Option Trading Rules

Option trading FAQ

What's the trading unit for options?

What are the trading hours for options?

Why can't I trade some index options on the expiration date?

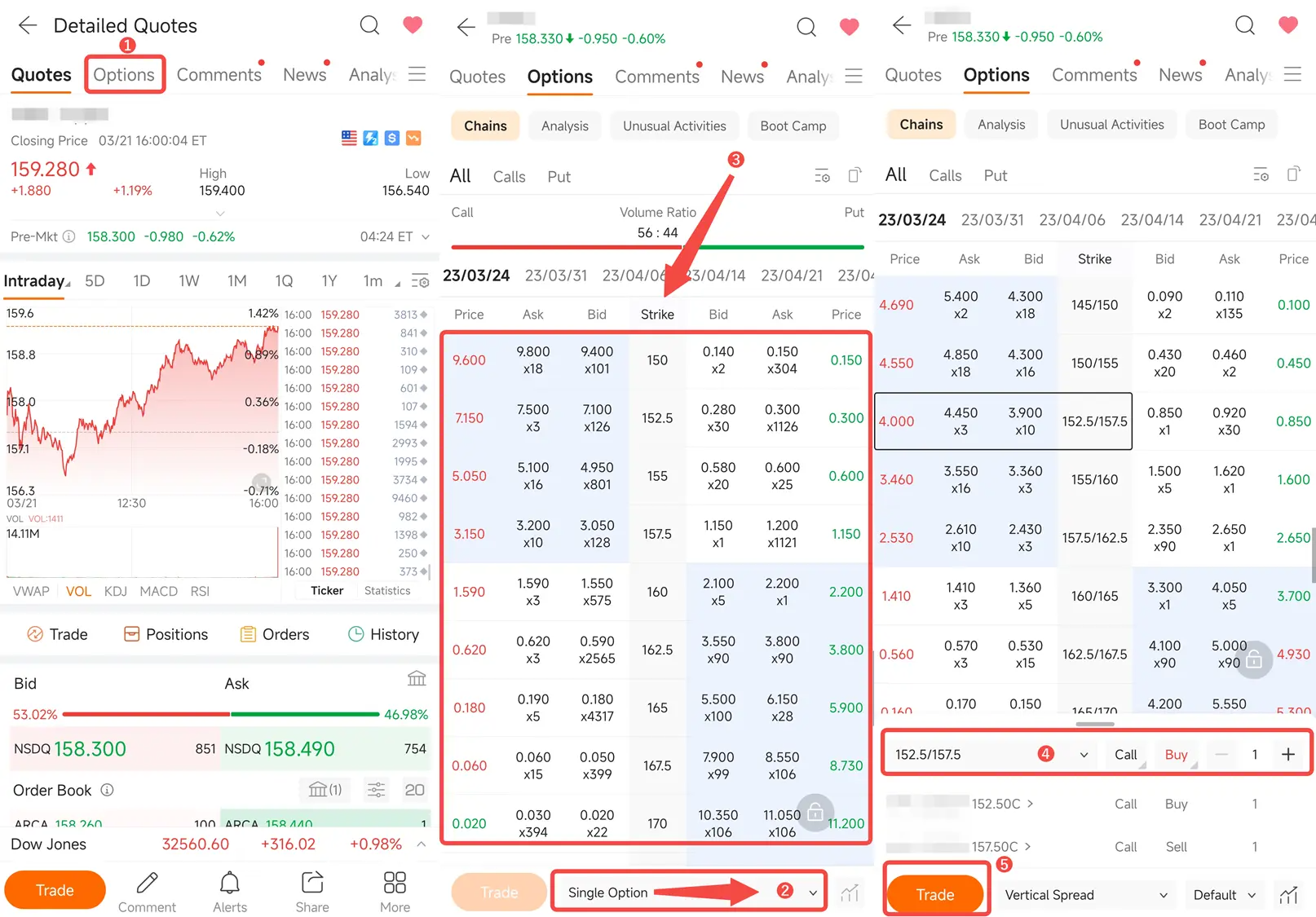

How to trade options?

