What Is Earnings Season

The period of time during which companies make their earnings reports available to the general public is referred to as earnings season. There are four earnings seasons every year, one for each quarter of the year. These seasons correlate with the quarterly financial reports.

Why Is Earnings Season Important?

Earnings season is a great time to get insights into not just how a firm is doing but also how the economy is growing due to the wealth of data released at this time. After this, the disclosed data is compared with analyst projections from before the earnings report to establish how well a firm performed compared to how well it was predicted to do. As an investor, the reports published during earnings season may assist you in evaluating the historical performance of a business and determining where the firm may be going in the future. When earnings season comes around, it is helpful to know what to anticipate if you have equities in your portfolio.

Earnings Season: A Brief Explanation and Some Real-World Examples

Earnings season is the time of year when businesses publish their quarterly financial results to the general public for the first time. Earnings season begins every quarter and normally lasts for a few weeks after the preceding quarter's conclusion.

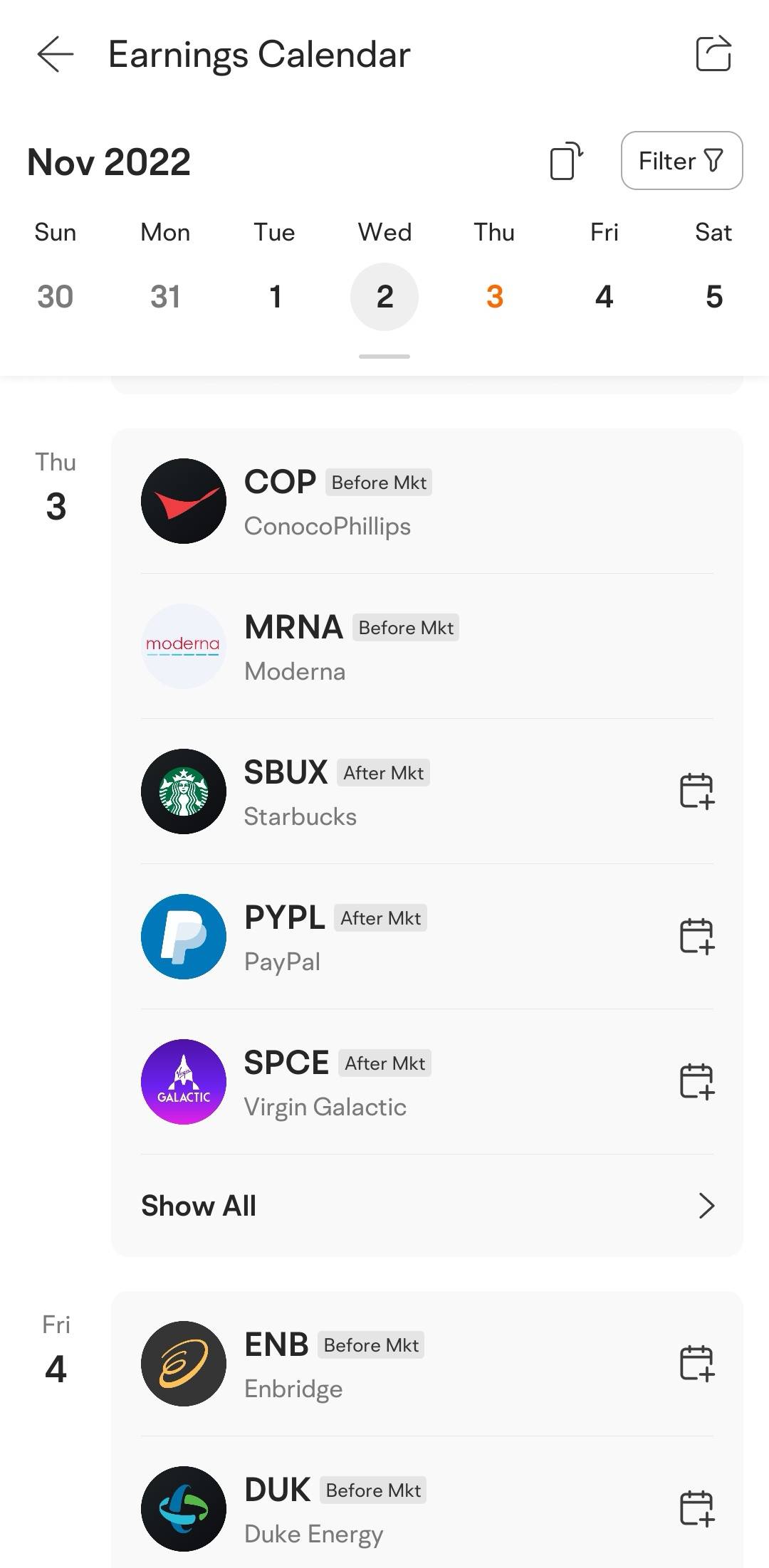

The following is an example of what a calendar for the earnings season can look like:

First-quarter earnings season: April

Second-quarter earnings season: July

Third-quarter earnings season: October

Fourth-quarter earnings season: January

In most cases, an earnings report will run for about six weeks. Historically, publishing financial reports by the aluminum company Alcoa marked the unofficial beginning of the quarterly earnings season (AA). As a result of the company's decision to divide into two distinct entities, it is no longer the first to publish annual results. [1]

Reports are often distributed by a number of different companies on the same day. On Oct.14, 2021, for instance, the first day of the October earnings season, reports on the financial performance of companies including UnitedHealth Group (ticker: UNH), Bank of America (BAC), Wells Fargo (WFC), Domino's Pizza (DZP), Citigroup (C), and Alcoa (AA) were scheduled for publication. [2]

How It Impacts Regular Investors

Earnings season is hectic on Wall Street since hundreds of firms announce results on certain days. Some individuals become energized when they go through a company's earnings report number by number or when they listen to conference calls and analyze every statement made by management. Although it's possible that active traders would feel the effects of this rush of activity the most directly, long-term investors will also be impacted:

The Earnings Season Increases Market Volatility

The key question throughout earnings season is whether or not actual results live up to anticipated outcomes. If a firm reports results that either exceed or fall short of the expectations of analysts or if the comment from management shocks market players, then the price of the company's stock may see some significant price fluctuations as Wall Street strategists and market players alter their ratings and holdings.

