Options Expiration: Things You Need to Know

Options contracts come with different underlying assets, strike prices, and premiums as well as another key component: the expiration date. This represents a specific date and time when an options contract will either become invalid or worthless, representing the final day for an options contract to trade.

All options contracts have an expiration date but there are different timelines, with expirations varying from daily, up to three years. Read on to learn more.

What is an expiration date in options trading?

In options trading, the expiration date represents the final date that an options contract can be traded or exercised by the holder. There's no guess work on it as its specified in the options contract, typically on a future date (but more on this later).

For U.S. listed stock options, their expiration date is usually the third Friday of the contract month. When a Friday lands on a holiday, then the expiration date is Thursday of the same week. After the contract expiration date, the options contract no longer exists and the options holder can neither sell the contract to another trader nor exercise it.

Types of expiration dates and options styles

While all options have expiration dates, their expiration will vary depending on the options style and its underlying asset. There are two types of styles: American-style and European-style.

Most U.S. equity options and ETF options are American-style options. This options style can be exercised at anytime beginning from the time the options are purchased until their expiration.

For European-style options, typically index options, they stop trading one day prior to the third Friday of the expiration month (at the close of Thursday's business). They are less flexible than American-style options; they can only be exercised on this specific expiration date.

When does an option expire? Read on to find out.

Monthly contract expiration

Besides different exercise styles that dictate expirations, there's also various options expiration dates. The most common and traditional one is the monthly contract expiration. It can represent a nice balance for traders seeking neither a short nor long-term commitment.

A monthly contract expiration occurs on the third Friday of every month between the 15th and 21st day of the month in the U.S. As we previously mentioned there is an exception with Friday holidays: if this third Friday occurs on a stock market holiday, then the monthly contract expiration will take place on the Thursday of the same week.

Weekly contract expiration

The option expiration date for this contract type takes place at the end of the trading week and it's referred to as weeklys. Traders using this shorter weekly expiration are trying to take advantage of short-term market movements and will likely undergo a faster pace of trading without a monthly contract commitment. This expiration will also bring greater risk and volatility, but it can offer opportunities to trade on news events, economic releases, and earnings.

These "weeklys" typically expire every Friday. So instead of one Friday per month for monthly contract expirations, these weekly expirations can offer more variety.

Daily contract expiration

Expiring at an even faster pace are contracts with a daily options expiration. Options that trade under these daily expirations are also referred to as zero days to expiration options (0DTE). These options have grown in popularity in recent years with traders potetially finding an expiration at the end of the same trading day offering quick trading opportunities from overnight or intraday moves. Day traders may also find these appealing, as they can capitalize on these short-term price movements. And with daily contract expirations, 0DTE may undergo high trading volumes and tight price spreads.

Long-Term Equity Anticipation Securities (LEAPS)

On the other side of the expiration time spectrum are Long-Term Equity Anticipation Securities (LEAPs). These are options on either stocks or indexes, typically used as long-term investment strategies as well as long-term hedges. However, certain indexes, such as leveraged indexes, are not designed to be used as long-term investments or hedges. LEAPs can also offer investors more time for a trade to potentially be profitable, but it will also usually be a more expensive options contract with higher break-even costs.

LEAPs are no different than short-term options, other than their long expiration dates. They expire on the third Friday of their expiry month and their expiration dates are at least one year out, but they can extend to a three-year timeframe.

How to pick the right expiration date for options for your investments and objectives

Similar to creating a price forecast for the underlying asset in an options contract prior to selecting a strike price, traders will also need to spend time forecasting how it will take for the the trade to become profitable. Begin with an outlook and then select an option that aligns with this.

Additional tools to use for selecting an expiration date include:

Volatility: Look at either implied volatility (IV) or historical volatility (HV) data

