What Is Barbell Strategy?

Key Takeaway

The barbell method recommends putting your money into a range of assets from very risky to completely safe while disregarding the somewhat risky assets.

The barbell technique recommends mixing short-term and longer-term bonds when investing in fixed income.

Consequently, the investor has a safety net of long-term bonds if rates fall and an opportunity to profit from rising short-term yields.

The barbell approach is an investing theory that the most effective way to achieve a balance between benefit and potential danger is to invest in the two extreme values of high-risk and no-risk commodities while ignoring options in the middle. This strategy recommends making investments in high-risk and no-risk assets.

The main objective of any investment strategy should be to maximize return on investment while minimizing exposure to risk to the extent that an individual investor is comfortable. Investors who adhere to the barbell method are certain that the only way to do this is to engage in behaviors that are considered very risky.

Overview of Barbell Strategy

Most financial advisors believe that the first step in building a client's portfolio should be determining the level of risk that the client is willing to assume. A qualified individual could be willing to accept a significant amount of risk. A person who is retired may rely on a consistent income.

Therefore, the financial planner will design a portfolio that will allocate the funds into three or more separate pools, with each pool standing for a different kind of risk. Putting your money into speculative equities like initial public offerings (IPOs) or small biotechnology firms is not a good idea because of the high risk. Blue-chip stocks have a lower level of risk than other types of equities, but they are nevertheless susceptible to the ups and downs of the market. Bonds are a more secure investment than stocks, and bank certificates of deposit (often known as CDs) are the safest investment.

That young investor might put forty percent of their money into risky stocks, forty percent in blue-chip companies, and twenty percent in bonds. The retiree will likely invest 80% of their money in bonds and 20% in blue-chip companies. Everyone is looking to maximize their returns while maintaining a level of security that satisfies them.

How to Use Barbell Investment Strategy?

The Barbell Investment Strategy for Stock Investors

Those who adhere to the barbell method could claim that the portion of the risk spectrum located in the middle level should be disregarded.

The barbell method recommends pairing two kinds of assets that couldn't be more different. The assets in one basket are considered to be among the safest available, while those in the other basket are considered to be among the riskiest available.

This strategy enabled Nassim Nicholas Taleb, a statistician, writer, and derivatives trader, to succeed through the economic slump between 2007 and 2008, while many of his colleagues Wall Streeters could not do so.

The fundamental idea behind the barbell strategy was articulated by Taleb as follows: "If you understand that you are susceptible to forecast errors and are willing to acknowledge that the majority of measures are imperfect, then your tactic is to be as hyper-conservative and hyper-aggressive as you possibly can, rather than being mildly confrontational or conservative." [1]

The Barbell Approach to Investing in Bonds

The barbell method is most often used for bond portfolios in practice.

The biggest threat to investors who purchase high-quality bonds is the potential of missing out on a chance to purchase a bond that offers a higher return on investment. For example, suppose the investment is placed in a long-term bond. In that case, the owner won't be able to transfer that money into a higher-yielding bond if this higher-yielding bond becomes available in the interim. In contrast, the money is already committed to the long-term bond.

Short-term bonds have lower interest rates but are redeemed at an earlier date. Long-term bonds often provide a higher rate of return but come with a higher degree of interest rate risk.

Therefore, the two opposing ends of the spectrum in bond investment are short-term and long-term concerns. There is little motivation to pursue a path in the middle of the road.

In contrast to the advice given to equity investors by the model, who is to invest in companies with risk categories of two extremes, the advice given to bond investors by the model is to mix bonds with very short (less than three years) and very long (ten years or more) timetables.

It enables the investor to take advantage of better-paying bonds if and when they become available while simultaneously enjoying some of the higher yields associated with long-term bonds.

It should be no surprise that interest rates significantly impact how well the barbell approach performs. Short-duration bonds sometimes exchange for longer-term, higher-yielding offerings when interest rates go up. Investors who hold bonds with longer durations benefit when rates go down because they have already secured better interest rates.

When there are large yield differentials between short-term and long-term bonds, bond investors should consider using the barbell method. This is the perfect moment to use the strategy.

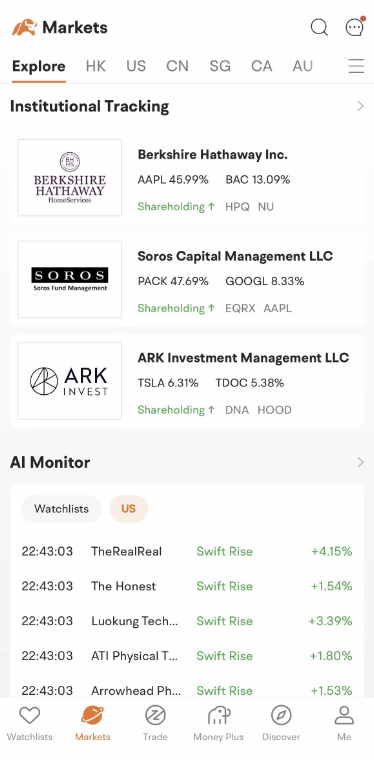

AI monitor of moomoo trading app can help you track market movements and seek market opportunities by monitoring all stock movements in individual markets, such as US stocks, A-shares, Singapore stocks, etc. You can also keep up with the investing strategies from the holdings of top institutions with high-value information in moomoo.

Barbell Strategy Vs. Bullet Strategy

Even for those who just invest in bonds, the barbell method could be a labor-intensive strategy since it requires continuous monitoring.

The bullet method is the opposite of the barbell strategy, and some bond investors may find that they prefer it. When using this strategy, investors commit to a specific date by purchasing bonds set to maturity simultaneously, for example, in seven years. They then do nothing until the bonds have fully developed.

The goal of this investment strategy is to protect investors from fluctuating interest rates but also enable them to make investments in a hands-off way by avoiding the need to continually re-invest their capital.

The moomoo app is designed for serious traders and investors. Get access to free advanced technical charting tools featuring 62 technical indicators and 37 drawing tools across mobile and desktop. Sign up for free. Get started now and see how moomoo can help you build your investment portfolio.

[1] Nassim Nicholas Taleb. "The Black Swan: Second Edition." Page 205. Random House Publishing Group. 2010.