price at which trading ended yesterday, then: Current OBV = Previous OBV + today's volume

2. If the price at which trading ended today is lower than the price at which trading ended yesterday, then: Current OBV = Previous OBV - today's volume

3. If the price at the close of business today is the same as the price at the close of business yesterday, then: Current OBV = Previous OBV.

On-Balance Volume: What Does It Tell You?

The concept that underpins OBV is predicated on the distinction between "the smart money" in the form of investment firms and "less sophisticated retail investors" in the form of individual investors. There is a potential that the volume may grow even if the price stays reasonably stable as pension and mutual fund funds continue to purchase into an issue that regular investors are dumping. At some point, the increase in volume will cause the price to rise. When this happens, larger investors start selling, while smaller investors start purchasing.

Even if OBV is shown on a price chart and assessed quantitatively, the exact quantitative value of OBV is irrelevant. Since the actual number value of OBV is arbitrary and relies on the start date, the indication is cumulative. However, the time period stays set by a specific beginning point. This means that the true number value of OBV cannot be determined with precision. Instead, traders and analysts focus on the characteristics of OBV changes over time; the OBV line's slope bears the whole weight of analysis.

Analysts use the OBV volume as a proxy for tracking the activities of major institutional investors. They look for chances to purchase against inaccurate prevalent trends by interpreting discrepancies between volume and price as a proxy for the dynamic between "smart money" and the unfocused masses. It is very uncommon for big investors to push up the price of a commodity before selling it, hoping to profit from the subsequent stampede of retail investors.

Limitations of OBV

To some extent, OBV's predictive power is limited by the fact that it is a leading indicator rather than a lagging one; the signals it generates can only point to future developments rather than provide insight into the past. As a consequence of this, it often generates erroneous signals. It is thus possible to counteract this using leading indication. You can verify a breakout in the price if the OBV indicator also makes a breakout simultaneously. This is done by adding a moving average line to the OBV and looking for breakouts in the OBV line.

When employing the OBV, another warning is that a sudden and significant increase in volume on a single day might throw off the indication for a considerable time. For instance, an unexpected earnings release is included in or deleted from an index, or big institutional block transactions might cause the indicator to spike or fall. However, the surge in volume may not indicate a trend in the underlying market.

[1]https://www.google.com/books/edition/Granville_s_New_Key_to_Stock_Market_Prof/21ukDwAAQBAJ?hl=en&gbpv=0