Introduction to Options Contracts

What is an Options Contract?

An option is a derivative contract that gives the buyer the right, but not the obligation, to buy or sell the underlying asset at a predetermined price within a specified period of time.

An exchange-traded option is a standardized derivative contract traded on an exchange, and cleared through a clearinghouse. Over-the-Counter (OTC) options, on the other hand, are non-standardized contracts exchanged between private parties in the over-the-counter market without the oversight of an exchange.

Unless otherwise specified, the term "options contract" usually refers to standardized contracts traded on exchanges.

The terms and conditions are usually standardized for the same type of options contract listed on the same exchange, but there can be variations between different exchanges and asset types. Generally, an options contract will include the following key elements.

1.Underlying Asset

The underlying asset refers to the asset to be bought or sold if the option is exercised.

2.Type

There are two types of options:

• Call Options: Give the buyer the right to buy the underlying asset.

• Put Options: Give the buyer the right to sell the underlying asset.

When a stock exchange lists an options contract, it will simultaneously list both call options and put options.

3.Strike Price

The strike price, or exercise price, refers to the predetermined price at which an underlying security can be either bought or sold once exercised.

4.Expiration Date

Expiration date refers to the date on which the options contract expires, and is no longer valid for trading.

5.Exercise Style

Exercise style is usually defined by the dates when the options contract can be exercised. There are two styles: European and American.

• European Style: Options that can only be exercised at expiration.

• American Style: Options that can be exercised at any time on or before expiration.

6.Settlement Style

Settlement style refers to the way the underlying assets change hands on exercise by the options holder.

• Physical Settlement: The underlying assets of the options contract are physically delivered on a predetermined delivery date.

• Cash Settlement: Cash-settled options are trades that pay out the price difference in cash at expiration.

To learn more about the specific terms and conditions of an options contract, please refer to the relevant contract.

What is Option Premium?

An Option Premium is the fee a buyer pays to a seller or contract writer for the right to buy or sell stocks (or other securities) at a set price when the contract ends. It's basically the current market price of an option contract. The calculation of an option premium consists of an option's intrinsic and time value.

• Intrinsic Value: The value of the options contract if it were exercised today. It equals the underlying price minus the strike price.

• Call option's intrinsic value = MAX(current underlying asset price – strike price, 0)

• Put option's intrinsic value = MAX(strike price – current underlying asset price, 0)

• Time Value: The remaining portion of an option's price after subtracting the intrinsic value.

Options Classification

Options can be categorized into different types based on the underlying asset type, exercise time, option rights, value status, and form of the underlying asset.

Underlying Asset Type

Options can be classified into financial options and commodity options based on the type of underlying asset.

• Financial Options: Includes equity, forex, and interest rate options.

• Equity options include the most well-known options such as stock options, ETF options, and index options (including volatility index options).

• Commodity Options: Includes agricultural, energy, industrial metal, and precious metal options etc...

Underlying Asset Form

Options can be classified into spot options and futures options by the form of the underlying asset.

• Spot Options: Have underlying assets, such as a stock or ETF, in the spot market.

• Futures Options: Have underlying assets in the futures market.

Commodity options are mainly futures options, while both spot options and futures options are widely used in financial options.

Exercise Style

Options can be classified into American options and European options based on the exercise style.

• American Options: Allow the buyer to exercise at any time during the contract's term. It provides more flexibility and is often used in stock options.

• European Options: Can only be exercised on the expiration date. It offers a fixed exercise time that is beneficial for options sellers in creating stable investment strategies. Index options are mainly European options.

Options Rights

Options can be categorized as either call or put options based on the buyer's rights.

• Call Option: Has the right to buy the underlying asset at a predetermined price on or before a certain date.

• Put Option: Has the right to sell the underlying asset at a predetermined price on or before a certain date.

Both call and put options sellers receive a premium from the buyer, but differ in their obligation to sell or buy the underlying asset at the predetermined price if requested by the buyer within the effective time period of the option.

Moneyness

Moneyness is the value of an option if you were to exercise it right away, and describes the intrinsic value of an option in its current state.

In-the-money (ITM), at-the-money (ATM), or out-of-the-money (OTM) are phrases to describe moneyness, and can be distinguished by the relation between an option's strike price and current stock price.

• In-the-Money (ITM)

An in-the-money option will gain a profit once exercised.