Earnings season may cause volatility in the stock market, even if you don't own shares of the firms being evaluated. This is because the results of one firm might have a domino effect on the performance of other companies within the same industry and the whole market.

Your Stock Investment Decisions May Be Affected by Earnings Season

Earnings reports provide a method by which you can evaluate the state of a company's operations, which is useful information to have if you are contemplating purchasing the shares of a certain firm.

Earnings reports are a great method to keep yourself informed as a shareholder if you own any stocks in a company. In addition, the availability of this information may have a role in the choice of whether to sell certain shares or purchase more ones. A firm's stock price and, perhaps, the market as a whole might be affected by what occurs during earnings season, so it's important to pay attention to whether or not you plan to make any financial choices based on this information.

Market Expectations Are Influenced by Earnings Season

Estimates provided by analysts for specific firms may also provide insight into the likely course the stock market will take in the future. Earnings forecasts from various analysts are compiled for use in constructing benchmarks such as the S&P 500. During earnings season, firms that make up this index will release their results, and professional investors may find it necessary to adjust their forecasts for where the S&P 500 is heading.

Conclusion

Earnings season has the potential to shed some light on the happenings in the stock market, especially if those happenings seem to be obscure. Most investors, whether expert money managers, day traders, or casual, long-term investors, have access to the same comprehensive range of financial information simultaneously.

Although it is essential to be aware that earnings season may be unpredictable and, as a result, to refrain from making long-term investing choices solely on this short-term information, an even more crucial takeaway is how information is shared among the different market participants. During earnings season, corporations need to publish their financials, which impacts current strategies and, ultimately, how the stock trades. Keeping up with the development of anything like this might help you become a more knowledgeable investor.

Moomoo trading app will provide the earnings report calendar feature, so traders and investors can track the earnings report schedule more quickly with convenience. Sign up and download the moomoo app today to access the clear and customizable earnings calendar!

Images provided are not current and any securities are shown for illustrative purposes only.

[1] https://www.finra.org/investors/insights/what-investors-need-know-about-earnings-season

[2] https://www.nasdaq.com/market-activity/earnings