What Are Options Strike Prices: How It Works and Examples

For investors, prices matter whether it's the purchase price or sale price of an order. But for options investors, one price that is unique to options orders is the strike price. The strike price helps set the value of an options contract and depending on whether an investor is buying or selling an options contract, the option strike price can help them determine when to enter or exit a trade.

What is a strike price?

Options contracts are derivatives that give contract holders the right, but not the obligation, to buy or sell an underlying security at a predetermined price sometime in the future. This set price is called the option's strike price or the exercise price. For call options, the strike price sets the purchasing price for the underlying security, but for put options, it decides the selling price.

A strike price is an important component of an options contract. The difference between the option's strike price and an underlying security's market price determines whether an option is either in-the-money (ITM) or out-of-the-money (OTM), or at-the-money (ATM).

Strike price vs. exercise price: What's the difference?

Investors get confused between an option's strike price and its exercise price. They are typically used interchangeably. An option's strike price definition is the pre-agreed price at which an underlying security can be bought (a call option) or sold (a put option) by the option holder until the expiration date of the options contract.

An investor knows the strike price when initiating an option trade and will sometimes say exercise price when referring to the price at which they'll exercise the option; however, it is also the strike price definition. If an options holder exercises his option, the strike price will determine what they'll pay or receive for each share at the time of exercise, depending on the strategy.

How the strike price works

A strike price can help determine if an option will be exercised at expiration and if it's either ITM or OTM. An option's intrinsic value is derived by the difference between its strike price and the underlying security's market price. This is called an option's "moneyness" and it informs part of the option's value.

For calls and puts, the distinction of whether they're ITM or OTM is different. There's also at-the-money (ATM) options. This is when the strike price is either at or very close to the stock's current market price.

Strike price for call options

As the stock's market price rises above the strike price, call options gain value. Conversely, if the stock's market price fails to exceed the strike price by the option's expiration, the call option becomes worthless.

Strike price for put options

For put options, the option's value increases as the stock prices drop below the strike price. The wider the difference between the prices, the option becomes more valuable. However, a put option will expire worthless at expiration if the stock price is higher than the strike price.