• Call Option: Strike Price < Market Price of Underlying Asset

• Put Option: Strike Price > Market Price of Underlying Asset

• At-the-Money (ATM)

An at-the-money option would neither make or lose money from exercising it.

• Call Option: Strike Price = Market Price of Underlying Asset

• Put Option: Strike Price = Market Price of Underlying Asset

• Out-of-the-Money (OTM)

An option is out of the money will lose money once exercised.

• Call Option: Strike Price > Market Price of Underlying Asset

• Put Option: Strike Price < Market Price of Underlying Asset

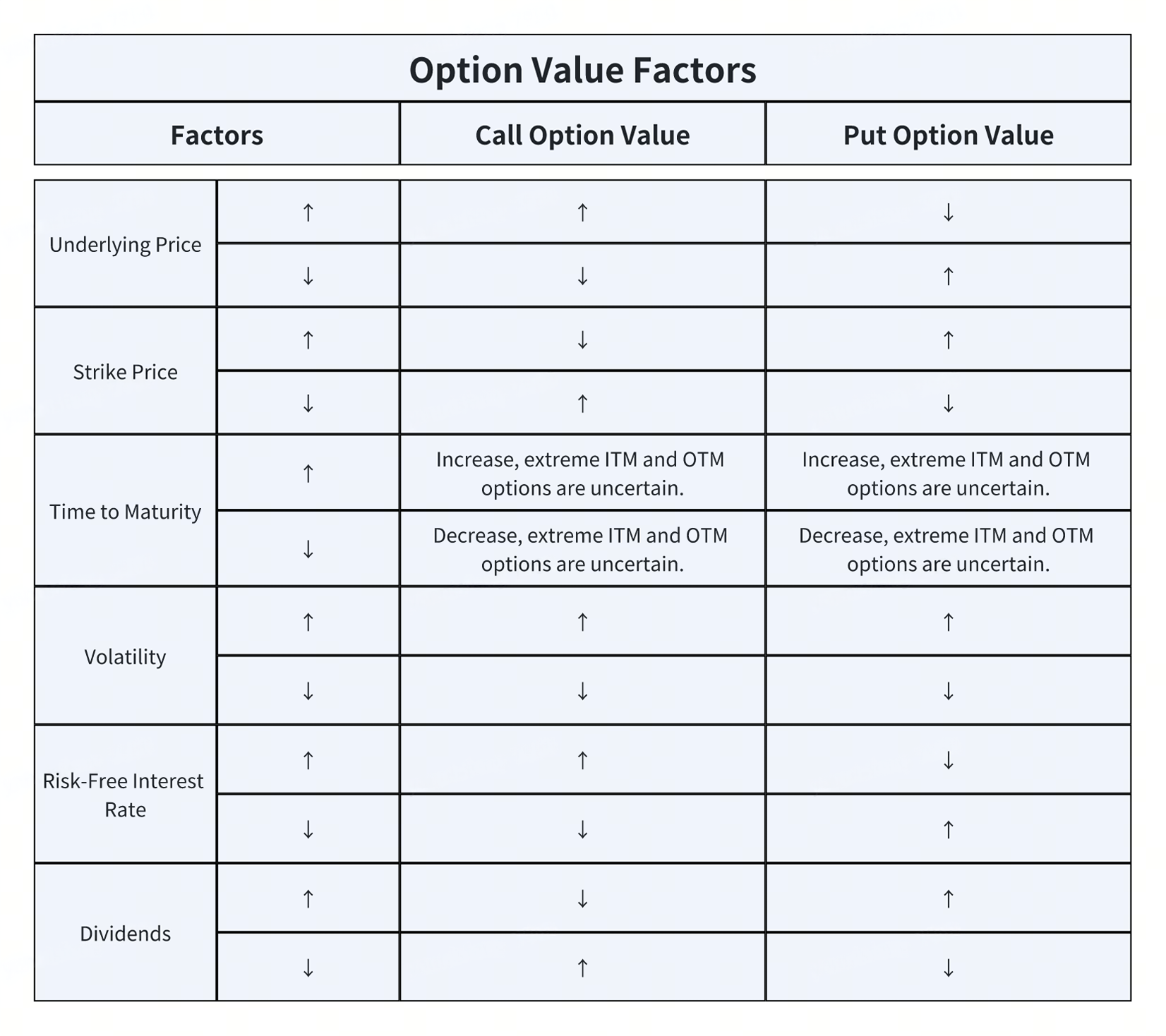

What factors influence Option Value?

