What Is the Price-to-Book (P/B) Ratio?

The price-to-book ratio, often known as the P/B ratio, is a metric used by companies to evaluate the relationship between a company's market capitalization and its book value. The formula for calculating it is to divide the stock price per share of the firm by its book value per share (BVPS). Value investors sometimes use the price-to-book ratio in their search for equities that they believe are being sold at prices that are lower than their intrinsic value.

A company's book value for an asset is the same as its carrying value on the balance sheet, which is arrived at by offsetting the asset's accumulated depreciation.

How to Determine the Price-to-Book (P/B) Ratio Through Formula and Calculation

The formula for determining the book value of each share is as follows: (total assets - total liabilities) / the total number of shares currently in circulation. Simply looking at the share price quotation in the market is all that is required to determine the market price of each share.

If the P/B ratio is low, it may indicate that the stock is underpriced. On the other hand, it might indicate something fundamentally wrong with the business. This, like most other ratios, varies from company to company. The price-to-book ratio is another indicator of whether or not you are paying an excessive amount for what would be left over if the firm went bankrupt immediately.

How to Understand the Price-to-Book Ratio

The price-to-book ratio (P/B ratio) indicates the value that players in the market place on a company's stock compared to the firm's book value per share. The market value of a company's shares is a statistic that looks into the future and represents the company's expected future cash flows. The book value per share is a measurement used in accounting that is based on the idea of historical costs. It considers previous stock issuances, adds in profits or losses, and subtracts out dividends and share repurchases.

The price-to-book ratio is a method for comparing the current market value of a firm to its historical book value. The market value of a corporation may be calculated by multiplying the price of each outstanding share by the total number of shares in circulation. The net assets of a firm are what constitute its book value.

To put it another way, if a firm were to sell all of its assets and pay off all of its liabilities, the value that was left over would represent the company's book value. The price-to-book ratio (P/B ratio) is a useful reality check for investors who are looking for growth at a price that is not unreasonable. This ratio is often used with return on equity (ROE), a growth indicator. Companies should often exercise caution if there is a significant gap between their P/B ratio and ROE.

The P/B Ratio: A Real-World Illustration of Its Application

Suppose a company's balance sheet shows $100,000,000 in assets and $75,000,000 in liabilities. An easy calculation would reveal that the firm's book value is $25 million ($100 million less $75 million).

In a company with 10 million shares in circulation, the book value of each share would be $2.50. Assuming that the share price is $5, the price-to-book ratio would be 2x ($5 divided by $2.50).

This demonstrates that the asset's book value is valued at double what it is now trading at on the market, which may or may not imply that the asset is overpriced. This would be contingent on how the P/B ratio compares to other firms operating in the same industry and size.

The Price-to-Book Ratio: Why Is It Important?

The price-to-book ratio is essential because it provides shareholders with a tool to determine whether or not a firm's current market price seems justified when seen in conjunction with a company's balance sheet. For instance, if a firm has a high price-to-book ratio, shareholders could look at it through the lens of other metrics, such as its historical return on asset (ROA) or increase in profits per share, to determine whether or not the value is appropriate given those other metrics (EPS). The price-to-book ratio is another common metric that is used in the process of vetting possible investment possibilities.

Restrictions of Using the P/B Ratio

The book value of stock offers investors a generally steady and user-friendly indicator that can be readily compared to the market rate, which is one of the reasons why the price-to-book ratio is valuable to shareholders. Since negative earnings make price-to-earnings ratios meaningless, and there are fewer businesses with negative book values than with negative profits, the P/B ratio may be employed for corporations with positive book values and negative earnings.

P/B ratios, on the other hand, may not be comparable when companies use different accounting standards, which is particularly true when comparing businesses based in different countries. Furthermore, P/B ratios may not be as helpful for service and information technology firms since these types of businesses often have few physical assets that can be seen on their balance sheets. Lastly, the valuation might go below zero if the company has had numerous losses in recent years, rendering the P/B ratio meaningless for comparative valuation purposes.

The book value figure in the calculation may also be skewed by various events, such as a recent purchase, a recent write-off, or a share buyback, which can lead to an inaccurate P/B ratio. In addition to the price-to-book ratio, investors should analyze other valuation metrics when looking for companies that are trading at a discount to their fair value.

Summary

The price-to-book ratio, often known as the P/B ratio, is a valuation metric that compares the current market price of a stock to the "book value" of the company's assets. If the P/B ratio is less than one, it is believed that the market is underpricing the stock. This is because the accounting value of the company's assets, should they be sold, would be more than the current price of the company's shares. Hence, professional investors often concentrate their attention on firms that, among other criteria, have a low price-to-book ratio. A high P/B ratio is another indicator that might help investors spot overpriced firms and steer clear of them.

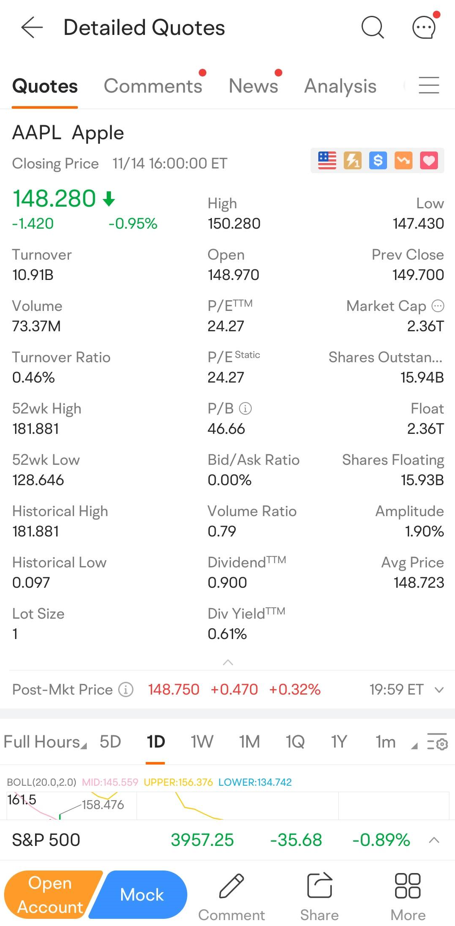

Moomoo trading app will provide investors with a comprehensive overview of individual stocks, like quote price, volume, price-to-earnings (P/E), price-to-book (P/B), market cap, and more. Sign up and download the moomoo app today to get free access to the latest stock market quotes.

Images provided are not current and any securities are shown for illustrative purposes only.