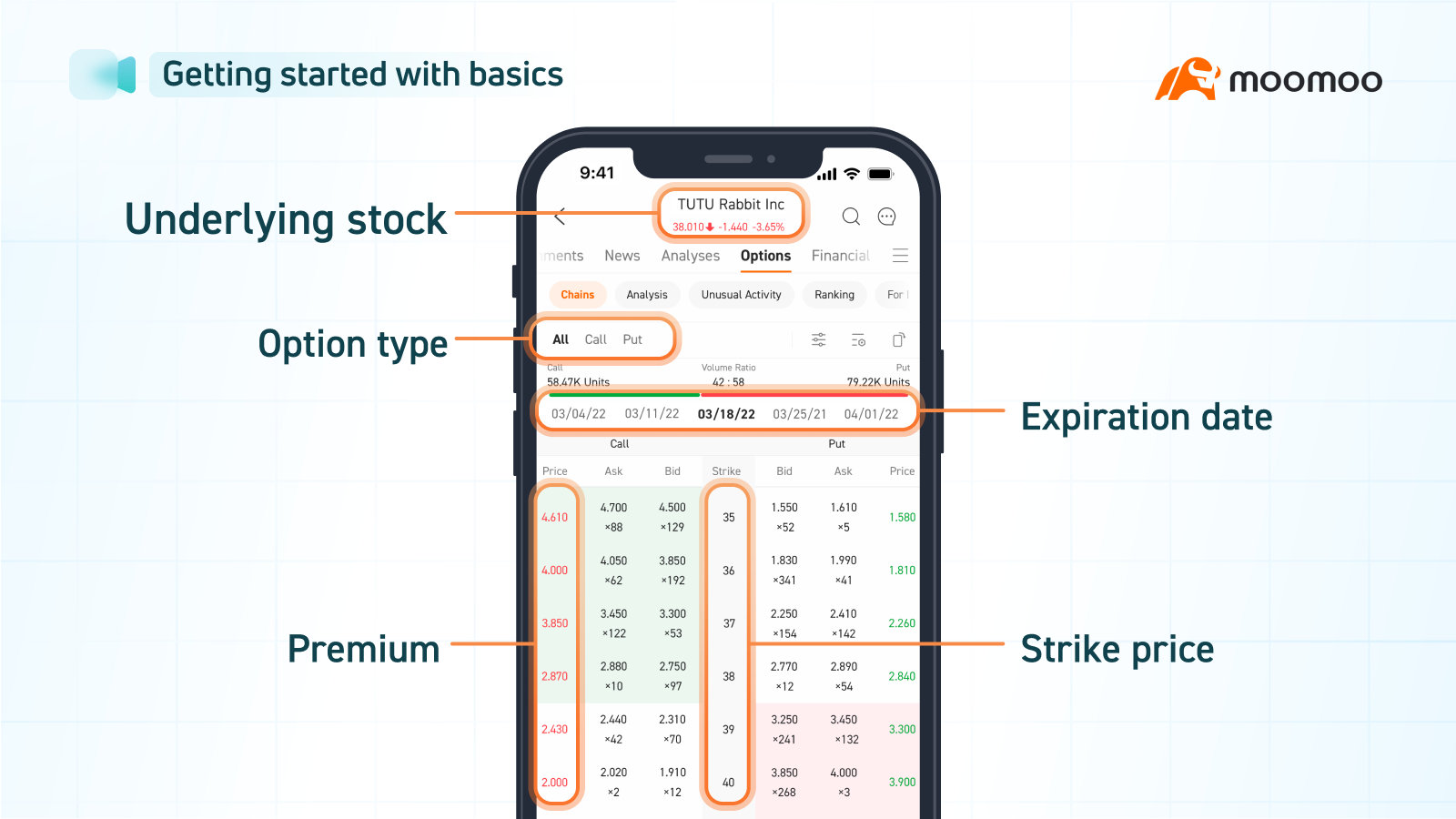

How are strike prices listed?

A strike price is a key component of an options contract and it states the set price that the investor can either buy or sell the underlying security in the options contract.

Strike prices are determined by options exchanges rather than individuals, and they can vary in increments typically ranging from $0.50 to $5.00, depending on factors such as the nominal value of the underlying stock and the volume of trading. For high-volume stocks, these increments might be as small as $1.00. The interval between strike prices, known as the strike width, is also established by options exchanges and can change over the lifespan of an option.

What determines the strike price?

An options investor can independently select a strike price, but they cannot set them for an options contract. This is because the options exchanges, or sometimes The Options Clearing Corp., will set strike prices of options contracts. An exchange will try to set option strike price intervals to meet the marketplace's needs for liquidity and granularity.

Options contracts can have different price intervals based on the asset's structure, such as a security vs. a future, and market needs. Intervals may also change based on expiration months; strike prices will usually be further apart for stocks with higher prices and lower trading activity or liquidity

Options moneyness: Three types of strike prices

"Options moneyness" is a term used to classify whether an options contract is at-the-money, in-the-money, or out-of-the-money. It also relates to an option's intrinsic value, which is determined by comparing the stock's market price to the strike price. When the stock's market price surpasses the strike price, the option is considered in-the-money.

If the stock's market price isn't above (Call) or below (Put) the respective strike price of the option, then it's considered OTM. And if an option's strike price equals the stock's market price, an option is the ATM. Throughout an option's lifecycle, its moneyness can vary; it doesn't represent a trade's profitability.

In-the-money (ITM)

For an in-the-money (ITM) call option, the market value of the stock exceeds the strike price, allowing the option holder to purchase the security at a lower price than its current market value.

Similarly, for an ITM put option, the relationship between the strike price and the underlying stock price allows the option holder to sell the security at a higher price than its current market value. In other words, when the stock price is below the put option's strike price, the put option is considered in-the-money, enabling the holder to sell the security for more than its current market price.

