What Is a Bullish Harami?

A bullish harami is one of the candlestick chart patterns that indicates a possible reversal of a bearish trend in the market.

Comprehending the Bullish Harami

A bullish harami is an indication on a candlestick chart that a bearish trend may be ending. Certain investors may interpret a bullish harami as a signal to initiate a long position on the asset.

A candlestick chart is one type of chart that used to measure the performance of an investment. It is named for the rectangular shape on the chart, resembling a candle with wicks. Typically, a candlestick chart illustrates daily stock price information, including the opening, closing, high, and low prices.

To discover harami patterns, investors need to examine daily market performance as shown by candlestick charts. A bullish harami relies on first candles to signal that a downward price trend is ongoing and a negative market appears to be driving the price down.

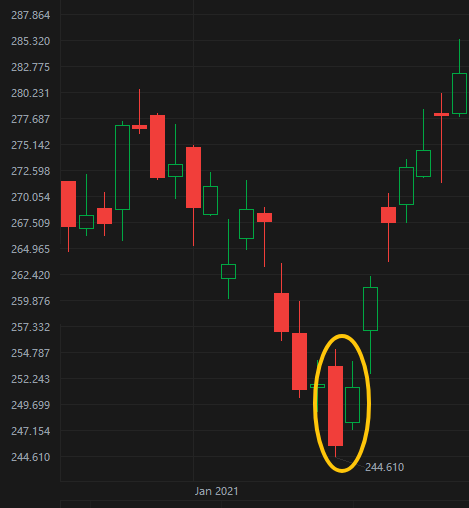

The bullish harami signal appears on a chart as a lengthy candlestick followed by a smaller body, known as a doji, that is totally contained inside the previous body's vertical range. A line drawn around this pattern may resemble a pregnant woman to some. The origin of the word harami is an old Japanese word that means pregnant.

For a bullish harami to form, the smaller body of the following doji must close higher within the body of the previous day's candle, indicating a larger probability of a reversal.

Images provided are not current and any securities are shown for illustrative purposes only.

Advanced Candlestick Patterns, Bullish Harami, Bearish Harami

Analysts will rely on candlestick chart patterns to expedite comprehension and decision-making to examine daily market performance data.

While the bullish harami and its opposite, the bearish harami, help to forecast imminent reversals in the trending direction of prices, candlestick chart analysis offers a diverse array of patterns to forecast future trends. In addition to bullish and bearish crosses, evening stars, rising threes, and engulfing patterns, bullish and bearish haramis are among the basic candlestick patterns. Using advanced candlestick patterns, such as island reversal, hook reversal, and san-ku or three gaps patterns, a more in-depth examination provides further insight.

Technical analysis with moomoo

Moomoo stock trading app provides free advanced stock charting tools to help various investors to analyze trends and patterns with 60+ technical indicators and add visuals to charts using 38+ drawing tools. Sign up and download the moomoo app today to access these charting tools!