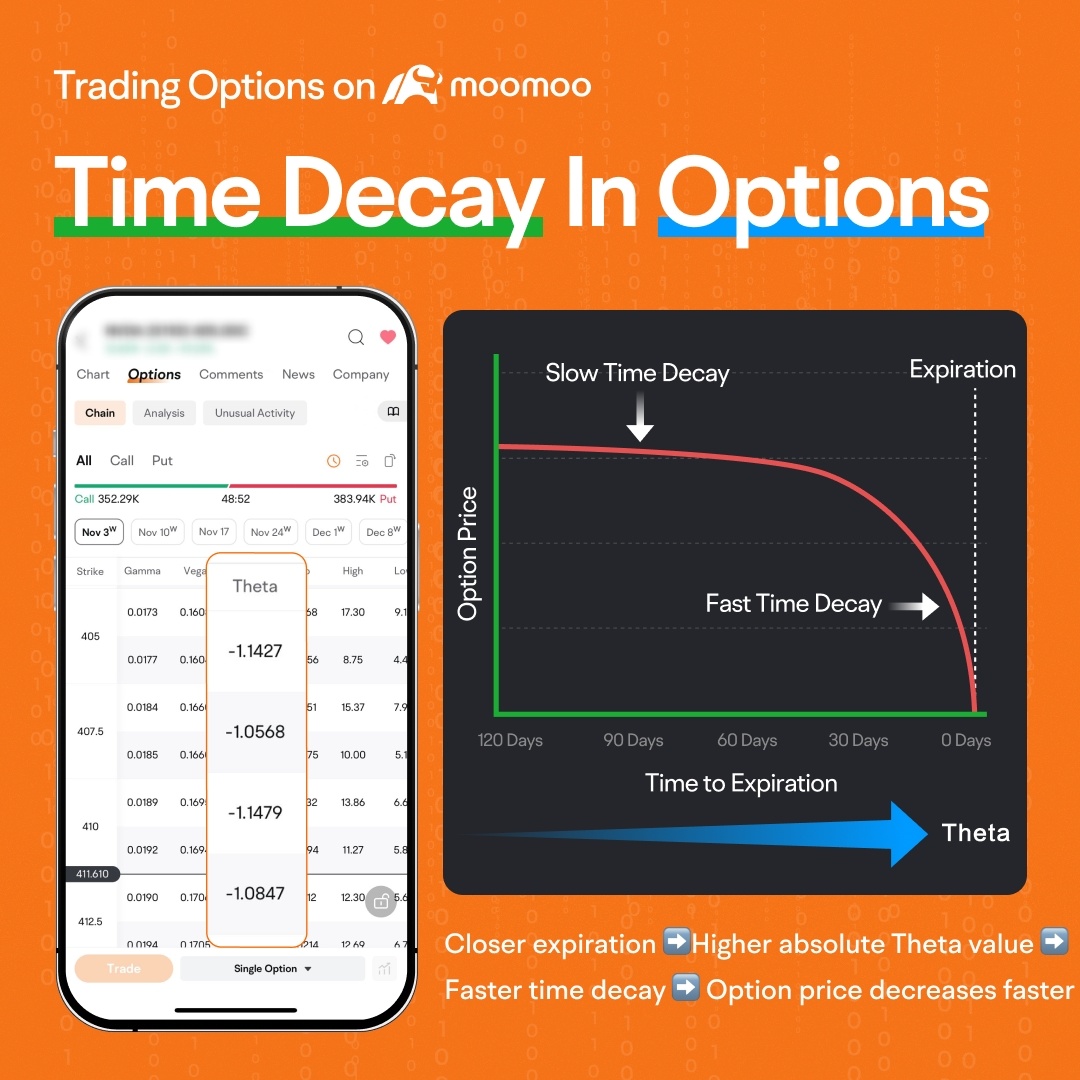

The Greeks: Review delta (an option’s sensitivity to the underlying stock price) or theta (measures the value lost on an option from time passage aka time decay)

Goals: Consider what options strategy to use and your investment objectives

What happens when options expire?

Just as options contracts have different expiration dates, what happens to options when they expire will vary depending on their value and the type. Here's a breakdown for option contracts that are out-of-the-money (OTM) or in-the-money (ITM). Options can also expire -at-the-money (ATM), which means the option has a strike price the same as or close to the underlying asset's market price. But today, we'll focus on OTM and ITM options.

If a trader has ITM options: These options, which have intrinsic value, can be sold prior to expiration.

If the trader has an OTM option: The options, which don't have any intrinsic value at expiration, are essentially worthless--no action is needed.

It's important for traders to monitor their positions as the expiration approaches, make informed decisions about selling, exercising, or allowing their options to expire, depending on their strategic investment goals and market conditions.

So how do you know if you have an ITM or OTM contract? Here's a look for calls and puts; however, it's important to note that this chart affects buyers and sellers of options differently. Usually the buyer is hoping for an ITM and the seller an OTM situation or outcome.

Type of contract | ITM | OTM |

Call option | Strike price below the underlying asset's market price | Strike price higher than underlying asset's price |

Put option | Strike price higher than the underlying asset's market price | Strike price lower than the price of the underlying asset |

A final note on expiration. Options technically expire at 11:59am EST on Saturday. Many underlying stocks trade after hours and depending on the broker some options contracts may be exercised as late as 5:30pm EST on Friday. Since options trading has already ceased this can cause unexpected outcomes with regard to assignment.

How to trade options using Moomoo

Now that you've learned about expiration dates and different options types, here are some steps to get you started trading options on the Moomoo app.