Out-of-the-money (OTM)

An option is OTM when it's without intrinsic value, but may have extrinsic value. Extrinsic value is the difference between an option's market price (premium) and the intrinsic price

A call option is OTM, when its underlying price trades lower than the call's strike price. OTM put option is when the underlying security's price is higher than the put's strike price.

At-the-money (ATM)

An at-the-money (ATM) option has a strike price equal to the underlying asset's (security) current market price. For ATM options, often they are the most active and liquid options traded in the asset and this encompasses both call options and put options. They can also simultaneously be ATM

The significance of strike price in options trading

The strike price of an options contract is a vital factor in an options contract's value and for investors when trading options. That's why it's important to understand the relationship between a strike price and the underlying stock's price to determine an option's value.

Underlying stock prices can change during the lifetime of an options contract and subsequently change an option's value.

When it comes to a call option, its value generally rises as the stock price increases above the contract's strike price. The bigger this difference, the greater the option's value. However, a call option will expire worthless at expiration if its stock price is lower than the strike price.

For example, consider a November 2023 $35 call option. Assuming the underlying stock closes at $40 at expiration, the option's intrinsic value would be $5 per contract($40 - $35). It's important to note that options contracts generally represent 100 shares of the underlying security, so the intrinsic value would be multiplied by this factor. Conversely, if the stock price remains below $35 at expiration, the call option would indeed expire worthless.

As for put options, if the underlying stock's price goes below the strike price, then the option has greater value as the difference widens. But at expiration, if the stock price is higher than the strike price expiration, the option expires worthless.

Strike price example

Options contracts can have a wide range of strike prices. For call options, the strike price represents the underlying security that can be purchased by the option holder, while the strike price for put options is the price that the underlying security can be sold.

If you are buying a call, for example, the call option could list an option's strike price of $40 and expiration date of June 2023; traders may refer to this as June 40s. The call option holder could buy the underlying stock (exercising the options contract) at the strike price until the contract expires, while the seller would have to sell the stock at the strike price until that time.

Here's a put option example. If you are buying a put with a strike price of $30, also with a June 2023 expiration date, its value increases as the stock's price dips lower than the strike price. If the underlying stock ended at $25 in the June expiration, the option would be worth $5 (s$30-$25); however, if the stock closed at or above $30, the put option expires worthless.

Selecting a strike price isn't a random exercise for investors. Putting some thought and research into it is important.

How to select a strike price

Step 1: Determine your options strategy and risk tolerance

When you're developing your options strategy, you'll need to decide what price you'll enter your options trade, when, and how. This can also include whether you want to buy calls or puts. It is important to determine this at the start to help avoid mistakes.

This is also the time to understand your risk tolerance as it can affect what strike prices to choose (e.g. a relatively more conservative investor might select a call option strike price either at or below the stock price and also factor in volatility, which is a large component of options trading that affects an option's value.

Step 2: Conduct analysis

After defining your risk profile and strategy, now is the time to conduct some fundamental and technical market analysis for the options contract that you want to trade. This can help you discover why market prices are currently up or down, gain some potential insights into whether or not your option contract could potentially be profitable and stay up to date with market prices.

It can also help you to learn more about the underlying stock and its patterns. Plus, some online options trading platforms allow users to set up price alerts to monitor stock and options pricing, as well as other free tools and educational resources.

