What is Simple Moving Average (SMA)?

Key Takeaways

● A simple moving average is one of the most basic technical indicators that reflects asset price changes.

● Investors tend to go long on a security when its short-term moving average crosses above the long-term average, signaling strong short-term prices.

● The indicator may be biased when applied to extreme short-term fluctuations.

Understanding SMA

A simple moving average, sometimes called an “arithmetic moving average”, averages out the closing prices for a specific period.

It is one of the most basic indicators that measures asset price fluctuations.

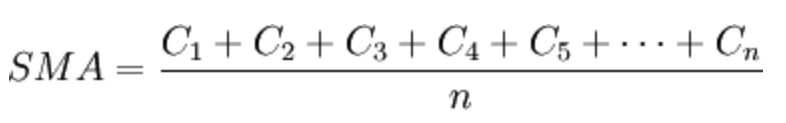

SMA formula

C: the closing price of an asset for each day over a specific period

n: the number of days

Let’s take a 5-day SMA as an example.

We could add the closing prices of a security for five consecutive trading days and divide the number by five. The result would be the first data point of this 5-day SMA.

The second data point would drop the closing price on the first day, add the closing price on the sixth day, and divide the figure by five again.

That way, all data points are finally connected up as SMA, forming a line that moves as the average value of the underlying asset changes.

How to use SMA

Traders often use SMA as a starting point when conducting their technical analysis. Short-term moving averages may inform their trading decisions.

For example, when the short-term average (5 days) crosses above the long-term average (30 and 60 days), it sends a bullish signal, where investors may consider entering trades.

By contrast, if the short-term average (5 days) crosses below the long-term average (30 and 60 days), investors might consider closing their positions as potential losses are in store.

It’s worth noting that SMA assigns an equal weighting to all closing prices on each day, with no regard to recent and older data. So the indicator may not tell a good story of violent short-term price moves.