An option's value is dependent on a number of factors, such as the strike price listed on the option's contract. Other factors, such as the underlying price and volatility, depend on market and economic conditions which may fluctuate over time.

The main factors included are: underlying price, strike price, risk-free interest rate, dividends, time to maturity, and volatility.

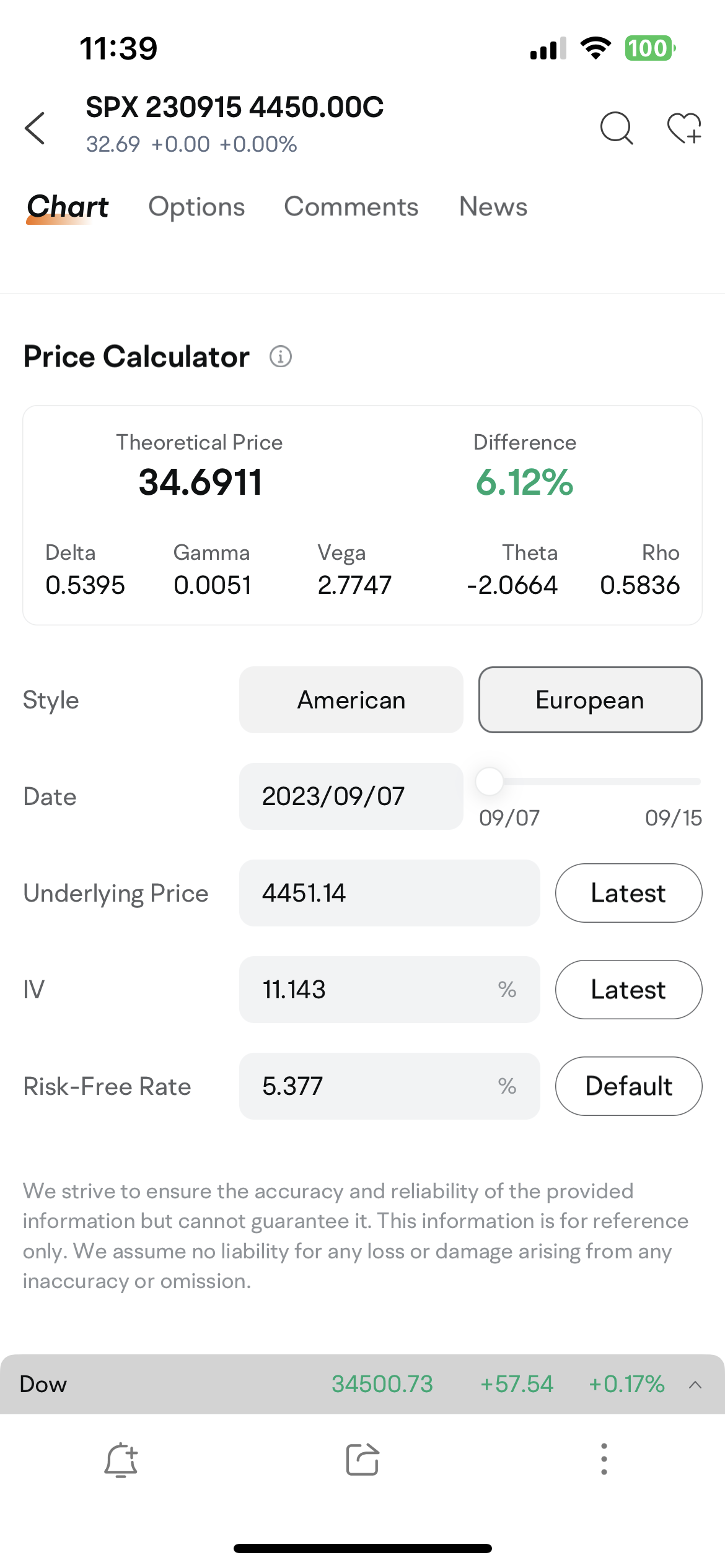

Use the Price Calculator to see the impact of different factors on option premiums.

