Trading Stocks Short: Overview

Does short selling provide monetary profit?

Short selling is a strategy that may be used to generate money off companies that have a price that is decreasing (also known as "going short" or "shorting"). The notion of short selling, in which an investor borrows a stock, buys the shares, and then purchases the stock back to return it to its lender, may seem rather straightforward. However, in terms of its application, it is a sophisticated approach that only seasoned traders and investors should use.

Short sellers stake their money on the expectation that the stock price they are shorting will go down. If the share price drops after the short seller sells it, he or she may simply repurchase the shares at a lower price and then return them to the lender. The income for the short seller is calculated as the difference between the price at which they sell the asset and the price at which they purchase it.

Main Points

Short sellers are betting that the price of the stock they are selling will go down.

Going short on a company is a higher risk investment strategy than going long on the stock since, in principle, there is no restriction on the amount of money that may be lost.

Speculators short-sell an asset to make a profit from its subsequent collapse, whereas hedgers short-sell to safeguard profits or reduce losses.

Investors without much knowledge can discover that selling stocks short is not to their benefit.

Example of a Short Sale

Consider the case of an investor who believes that Meta Platforms Inc. (META), which was once known as Facebook, is overpriced at $200 per share and would see a price decrease. Investor A might "borrow" from Broker B 10 shares of Meta, and sell them at Market C for $200 per share. The investor would earn $750 ($2,000 minus $1,250) if the stock dropped to $125, at which point he or she could buy back the 10 shares, return the borrowed shares to the broker, and pocket the difference. On the other hand, the investor suffers a loss of $500 ($2,000 minus $2,500) if Meta's share price climbs to $250.

What are the Potential Pitfalls?

The practice of short selling significantly multiplies the risk. When an investor purchases a stock (also known as 'goes long'), the most that they have to lose is the money that they initially put in the stock. Therefore, if the investor purchased one share of Facebook at $200, the most money they could lose is $200, given that the stock price cannot go below $0.

Since a company's price might rise indefinitely, short sellers stand to lose an endless sum of money if the stock continues to rise in value. To continue with the previous example, if an investor shorted Meta (or sold short the stock) and the price increased to $375 before the investor closed their short position, the investor would incur a loss of $175 per share.

Another risk that short sellers are exposed to is the possibility of a "short squeeze," which occurs when the price of a stock that has a significant amount of short interest (that is, a stock that has been sold short to a significant extent) suddenly increases. This results in a more precipitous rise in the stock price as an increasing number of short sellers purchase shares to cover their short positions and limit the amount of money they stand to lose.

Short Squeeze

In January 2021, dedicated fans of the Reddit community's WallStreetBets website worked together to drive up the price of shares in troubled firms with substantial short interest, such as video game retailer GameStop Corp. (GME). Because of this, the value of the company's shares increased by a factor of seventeen only in January. [1]

Short selling is restricted to margin accounts, which are special types of trading accounts that allow investors and traders to borrow money from their brokerages to trade securities. Therefore, the short seller is obligated to keep a constant eye on the margin account to guarantee that there is always enough cash or margin in the account to keep the short position open.

If the price of the share suddenly skyrockets (for instance, if the firm discloses in its quarterly update that earnings have surpassed expectations), the trader will be required to immediately deposit extra cash into the margin requirement. If the trader fails to do so, the brokerage may forcefully close out the short position, leaving the trader responsible for the loss.

Why Do Investors Engage in Short-Term Trading?

Speculation and risk management are two of the many applications for short selling. Speculators engage in short selling in order to profit from the possibility of a price decrease, either in relation to a particular asset or the market as a whole. Hedgers use the approach to either preserve profits or reduce losses in a share or portfolio.

It is important to note that institutional investors and experienced traders regularly participate in techniques that include short selling to speculate and hedge. Hedge funds are prolific short sellers because they employ short positions in some companies or industries to offset the risk of holding long holdings in other equities.

Because of the possibility of incurring almost unlimitable losses, short selling should not be attempted by anybody who is not an experienced investor or trader.

Costs Associated with Short Selling

Short selling involves many expenses, not the least of which are trading fees. There are additional expenses, such as the following:

● Margin Interest: Since short selling may normally only be done in a margin account, the person doing the short selling is required to pay interest on the money that they have borrowed.

● Stock borrowing costs: There may be a lack of liquidity in borrowing shares of some businesses due to substantial short interest or a small share float. To be able to borrow these stocks for speculative trading, the trader is required to pay a "hard-to-borrow" cost. This fee is calculated using an annualized rate, which may be fairly expensive, and it is then prorated depending on the number of trades that the short trade is open.

● Dividends and other payments: The short seller is responsible for making dividend payouts on the stock they borrowed and payments on other business events related to their borrowed shares, such as stock splits and spinoffs.

Does the Economy Suffer from Short-Selling?

Some unethical short sellers have tainted the whole industry by engaging in unethical practices designed to lower stock values, giving the practice of short selling a bad name. However, short selling can make the efficient operation of capital markets possible. It does this by increasing market liquidity, serving as a dose of reality for investors' inflated expectations, and ultimately lowering the risk of business bubbles while also making it possible to mitigate downside risk.

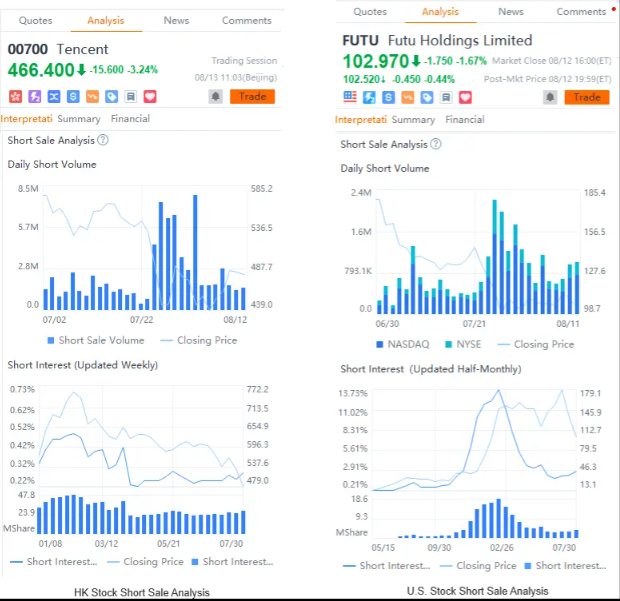

moomoo trading app provides short sell analysis to help investors to identify the long and short sentiment. Investors who like to short sale can find stocks with a high short-selling ratio and investment opportunities. Sign up and download moomoo app today to get the short sell analysis information!

Images provided are not current and any securities are shown for illustrative purposes only.

https://finance.yahoo.com/quote/GME/history

Disclosures:

When short selling there is no limit on how high a stock price could rise so the potential loss is unlimited. Other risks include dividend risk and margin risk, this strategy is not appropriate for all investors.

Margin trading entails greater risk, including, but not limited to, risk of loss and incurrence of margin interest debt, and is not suitable for all investors. Please assess your financial circumstances and risk tolerance before trading on margin.