Moomoo provides a user-friendly platform for trading options. Here's a step-by-step guide:

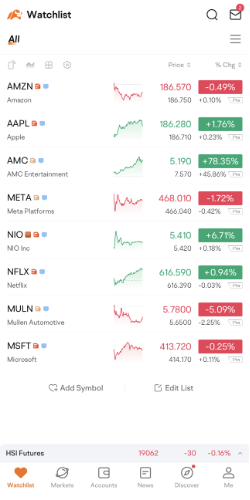

Step 1: Go to your watchlist and select a stock.

Disclaimer: Images provided are not current and any securities are shown for illustrative purposes only and is not a recommendation.

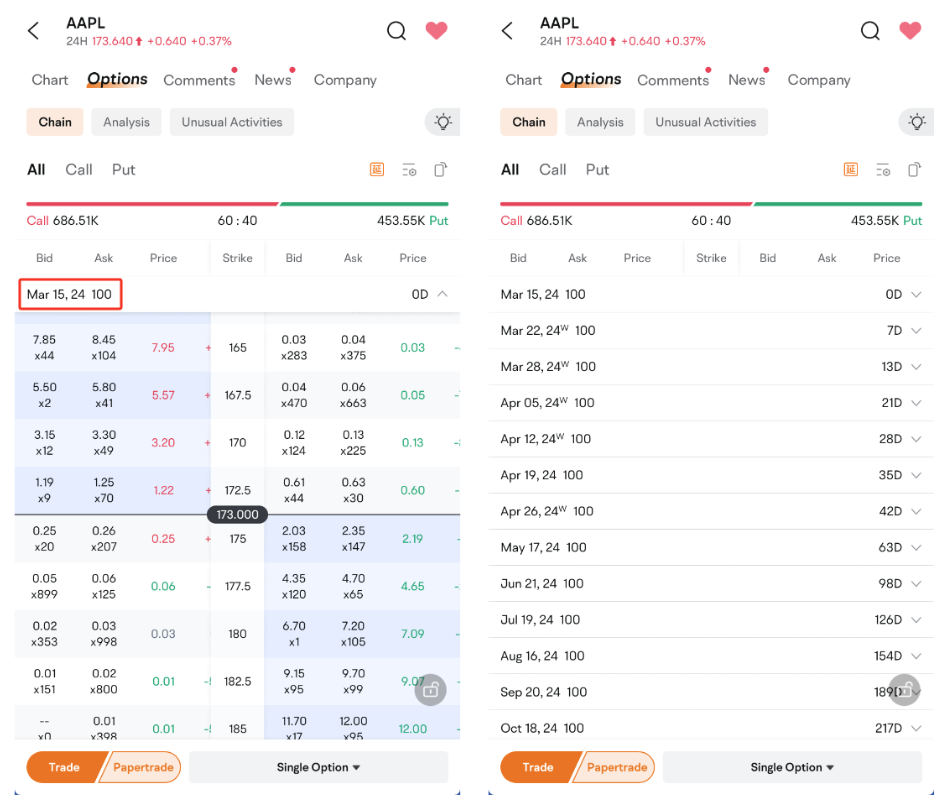

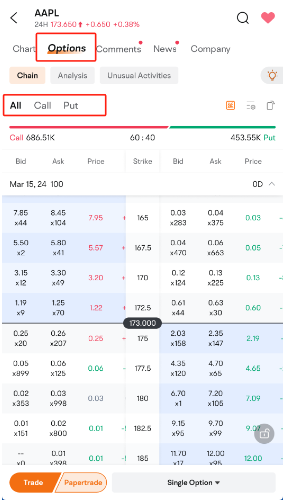

Step 2: Move to Options> Chain at the top of the page.

Step 3: Review options by expiration date via specific dates.

Disclaimer: Data shown may not be current and any securities are shown for illustrative purposes only and is not a recommendation.

Step 4: Filter options by calls or puts: Tap “Call/Put.”

Disclaimer: Images provided are not current and any securities are shown for illustrative purposes only and is not a recommendation.

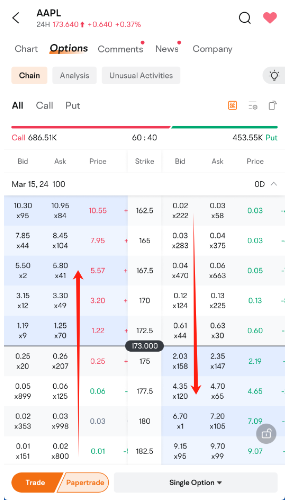

Step 5: Discover out-of-the-money options (in white) and in-the-money options (in blue). To obtain more information about the options, scroll horizontally.

Disclaimer: Images provided are not current and any securities are shown for illustrative purposes only and is not a recommendation.

