Trading As A Side Hustle - Stock Trading As A Side Hustle

Are you waking up early to set up your pre-market positions or sneaking a look at your P&L during the lunch break? You’re not alone. Retail or individual investors drove 24% of all equity trades in 2021. When it comes to finding the best routine for trading as a side hustle and creating a strategy that fits your goals, there are a few steps you can follow.

Develop a trading plan tailored to your goals and style

Not having a plan or not following a set plan is the single biggest reason traders fail. Without a plan, you can fall victim to emotional trading and other ill-advised approaches when unforeseen market shifts arise. You also put yourself into the position of relying on luck and chance to see any profits.

Having a strong plan helps you to decide your course of action and avoid reactionary responses. A good plan addresses four specific questions:

1. Are you a value investor, a technical trader, or somewhere in between?

2. Do you have enough time to research and identify entry and exit points for each stock?

3. Will you set aside a specific budget for trading every month? This minimizes emotional trading.

4. How will you record a trade and what you learned from it?

To improve your potential for seeing profits, you should develop a strong plan as quickly as you can when you are trading as a side hustle.

Practice makes perfect

One of the best ways to try out your trading strategies and put your plan to the test without risking any of your own capital is with paper trading.

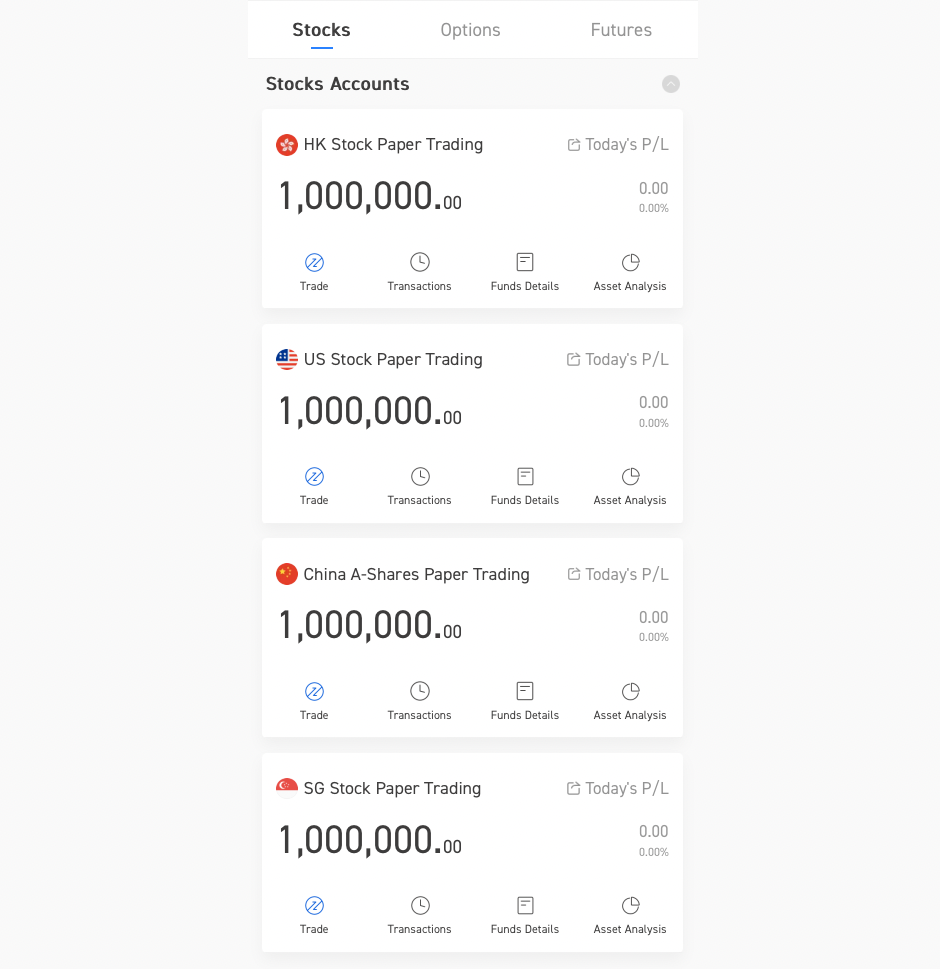

Look for an app with a robust paper trading feature that allows you to simulate buying and selling without risking real money. Your paper trading account should mimic the size of your real portfolio so that you can practice responding to real time price and volume movements and market news. Moomoo offers not just US stock paper trading, but international stock and options paper trading as well, so you can practice new trading strategies at all levels of trading.

Know the right price to buy or sell a stock

The only way to effectively gauge when you should enter or exit the market is with data. And if you want detailed insight into price action, real-time and in-depth data is what you need. Understanding how the price has historically behaved and the current trends they are exhibiting can help you to make informed decisions based on analysis and not gut reactions or lagging information.

Images provided are not current and any securities are shown for illustrative purposes only.

When you have this data, there are a number of technical indicators and tools you can use to determine if the price is right to enter or exit a stock. Some of these include moving averages, gold crosses, moving average crossover divergence (MACD), relative strength index (RSI), Bollinger Bands, and more.

Don’t risk money you need to pay the bills

If you can’t afford to lose it, you can’t afford to trade with it. Plus, if you don't have it, don't trade it. 80% of Gen Z traders took on debt to trade in 2021, and this is a dangerous situation to put yourself in financially. There are never guarantees for profits when it comes to trading. If you are using necessary money or money that you have borrowed, you may never see it again and can put yourself into serious straits.

When you first begin trading, start small with discretionary money that already exists in your budget. As you practice your plan and start to see consistent returns, you can begin to trade more money because you have built your capital to work with. Make sure that for any amount that you trade, you can cover any and all losses with funds that exist outside your monthly living expense budget.

Stay tuned to market chatter, but keep your perspective

When it comes to trading, it's important to be aware of what is happening in the market. Reputable news sources can help you stay informed on major events that may impact specific stocks or the market as a whole. And a trading community with like-minded traders, such as the Moo community, can help you stay abreast of stock developments. However, it’s also important to do your own research.

You should always analyze a stock for its current performance and historical trends, how the stock fits into your strategy, and check any emotional reactions when making trading decisions. Keep your perspective when hearing news, especially if you are one of the last to hear and will be making decisions behind the trend.

Get started with moomoo

Now that you have some basics down, are you ready to start trading? Download the moomoo app today to start building your strategy and taking control of your portfolio.