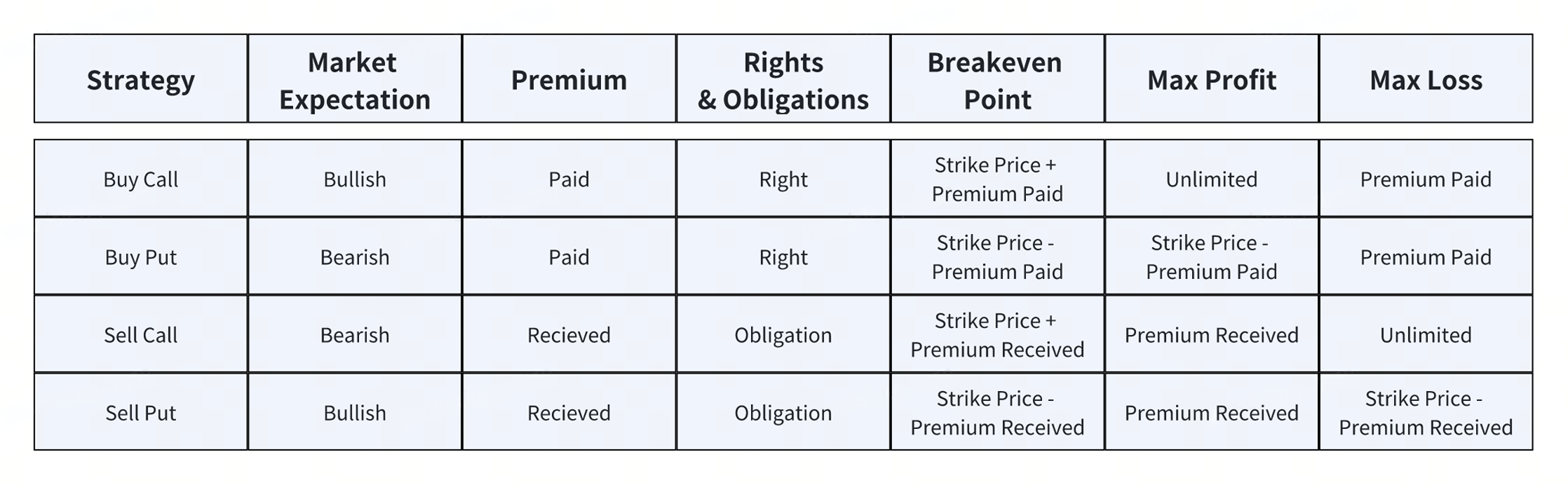

Basic Options Strategies

There are four basic ways to trade an option: buy calls, sell calls, buy puts, and sell puts.

Buy Call Options

Buying call options is a bullish strategy used to profit from an expected increase in the underlying asset price.

• Max Loss = Premium Paid

• Breakeven Point = Strike Price + Premium Paid

• If underlying asset price < strike price:

• Loss = Premium Paid

• If strike price < underlying asset price < breakeven point:

• Loss = Breakeven Point – Underlying Asset Price

• If underlying asset price > breakeven point:

• Profit = Underlying Asset Price – Breakeven Point

Profits increase as the underlying asset price rises beyond the breakeven point.

Buy Put Options

Buying put options is a bearish strategy used to profit from an expected decrease in the underlying asset price.

• Max Loss = Premium Paid

• Breakeven Point = Strike Price – Premium Paid

• If underlying asset price > strike price:

• Loss = Premium Paid

• If breakeven point < underlying asset price < strike price:

• Loss = Underlying Asset Price – Breakeven Point

• If underlying asset price < breakeven point:

• Profit = Breakeven Point – Underlying Asset Price

Profits increase as the underlying asset price falls. The maximum profit occurs when the underlying asset price reaches zero.

Sell Call Options

Selling call options is a bearish strategy that focuses on earning the yield from premiums. Sellers believe an underlying asset price will remain flat or decrease in the future. The seller of call options can receive premiums, but must undertake the obligation to sell the underlying asset at the strike price if the buyer exercises the option.

• Max Profit = Premium Received

• Breakeven Point = Strike Price + Premium Received

• If underlying asset price > breakeven point:

• Loss = Underlying Asset Price – Breakeven Point

• If strike price < underlying asset price < breakeven point:

• Profit = Breakeven Point – Underlying Asset Price

• If underlying asset price < strike price:

• Profit = Premium Received

Losses increase as the underlying asset price rises beyond the breakeven point. The maximum loss is unlimited.

