What Is a Three Outside Up and Down?

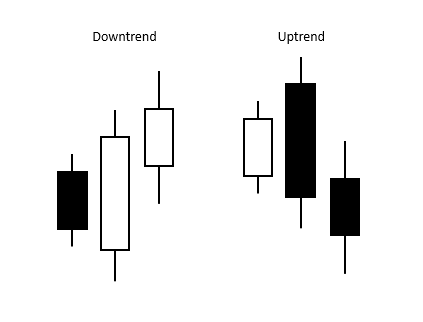

Two different types of three-candle reversal patterns may be seen on candlestick charts. These patterns are the three outside up and the three out down. Three candles must appear in a particular order for the pattern to take shape. This indicates that the ongoing trend is losing steam and may indicate a change in the direction of an existing movement.

Specifically, the pattern is created when a bearish candlestick, which is a candlestick that closes at a lower price than it opened, is followed by two instances of a bullish candlestick, which closes at a higher price than it opens, or vice versa. In other words, a bearish candlestick is followed by two instances of a bullish candlestick.

It is possible to draw parallels between the three outside up and three out-down candles and three inside up/down candles.

How Three Up/Down Candlesticks on the Outside Works

One bullish candlestick pattern is known as the three outside up, and it has the following characteristics:

The market is in a downtrend.

The first candle is bearish.

The second candle is bullish with a lengthy actual body and completely encompasses the previous candle inside its boundaries.

With a higher closing than the previous candle, the third candle shows encouraging signs for the market.

Bearish candlestick patterns may be identified by their appearance, and one such pattern is known as the three outside down. This pattern has the following characteristics:

An upward trend can be seen in the market.

The first candle is bullish.

The second candle is bearish and has a lengthy actual body that completely encompasses the first candle.

Bearishness is indicated by the third candle's closure, which is below the second candles.

As the second candle swallows up the first candle, it signals the beginning of the end of the trend that has been predominant up to this point. The appearance of the third candle indicates a quickening of the trend reversal.

The three outside up patterns and the three outside down patterns are common occurrences that may be relied upon as accurate indications of reversals. Traders may utilize these indications as central buying or selling signals; however, they should still watch for confirmations from other chart patterns or technical indicators.

Trader Psychology for the Three Outside Up

The first candle maintains the bearish trend, which shows that substantial selling interest is there while growing bear confidence since the closure of the candle is lower than the open price. The second candle begins at a lower price but reverses direction, showing bullish strength by crossing through the starting tick. This price action throws up a red signal, which tells bears to either take gains or tighten their stops since a reversal is possible.

A bullish outer day candlestick pattern has been formed as the security continues to show gains, which have lifted the price above the range of the first candle. This boosts bulls' confidence and triggers buying signals, validated when the security in question hits a new high on the third candle.

Trader Psychology for the Three Outside Down

The first candle maintains the bullish trend, which shows significant buying demand while strengthening bull confidence with a close that is higher than the open. In a demonstration of bearish force, the second candle rises higher but reverses direction and crosses through the initial tick. Since the price movement, a warning sign has been triggered, advising bulls to either lock in their gains or reduce their stop-loss levels since a trend reversal is probable.

As the asset's value continues to decline, the first candle's price range is breached, resulting in the formation of a bearish outer day candlestick. This boosts the confidence of bears, which triggers selling signals verified when the security makes a fresh low on the third candle.

Technical analysis with moomoo

Moomoo stock trading app provides powerful stock charting tools to meet various investors' technical analysis needs and help to make investing decisions. Moomoo stock charting tools consist of 63+ technical indicators, 38 types of charts, support for saving and synchronization of charts, and customized color patterns, etc. Download the moomoo app today to get access to these free charting tools!