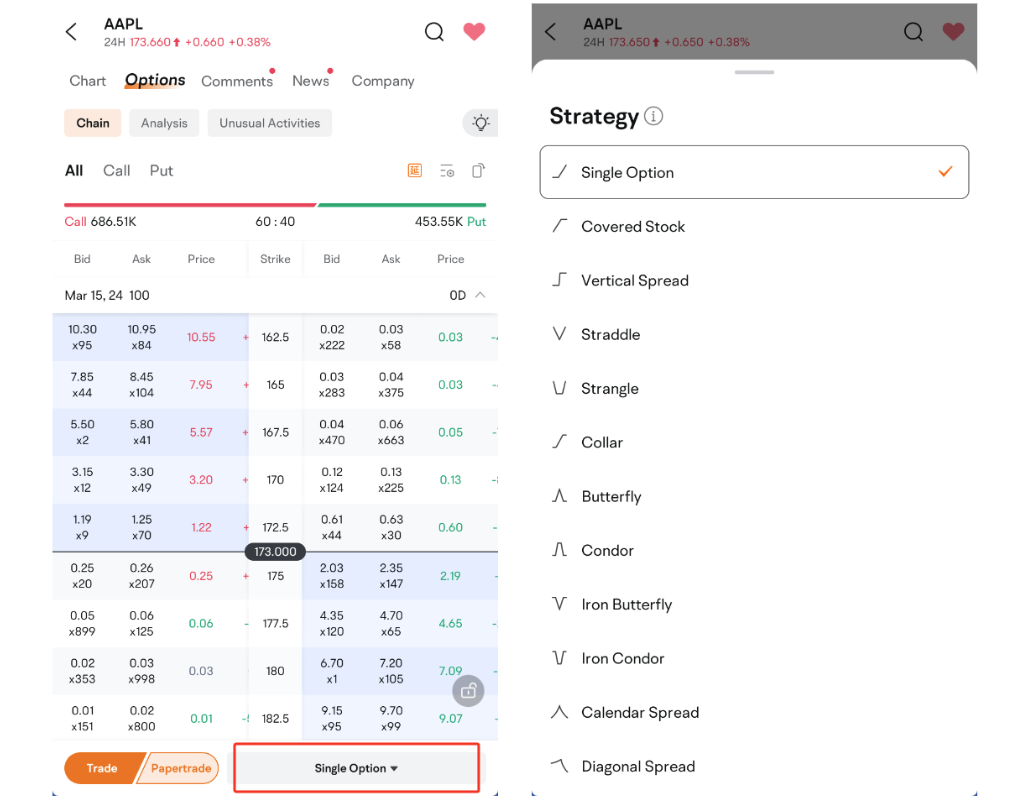

Step 6: Evaluate trading strategies at the bottom of the screen.

Disclaimer: Images provided are not current and any securities are shown for illustrative purposes only and is not a recommendation.

FAQs about options expiration date

What date do options expire?

The expiration date for options is typically on the third Friday of the month (unless it's a stock market holiday). This is usually called“expiration Friday” but there are other option expirations dates such as daily, weekly and for longer-term options, up to three years. This will depend on the type of options contract that you choose to trade.

What happens on options expiry date?

A few things can happen at expiration:

In-the-money (ITM) options will usually be exercised to either long or short stock shares, or if cash-settled (European-style options). Note that a cash-settled option where the actual physical delivery of the underlying asset or security is not required. Instead of receiving the underlying asset, the settlement results in a cash payment.

Out-of-the-money (OTM) options will expire worthless.

A trader can do one of three things: sell (or buy back) the option in the open marketplace, exercise an ITM option or if it's OTM, allow the option to expire.

What happens if I don't close my options on expiry?

This can go two ways at expiry. First, if your options are in-the-money and you don’t sell them, then they will typically be exercised automatically (keep in mind you will need necessary shares or funds); however, if you have out-of-the-money options, they will expire worthless.

What happens if my option expires out-of-the-money?

If you have an option that expires out-of-the-money, it will expire worthless. The maximum amount a contract holder can lose is the premium. If they sell the option before it expires, they may recoup any remaining extrinsic value.

What happens if my option expires in-the-money?

If a trader is long an in-the-money (ITM) option, it will be automatically exercised (but it can be communicated to the broker to not do so). Furthermore, if the account doesn't bear enough money to support the long or short stock position, the brokerage, at its discretion, can choose not to exercise the option. This is referred to as do not exercise ("DNE") and any gain the trader may have attained by exercising option will be eliminated.

On the other hand, if a trader is short an ITM option, it will be automatically assigned. Many times, a trader will not exercise the option and instead trade out of the position before expiration.