Sell Put Options

Selling put options is a bullish strategy that focuses on earning the yield from premiums. Sellers believe the underlying asset price will remain flat or increase in the future. The seller of put options can receive premiums, but must undertake the obligation to buy the underlying asset at the higher, pre-set strike price if the buyer exercises the option.

• Max Profit = Premium Received

• Breakeven Point = Strike Price – Premium Received

• If underlying asset price > strike price:

• Profit = Premium Received

• If strike price > underlying asset price > breakeven point:

• Profit = Underlying Asset Price – Breakeven Point

• If underlying asset price < breakeven point:

• Loss = Breakeven Point – Underlying Asset Price

Losses increase as the underlying asset price falls beyond the breakeven point. The maximum loss is unlimited, but in practice, is reached when the underlying asset price falls to zero.

Summary of Basic Options Strategies

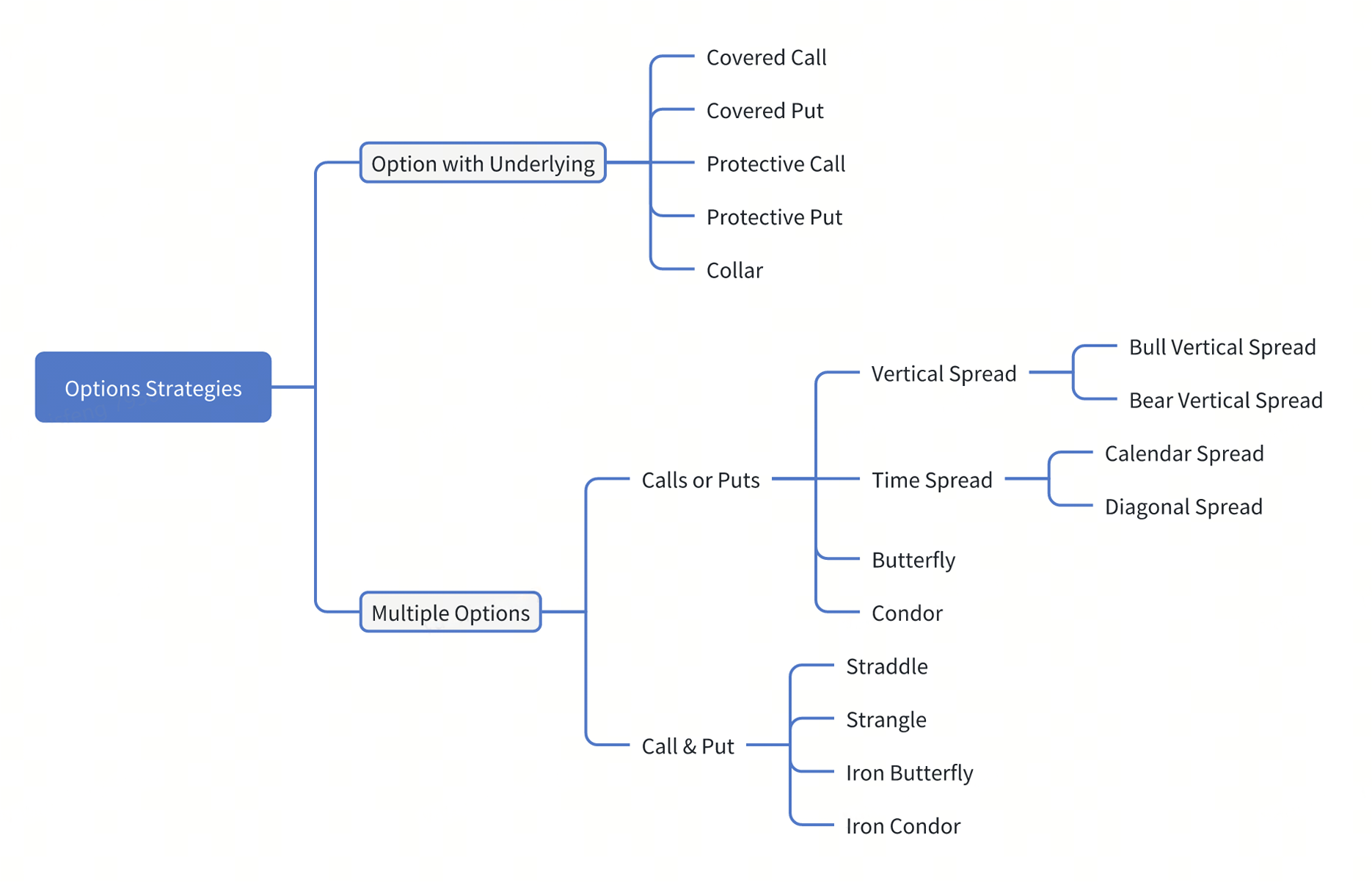

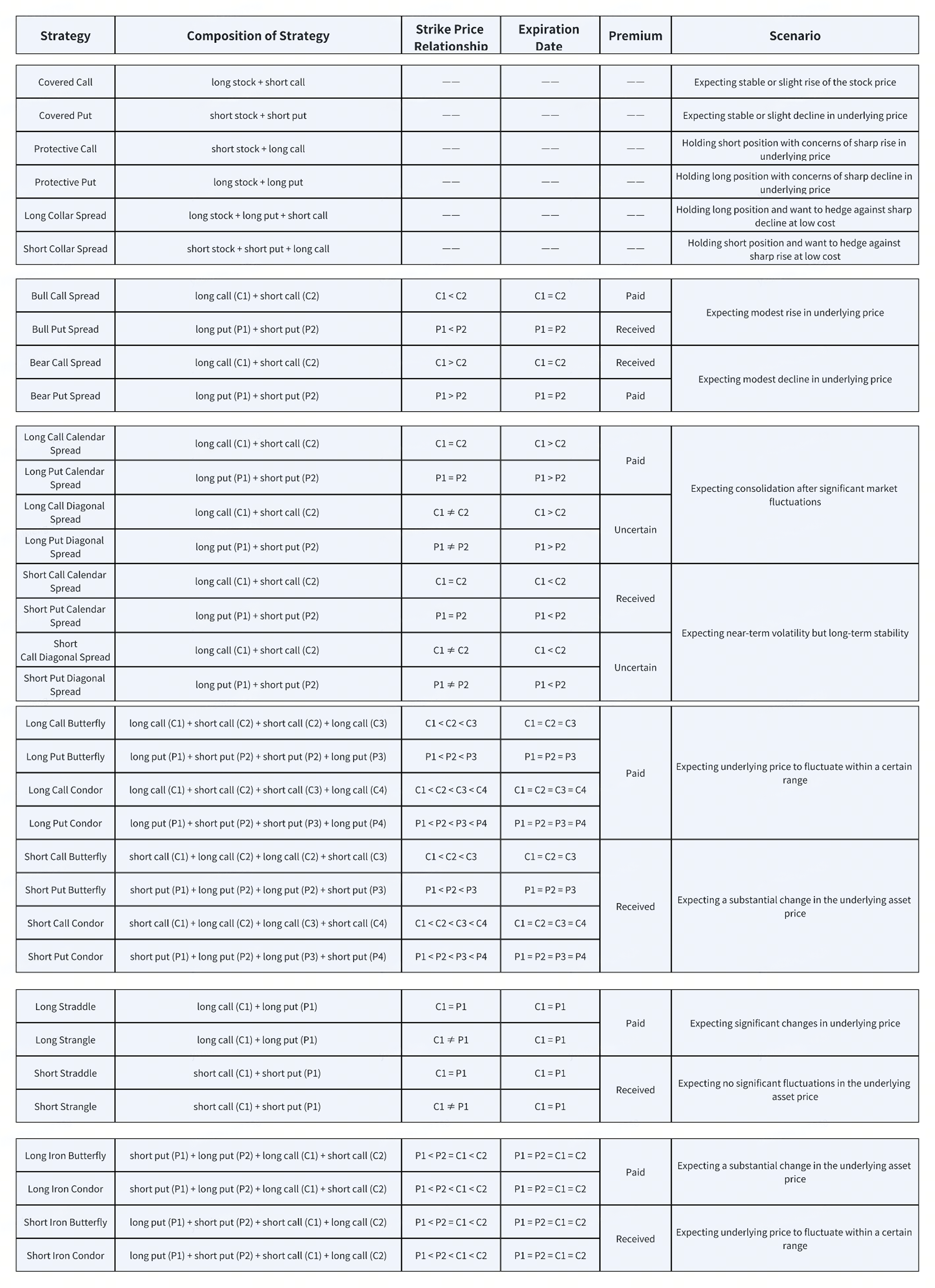

Options Strategies

Investors can use different options strategies based on their risk preferences and market outlook. Investors can reduce risk and increase profits by either combining trades of the assets and options or buying multiple options.