Trading options is similar to trading stocks. You can place an order after entering the quantity and price.

You can choose to buy open or sell short to establish new positions in an option; if you already have a long or short position in an option, you can also close the position through sell and buy operations.

What's the trading unit for options?

Options are traded in units of their contracts. One contract is usually equal to 100 shares of the underlying stock or 100 times the point value of the underlying index. Corporate actions may result in a different number of shares, or point value of the underlying index.

For example, a stock option contract of AAPL 170314 140.00C has a quoted price of $2.00. The premium of this contract is calculated as:

-

$2.00 * 100 = $200.00

Upon being exercised, you will receive 100 shares of AAPL, Apple Inc.

By comparison, an index option contract of SPXW 240110 4770.00C has a quoted price of $4.00. The premium of this contract is calculated as:

What are the trading hours for options?

U.S. equity options:

-

Trading hours for the options are 9:30-16:00 US Eastern Time.

-

Equity options do not support pre- and post-market trading, but some ETF and ETN options are late close exceptions and will trade until 16:15 US Eastern Time.

U.S. index options:

-

Regular trading day:

-

9:30~16:15 US Eastern Time

-

Last trading day:

-

AM-settled index options: 9:30~16:15 US Eastern Time

-

PM-settled index options: 9:30~16:00 US Eastern Time

Why can't I trade some index options on the expiration date?

Index options contracts have an expiration date and last trading day respectively.

-

AM-settled index options: The last trading day is the trading day before the expiration date.

-

PM-settled index options: The last trading day is the expiration date.

Index options can only be traded on or before the last trading day. Therefore, AM-settled index options can't be traded on the expiration date.

SPXW230915C4500000 and SPX230915C4500000 both expire on September 15, 2023. However, the former can be traded on the expiration date and the latter can't.

Options order types

Options support both single-leg and multi-leg orders.

Single-leg orders

Placing orders for single-leg options supports the follow order types:

-

Supported order types: market, limit, stop, stop limit, market-if-touched, limit-if-touched, trailing stop, and trailing stop limit.

For more information, refer to the help article "Order Types".

Multi-leg orders

What is a multi-leg options order

A multi-leg options order is an order where two or more option transactions are bought and/or sold simultaneously. This could mean the options selected could have more than one strike price and expiration date. Each leg in a multi-leg options order is typically filled at the same time. However, if there are many option contracts under each leg, partial fill may occur, in which case the order will be filled in proportion to the leg ratio. For example, a vertical spread strategy contains two legs, i.e. the long call option and the short call option, and the leg ratio is 1:1; if you place a multi-leg option order for 5 vertical spread that contain 5 long call option contracts and 5 short call option contracts under each leg, respectively, and 2 long call option contracts are executed (i.e. partial fill), then only 2 short call option contracts will be executed accordingly.

Multi-leg options orders allow investors to build complex strategies while potentially saving time to a certain extent. In the event where the general market trend is uncertain, investors may use certain multi-leg options orders to potentially benefit from significant fluctuations in the price of the underlying security.

Currently, multi-leg options order only supports Limit Order.

How to place a multi-leg options order

Tap Watchlist > a stock/index > Options > Chains, select the desirable strategy, and tap the Trade button.

(Any app screenshots are not necessarily up to date, and all securities mentioned are for illustrative purposes only.)

