What Is Initial Margin?

When opening a margin account, you'll need to deposit cash or security equal to the first margin, which is a proportion of the security's purchase price. Regulation T of the Federal Reserve Board stipulates that a minimum initial margin requirement of fifty percent needs to be met at all times. However, this law only constitutes the bare minimum of what is required; equities brokerage companies have the discretion to establish a greater initial margin requirement for their clients. [1]

Main Points

• One of the requirements of utilizing a margin account is an initial margin, which is a fixed percentage of the total purchase price that needs to be paid in cash.

• In accordance with the rules now in place issued by the Fed, the initial margin needs to be equal to or more than fifty percent of the asset's purchase price. However, brokerages and exchanges can establish initial margin requirements greater than the Fed's minimum specified.

• Initial margin needs are not the same as maintenance margin requirements, which refer to the minimum percentage of equity that needs to be kept in the account at all times. Both sets of criteria need to be met before the account can be opened.

How Does Initial Margin Work?

The initial margin requirement refers to the amount of cash, securities, or other collateral that needs to be deposited into a margin account before it may be opened at a brokerage company by an account holder. Other forms of collateral may also be accepted. Investors, traders, and other market players may utilize leverage in a margin account to buy assets with a value that exceeds the amount of money in the account. Interest is calculated daily on the unpaid amount of a margin account, which is a method of dealing with a line of credit.

Brokerage firms will lend money to account holders in exchange for collateral in the form of securities held in a margin account. This method amplifies the possibility for both profits and losses, but the former may be realized more easily. In the worst-case scenario, when the value of the assets acquired using a margin account decreases to zero, the account owner is required to pay the loss by putting up the whole original value of the stocks in the form of cash or some other liquid collateral.

Futures and initial margin

The initial margin requirements for futures contracts might be as low as five or ten percent of the total contract value, depending on the exchange. For instance, if the price of a crude oil futures contract is listed at $100,000, an individual with a futures account may initiate a long position by depositing an initial margin of just $5,000, which is equivalent to 5% of the contract's value. In other words, the account holder could use 20 times as much money as they put into their account.

During times of severe market volatility, futures exchanges have the option to boost initial margin requirements to any amount they feel suitable. This gives them the same ability as stock brokerage companies, which have the power to increase initial margin levels above those needed by Fed regulation.

Initial Margin vs. Maintenance Margin

The initial margin and the maintenance margin are two different things. When it comes to investment, both terms refer to the ratio of available cash to the amount of money that may be borrowed. On the other hand, the initial margin requirement refers to the quantity of cash or collateral that needs to be provided to acquire securities. In accordance with Regulation T of the Federal Reserve, this number needs to equal a minimum of at least fifty percent of the total transaction. Therefore, you are limited to borrowing no more than 50% of the total investment price.

On the other hand, the maintenance margin refers to the total amount of equity required to be held in the margin account going ahead. In accordance with Reg T, the required minimum amount of maintenance margin is twenty-five percent. This implies that a minimum of 25% of the value of securities held in the account needs to be kept as cash or collateral at all times. [2]

The maintenance margin protects account holders by requiring them to keep a certain amount of collateral in the account at all times, even if the value of their assets drops. Certain securities, particularly those with a high degree of volatility, will have greater margin requirements than others imposed by brokerages.

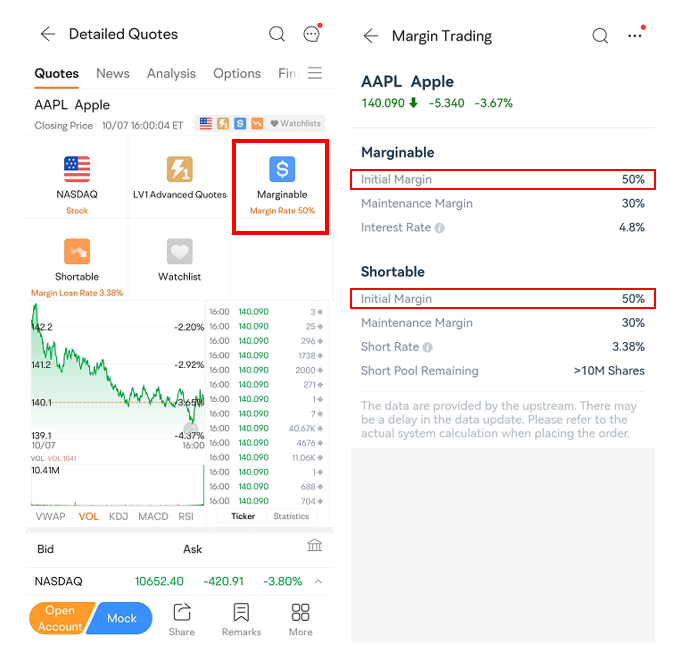

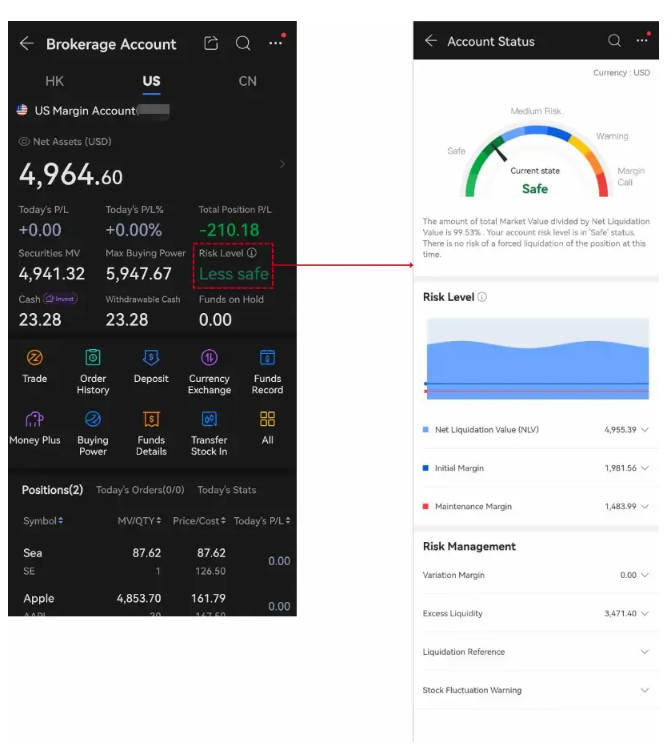

In moomoo trading platform, you could find the initial margin rate on your statements. Specific rates are available on the 「Margin Trade」 page.

moomoo app discloses the risks on the user's account risk details page. It will contain descriptions of your account risks, disposal suggestions, and early warning information on fluctuations of individual stocks. You could easily find out the risk level of the stock when you do margin trading and be better informed of the dangers in the early stage.

Example of Initial Margin

Consider the following scenario as an illustration: a person with an account wishes to buy 1,000 shares of Meta, Inc. (META), which was previously known as Facebook and has a share price now at $200. Using an account with a cash balance would result in a total cost of $200,000 for this particular transaction. The overall buying power, however, will increase to $200,000 if the account user creates a margin account and deposits the first margin requirement of fifty percent, which is $100,000. In this particular scenario, the margin account has access to a leverage ratio of two-to-one.

[1] SEC.gov | Investor Bulletin: Understanding Margin Accounts