Popular Options Strategies

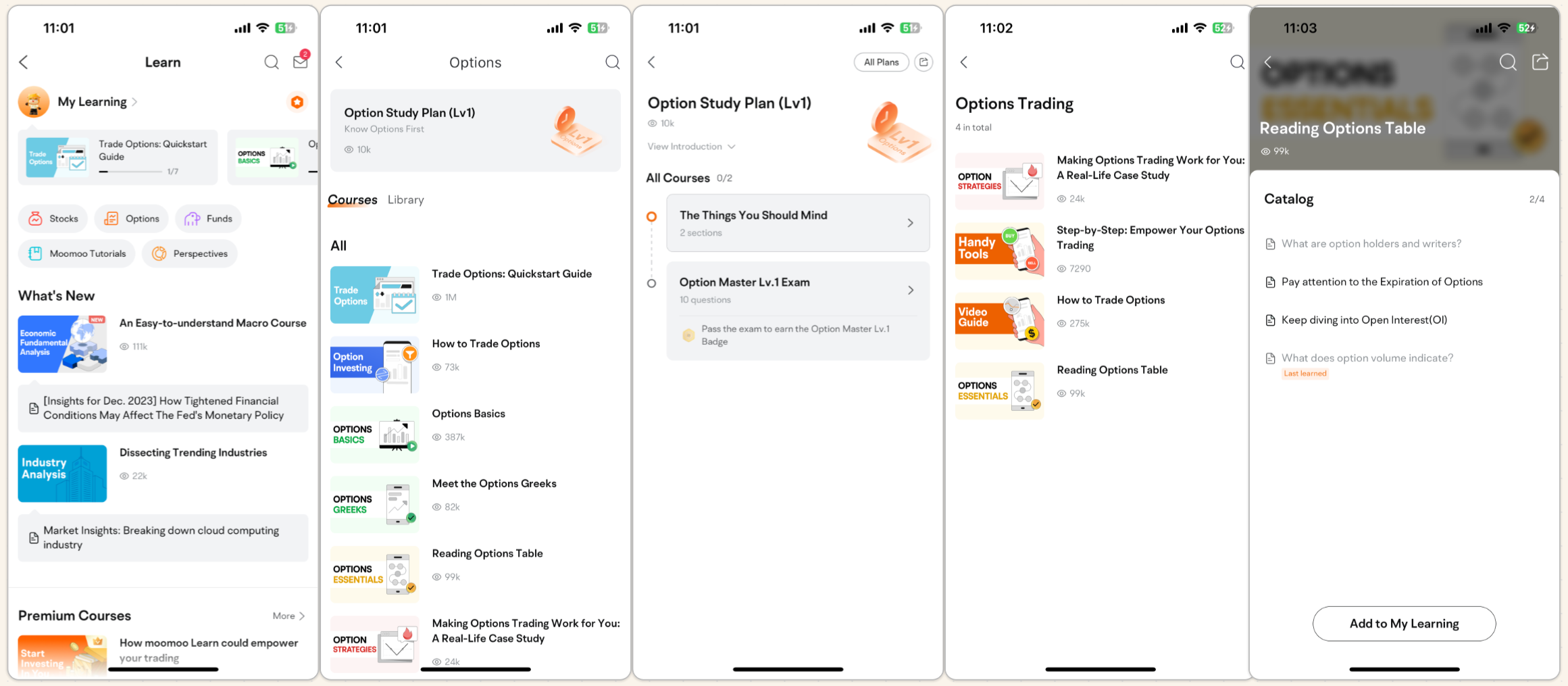

To learn more about options, please open the moomoo app, and go to Learn > Options.

This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal.

Overview

- What is an Options Contract?

- 1.Underlying Asset

- 2.Type

- 3.Strike Price

- 4.Expiration Date

- 5.Exercise Style

- 6.Settlement Style

- What is Option Premium?

- Options Classification

- Underlying Asset Type

- Underlying Asset Form

- Exercise Style

- Options Rights

- Moneyness

- What factors influence Option Value?

- Basic Options Strategies

- Buy Call Options

- Buy Put Options

- Sell Call Options

- Sell Put Options

- Summary of Basic Options Strategies

- Options Strategies

- Popular Options Strategies

- No more -