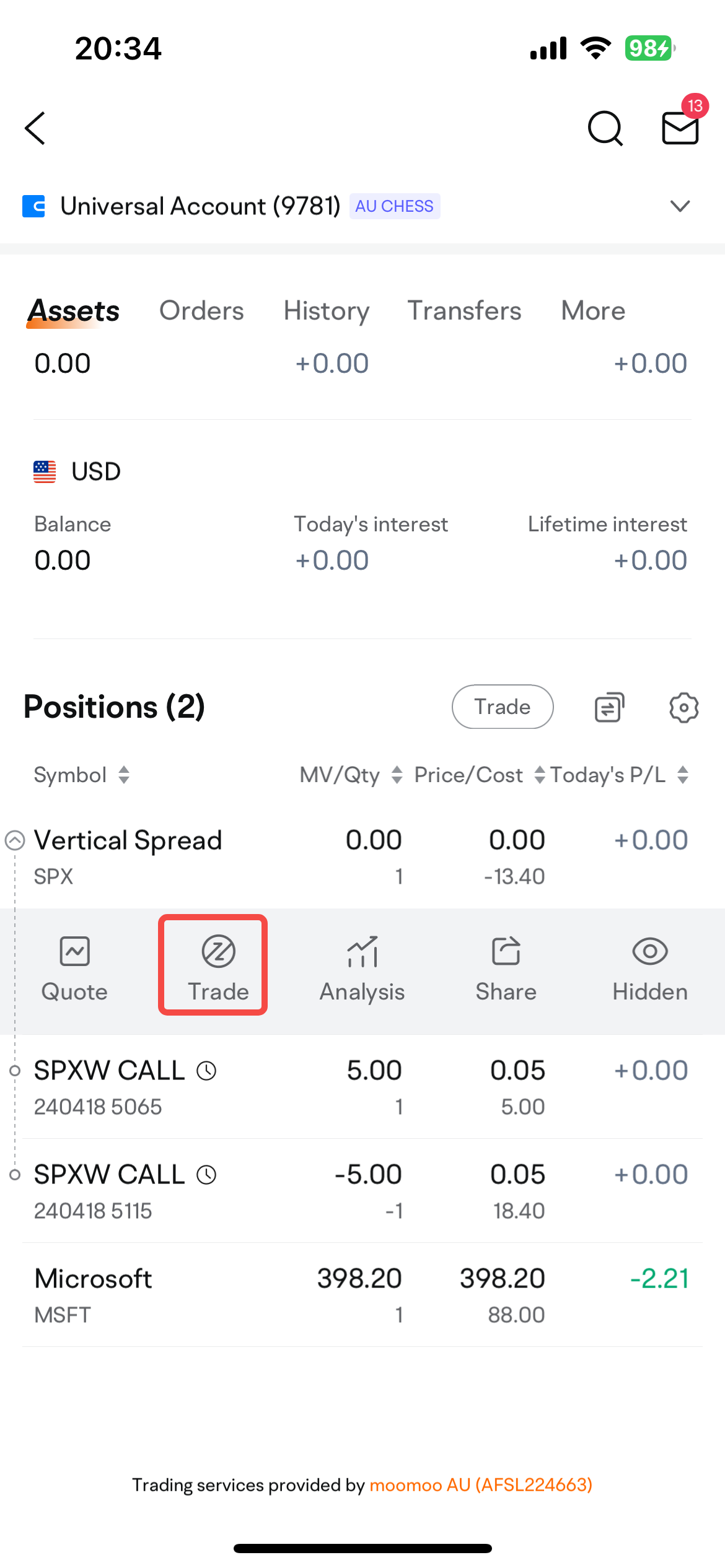

Open or close a position in an option strategy

Tap the option strategy position, then tap the icon indicated in the illustration below, and you can open or close a position in an entire option strategy (applicable only in the Option Strategy View).

(Any app screenshots are not necessarily up to date, and all securities mentioned are for illustrative purposes only.)

