Scalping Stock Trading: How Does It Work?

What Is Scalping Trading?

Scalping is a day trading style that many professional traders use. It is one of the shortest trading cycles among other forms of trading. Since it involves quick entry and exit to skim off small profits, it is called scalping trading. The traders who adopt this trading style are known as scalpers. The scalpers aim to make big profits through small trades.

Here's a brief overview of how scalping works.

Scalpers enter a limit order and buy a specific stock at a particular price.

Automatic execution of trade occurs once the price falls to limit order.

Traders observe the positive movement in the stock price

Trader closes the trade as soon as the stock price moves up

How Does Scalping Work?

Scalpers believe in making big profits by making small moves. They don't want to take risks in a desire to make big profits. To ensure less risk, scalpers set tight trading windows for the time frame and price movement.

Indeed scalping may help prevent you from losing. At the same time, you may lose an opportunity to gain big. Scalpers don't wait to get more profit. Instead, they prefer exiting the trade once they achieve the desired profit. Likewise, they don't wait for a positive change once the stock hits the target loss level and gets out of trading.

How to Analyze the Market for Scalping?

Scalpers prefer technical analysis to fundamental analysis to examine past price movements of a stock. They take help from indicators and charts to identify all the trading events. A good analysis helps them assess when they should enter or exit the market.

Scalpers use real-time charts to observe the day's trading prices and stock's price action. After that, they take help from known patterns and indicators to forecast the stock movement in the next few minutes. Ultimately, they create low and high trading points for entry and exit.

On the other hand, fundamental analysis involves ratio calculations with the help of a company's financial statements. The calculated ratios help traders assess how much they should invest. Moreover, it allows traders to evaluate a company and manage risks accordingly.

Scalpers may trade on any event or news that changes a company's worth. They might scalp trades based on the short-term changes in fundamental ratios. On the other hand, most traders focus on charts and trading indicators. However, these charts have a drawback. Since they indicate past prices, they could lose their value over time.

The time horizon is a factor that decides the worth of a position. It tells us how long a position is held. A position with a higher time horizon has less value. Therefore, trading indicators and technical analysis work better for short-term Scalping.

Types of Scalp Trading

Discretionary Traders:

They analyze market situations and make quick decisions. Additionally, they also decide profit targets and timing for each trade. However, the introduction of biases in discretionary scalping poses a risk. Emotions may lead to bad trading.

Systematic Traders:

They use computer programs and artificial intelligence to automate scalping. Computer programs help them take advantage of every trading opportunity without waiting for them to assess the market. Systematic trading doesn't rely on humans. That's why it is an unbiased scalp trading strategy.

Day Trading vs. Scalping: What's the Difference

Scalp trading and day trading are similar. Both make several trades in a day. However, there still exist some differences.

For instance,

A day trader uses a timeframe of 1-2 hours, and a scalp trader uses a timeline of 5sec -1 min.

The scalp trader has a larger account size than a day trader's account (average account size).

Scalp traders do quick trading. On the other hand, day traders trade in quick successions but at an average speed.

Scalp traders rely on experience. They understand the stock market's movement. On the other hand, a day trend makes trading decisions based on technical analysis.

Scalp Trader Characteristics

Scalpers plan trades with the help of one-minute charts or short time frames. Additionally, they need to be dedicated, efficient and disciplined to scalp deals. Scalp trading is not for those who take time to make decisions. This is a trading strategy for very experienced traders with access to the necessary systems and not for the majority of traders.

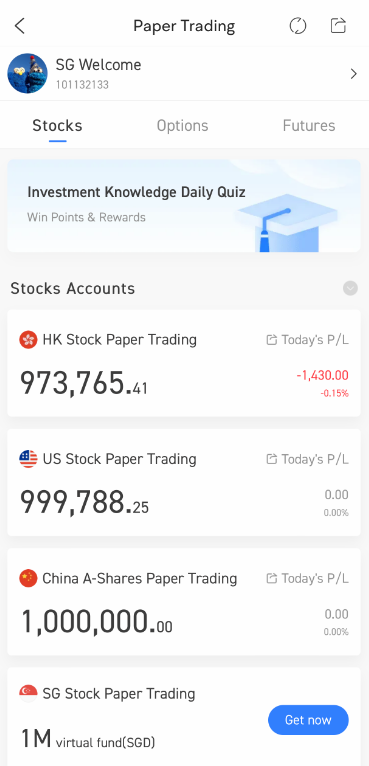

If you want to practice your trading strategies, you can try the paper trading on moomoo app. The paper trading process is exactly the same as the real scenario, with real-time stocks or options data, which will help you familiarize yourself with the trading rules without using real money, getting $1,000,000 virtual balance today by downloading and using moomoo paper trading! Sign up your moomoo now to practice paper trading today!