What Is a Doji?

A doji is the word for a trading session in which the open and close levels of securities are almost identical, as depicted by a candle on a chart. Technical analysts attempt to predict price behavior based on this shape. Doji candlesticks might resemble a cross, an inverted cross, or a plus sign.

Although uncommon, a doji candlestick often indicates a trend reversal to analysts, however, it can also indicate future price hesitation. Generally speaking, candlestick charts can reflect market patterns, market sentiment, momentum, and volatility. Candlestick charts show the patterns that result from market movements and reactions.

What Does a Doji Indicate to Investors?

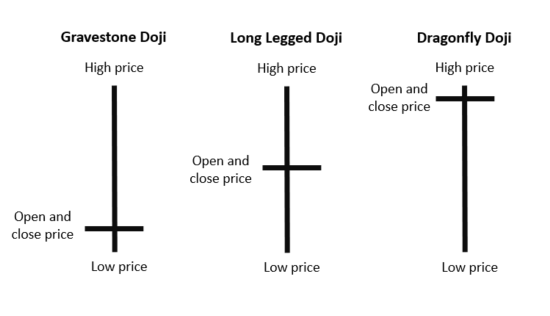

In Japanese, "doji" ((どうじ/ 同事) means "the same thing," referring to the rarity of a security's opening and closing prices being identical. Depending on where the open/close line lies, a doji can be described as a gravestone, long-legged, or dragonfly.

Technical analysts believe that the stock's price reflects all available information or that the price is efficient. However, previous price performance does not predict future price performance, and a stock's actual price may not reflect its real or intrinsic worth. In order to decrease the noise and identify the trades with the highest likelihood, technical analysts employ tools.

Every candlestick pattern is defined by four kinds of data. Analysts can draw inferences about price behavior based on this structure. Each candlestick has an open, high, low, and close. The time period or tick interval utilized is irrelevant. The body is the filled or hollow bar that is generated by the candlestick pattern. Shadows are the lines that emanate from the body. A stock that closes higher than it opened will have a hollow candlestick. The body will have a filled candlestick if the stock closes at a lower price. The doji is one of the most significant candlestick formations.

A doji, which can apply to both singular and plural variants, is formed when the open and close of a stock are almost identical. Doji typically has little or nonexistent bodies and resembles a cross or plus sign. From the perspective of auction theory, doji signifies indecision on the part of both buyers and sellers. All parties are equally matched, hence the price remains unchanged; buyers and sellers are in a stalemate.

Some experts take this as a hint of a price reversal. It may also be a moment when buyers or sellers acquire the impetus to continue a trend. Doji is frequently observed during consolidation periods and can assist analysts in identifying potential price breakouts.

Doji Constraints

A doji candlestick is one neutral indicator that may provide limited information when viewed alone. In addition, a doji is a rare occurrence; consequently, it is not a trustworthy indicator for detecting price reversals. When a reversal does occur, it is not always trustworthy. There is no promise that the price will continue in the expected direction after the confirmation candle.

Depending on the length of the doji's tail or wick and the size of the confirmation candle, the entry position for a trade may be far from the stop-loss location. This means that traders will need to locate another position for the stop-loss, or they may need to abandon the transaction because the possible benefit of the trade may not justify the stop-loss amount.

In addition, it can be difficult to estimate the potential profit of a doji-informed transaction because candlestick patterns often lack price goals. Therefore, traders must use other candlestick patterns, technical indicators, or strategies before making the final investment decision.

Technical analysis with moomoo

Moomoo stock trading app provides free advanced stock charting tools to help various investors to analyze trends and patterns with 60+ technical indicators and add visuals to charts using 38+ drawing tools. Sign up and download the moomoo app today to access these charting tools!