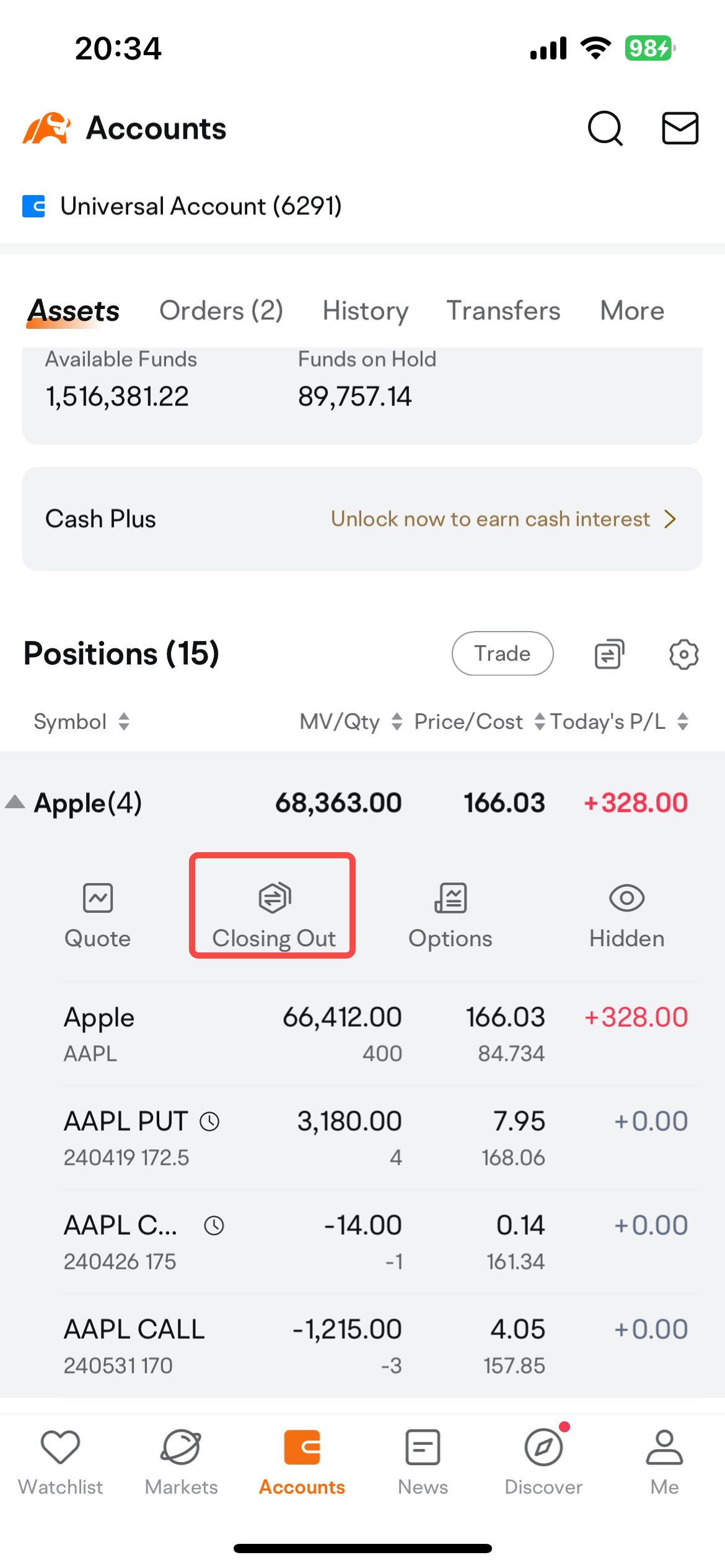

Close out multiple positions with a multi-leg options order

Tap the position list, tap the icon indicated in the illustration below, and you can close out multiple positions as you want with a multi-leg options order (applicable whether in the Option Strategy View or not).

(Any app screenshots are not necessarily up to date, and all securities mentioned are for illustrative purposes only.)

Option strategies

You will be able to trade the single options and option strategies listed below using a Cash Account with Moomoo AU.

Single options

Call options

You can hold a long call in your Cash Account. However, please note that when the call option is close to its expiration date and is in-the-money, your available cash will be temporarily held, assuming that the option will be exercised.

In addition, you can only hold a short call in a Cash Account if it is part of an option strategy that involves underlying shares or other types of options.

Put options

You can hold a long put in your Cash Account. However, please note that when the put option is close to its expiration date and is in-the-money, you must have sufficient underlying shares to meet the option exercise requirement.

Similarly, you can hold a short put in your Cash Account. However, please note that when the put option is close to its expiration date and is in-the-money, your available cash will be temporarily held, assuming that the option will be exercised.

