What Is a Bellwether?

An economic bellwether is an indicator of future developments. A bellwether is a firm that investors pay particular attention to because changes in its financial performance can indicate changes in the broader economy. If a firm's stock is seen as hinting towards an upward or negative trend in a sector, then that stock may also be considered a bellwether for that sector. One such corporation is FedEx, which acts as a bellwether for the shipping industry. It seems to reason that an increase in consumer spending would result from an announcement by FedEx about a significant rise in the number of packages delivered during a certain quarter. More products are being created to fulfill the growing number of wholesale orders, more wholesale orders are being delivered to retailers, and retailers are purchasing more products to keep up with the growing customer demand.

Main Points

When it comes to the economy, a bellwether is a leading indicator that may provide insight into broader phenomena.

A bellwether firm is widely monitored because its highs and lows are believed to indicate a shift in trend for the industry it operates in or for the economy as a whole.

A stock considered to be a bellwether is used to anticipate how the market as a whole or a particular segment of it will perform.

Companies that are regarded as leading indicators are often leaders in their respective fields and are sometimes referred to as blue chips.

Even though bellwether stocks may be able to indicate future trends, this does not mean that they are always the greatest investments in their respective industries.

How to Understand a Bellwether

Since the success of FedEx and a number of other publicly traded firms is highly connected with a general trend, experts believe that the performance of these companies may provide insight into the direction in which the economic and financial markets are moving. Blue chips, which often include leading companies, are a type of company that serves as a bellwether for the economy.

When evaluating the condition of the marketplace or the economy as a whole, bellwether stocks are often referenced. Although the position of a company as a bellwether may change over time, in the equity markets, the bellwethers of a sector are frequently the largest and most well-established businesses in that sector.

Most companies that qualify as bellwethers already have established themselves as lucrative and reliable market participants within an industry with well-established client bases and strong brand loyalty. Some show remarkable resilience in the face of economic downturns.

These companies also serve as the basis for most of the main market indexes; large-cap bellwethers such as the Boeing Company and Johnson & Johnson dominate the Dow Jones Industrials and the S&P 500, respectively.

Many Important Factors to Take Into Considerations

There is no assurance buying bellwether stocks will provide the highest returns, but they may be a good indicator of where the market is headed. Once a corporation has achieved bellwether status, its days of experiencing the highest growth rate are often in the past, and its massive scale makes substantial expansion impossible.

However, investors may choose to utilize bellwether companies as indications while investing their money in emerging firms that have potential for growth still in front of them.

There are benefits and drawbacks to using bellwethers

Bellwether stocks, also referred to as barometer stocks are good benchmarks for assessing the general trend of a sector, such as whether it will have a bull or bear market. Bellwethers provide some insight into the direction the market is heading, which is especially helpful in investing, where a great deal of unpredictability must be accounted for. On the other hand, it is important to emphasize that bellwethers are not always accurate predictors of the future since correlation does not necessarily imply causation.

The general health of a company's finances may significantly impact the markets, particularly when it comes to bellwether stocks, also known as blue-chip stocks. However, such and other bellwether stocks often belong to well-established, secure, and financially sound companies. But it also indicates that its growth days slow down. If you just look at bellwether stocks, you can get an inaccurate picture of this potential's value. Newer and more developing firms might show higher growth and be good investments.

Pros

● Provide indications of future behavior with the use of previous information.

● Provide leading signs of when market circumstances are changing

●Are generally simple pulse checks

Cons

● Not necessarily a reliable indicator when comparing organizations or sectors of various sizes.

● There is no assurance that one outcome will be reached based on bellwethers.

● There is a risk of putting too much emphasis on a single indicator.

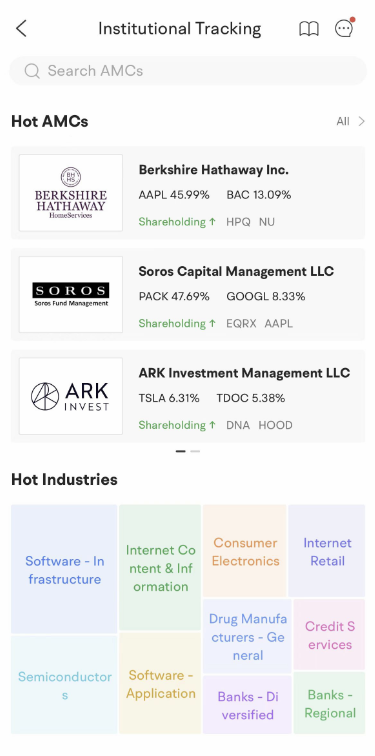

moomoo trading app provides a collection of position reports from institutional investors such as Warren Buffett, and High Tide Capital, providing investors with quick access to information. Investors could easily find the list of stocks held by these institutions along with historical position trends and intra-day trading information. Sign up and download moomoo app now to track institutional holdings.

Images provided are not current and any securities are shown for illustrative purposes only.

The Crucial Points to Consider

No matter how you interpret the actions of a bellwether company, it is important to keep a careful eye on such businesses, particularly if historical evidence supports the conduct of those businesses. Bellwether stocks are stocks known to give a beneficial initial pulse check on wider economic trends for investors who are following the market.