What is an Investment Portfolio

Key Takeaways

An investment portfolio is about diversified investment strategies.

Diversified portfolios can better weather ups and downs in the markets.

Risk tolerance is the priority concern when creating a personalized investment portfolio.

Understanding an investment portfolio

When you start to learn investing, you've probably heard a saying— "Don't put all your eggs in one basket. "

Broadly speaking, it's the simplest explanation for investment portfolios.

To be more accurate, an investment portfolio refers to a basket of assets, which may consist of such asset categories as cash, gold, stocks, options, bonds, funds, commodities, etc.

The underlying reason for portfolio investment is to maximize returns while minimizing risks. When building your own portfolio, you are diversifying the investment. The diversification can take place across different asset categories as well as within a certain category.

Features

Diversified

Investment portfolios are a collection of assets, which is a display of diversified allocation. Diversification means distributing your capital into different investments, which is a common risk management strategy. Securities, gold, bonds, businesses, and real estate are frequently chosen by investors.

Hedging

A diversified portfolio tends to be less closely correlated across asset classes. For example, when the stock market endures huge volatility, gold prices usually go higher driven by investors' hedging demand. If there is a portion of gold in your portfolio, loss in stock markets could be partly mitigated.

Personalized

A healthy investment portfolio could help you ride out the ups and downs of markets. However, building an investment portfolio should be based on your own considerations. Risk tolerance and time horizons are the main concerns, which means how much loss you could bear and your expectation for the return cycle if your portfolio doesn't perform well while the broad market is on a downward trend.

Investment portfolios come in various types corresponding to their investing strategies. For example, if you are reserving funds for your children's education, you can't take too many risks, so a conservative portfolio is a better choice for you. If you have abundant extra money and have a strong risk tolerance, you may prefer constructing an aggressive strategy to seek greater gains.

Example

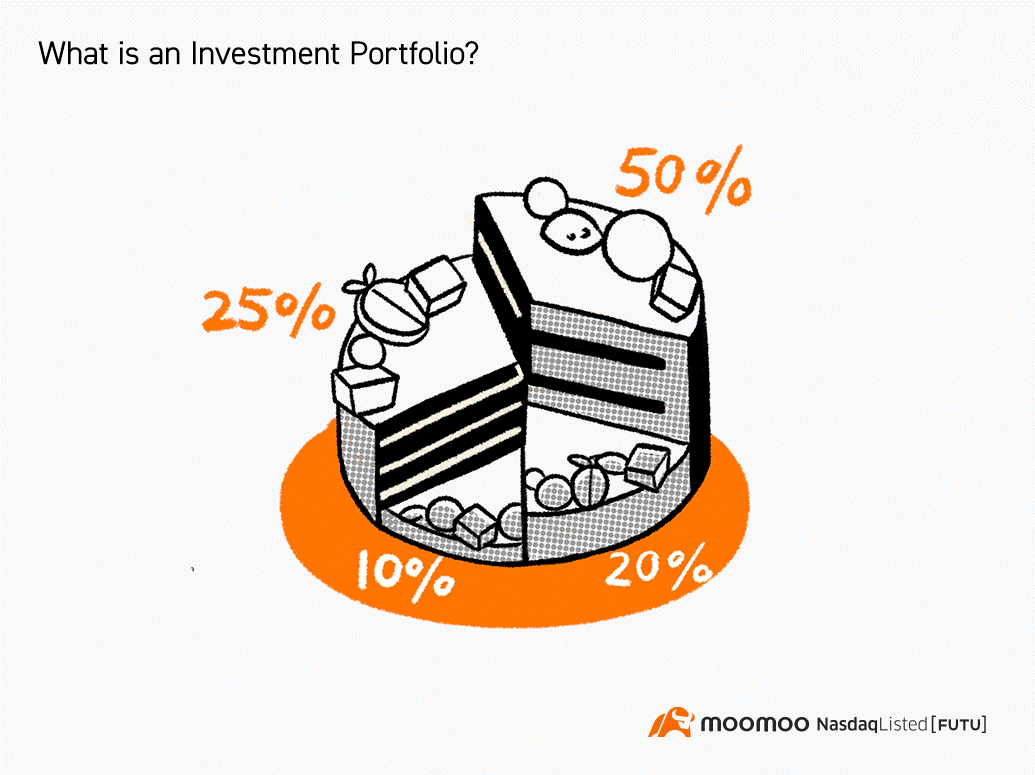

Specifically, suppose you have a $1,000 investment fund. You might spend $500 on buying stocks, such as $Apple(AAPL.US)$, $Costco(COST.US)$, $NVIDIA(NVDA.US)$, from different sectors. Furthermore, you are positive about the electric vehicle industry, for it seems like a disruptive business with huge potential.

However, you are unfamiliar with the industry chain, only knowing that Tesla is a game-changer. You could purchase $200 sector ETFs to grab the momentum. You also put $100 in government bonds, which are closely related to inflation and interest rates. Besides, you set $200 aside to wait for a chance to buy at the bottom. In this case, your investment portfolio consists of stocks (50%), funds (20%), bonds (10%) and cash (20%).