Option strategies

Stock Options

• Covered Call

A Covered Call strategy is to sell a call option of a stock while holding a long position in the stock on a share-for-share basis. This strategy may be considered when the investor is neutral or slightly bullish on a stock by the expiration date.

• Protective Collar

A Protective Collar strategy, also known as a hedge wrapper, is used to help prevent substantial losses, which in turn puts a limit on potential gains.

This strategy comes in handy when investors want to protect any unrealized gains on the underlying long stock from the downward movement in the market. Collar strategy may be used when the underlying long stock position has substantial unrealized gains. Also, investors who are bullish on the stock in the long run but are uncertain about the short-term outlook may consider this strategy. The tradeoff is that the covered call sold limits the potential upside of the long stock.

Index options

• Vertical Spread

A Vertical Spread strategy is to simultaneously buy and sell two options of the same underlying stock, same type (calls or puts), and same expiration date, but with different strike prices.

Debit and Credit Spread

A Vertical Spread strategy is mainly used to serve the following two purposes:

-

For debit spreads, it is used to reduce the payable net premium.

-

For credit spreads, it is used to lower the risks of short selling option positions.

| Type | Definition | Strike Price Comparison | Debit/Credit | Theoretical Max Profit | Theoretical Max Loss | Breakeven |

| Long Call Spread (Bullish) | Long Call (C1)+Short call (C2) | C2>C1 | Debit | C2 - C1 -Net Debit Paid | Net Debit Paid | C1 + Net Debit Paid |

| Short Call Spread (Bearish) | Long Call (C1)+Short Call (C2) | C1>C2 | Credit | Net Credit Received | C1 - C2 - Net Credit Received | C2 + Net Credit Received |

| Short Put Spread (Bullish) | Long Put (P1)+Short Put (P2) | P2>P1 | Credit | Net Credit Received | P2 - P1 - Net Credit Received | P2 - Net Credit Received |

| Long Put Spread (Bearish) | Long Put (P1)+Short Put (P2) | P1>P2 | Debit | P1 - P2 -Net Debit Paid | Net Debit Paid | P1 - Net Debit Paid |

When opening a Vertical Spread strategy, your available cash will be temporarily held to cover the potential theoretical maximum loss.

Note: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy.

Option Level

Type of option available to trade for different Option Level

Moomoo AU will assess your option level based on the personal and financial information you provide when applying for an options account and allow you to use the respective option strategies:

| Option Level | Available Strategies | |

| Stock Options | Index Options | |

| 0 | None | None |

| 1 | Long Call or Put | Long Call or Put |

| 2 |

Long Call or Put

Covered Call

Protective Put

Collar

Cash-Secured Put

|

Long Call or Put

Cash-Secured Put

|

| 3 | Long Call or Put Covered Call Protective Put Collar Cash-Secured Put |

Long Call or Put Vertical Spread Cash-Secured Put |

How to view and change my option level

You can submit your application of update option level via app > Accounts > More >Option Level > Update Level. You can also click here to submit your application for updating option level.

Note:

-

Moomoo AU may adjust your option level and the option strategies available for each level at any time according to regulatory requirements and risk management needs.

-

Update level application will take 1-2 business days to review. For results of the update option level application, please mind the notification in the App.

Options trading fees

Single-leg orders

To learn more about the fee schedule of single-leg option orders, click here.

Multi-leg orders

US multi-leg options order may consist of either a combination of US options or combination of US options + stocks/ETFs. Each leg in a multi-leg options order is charged separately. Total fees are calculated by adding up the fees for each individual leg.

Example 1: To build a long covered call, an investor buys 100 shares of the underlying stock at US$35 per share and simultaneously sells 1 call option on the same underlying stock at US$5. The commissions and other transaction fees for the 100 shares of stock and the 1 option contract are calculated separately.

Taking the commission as an example, the commission for 100 shares of stock is 0.0. The commission for 1 option contract is 1 × US$0.1 = US$0.1.

Therefore, the total commissions are US$0.0+US$0.1 = US$0.1.

*Subjected to other fees e.g. Platform fees.