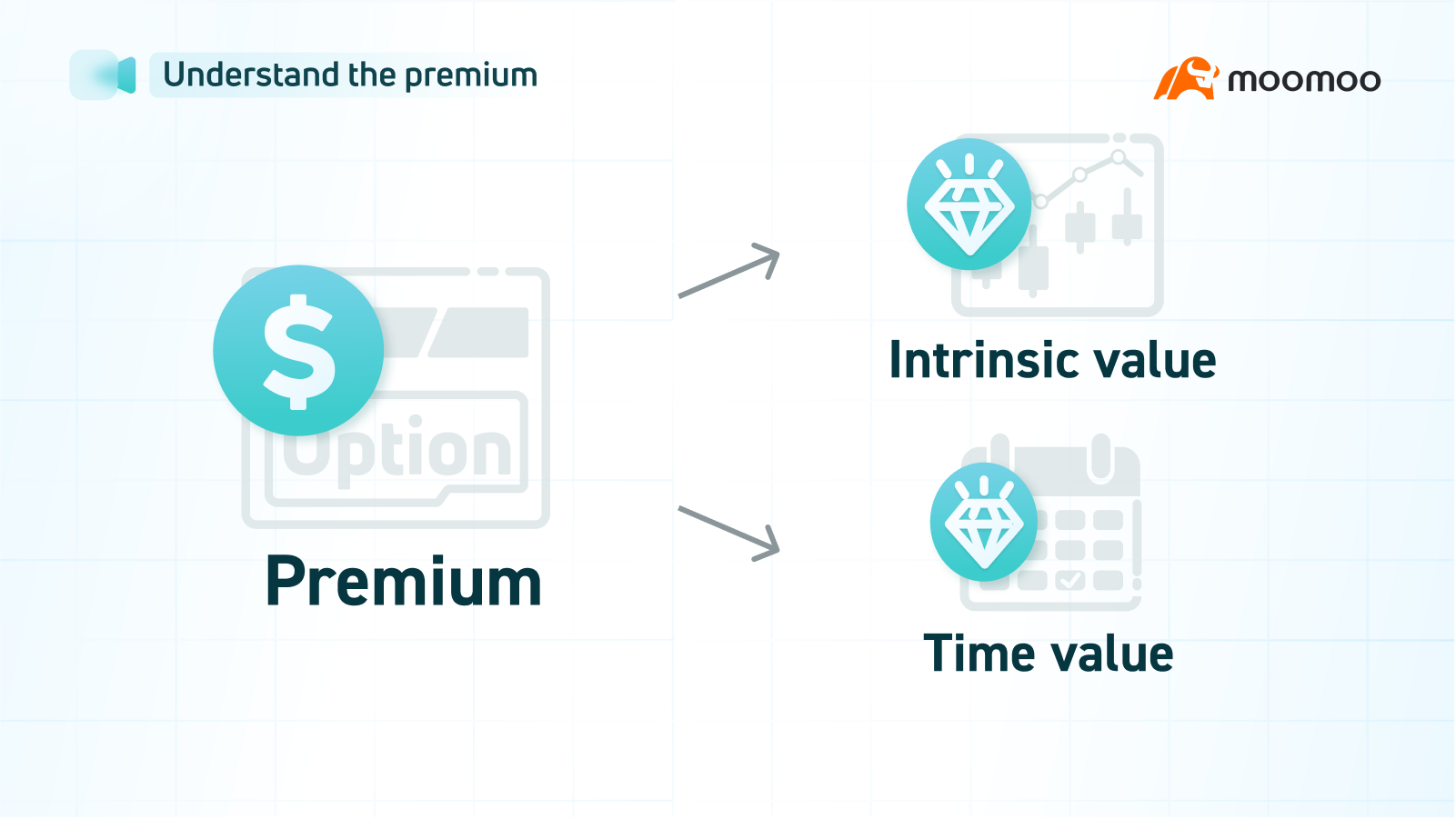

Step 3: Understand intrinsic value and time value

Understanding an option's value is a key component of options trading. There are two value types to know: intrinsic value and time value.

Intrinsic value is the difference between an underlying asset's current price and the option's strike price. This is also the amount by which the option is ITM as compared to the stock's market price.

Time value is the additional monetary amount an option's buyer will pay greater than the intrinsic value. They may do so if they believe the option's value will rise before expiration. Time value is the option's premium less the intrinsic value.

FAQs About Options Strike Price

What is a good strike price?

An investor's goals and risk tolerance are some factors to consider when selecting a strike price but there is no right or wrong answer for a "good" strike price; it is an individual investor's decision. But whatever direction you choose, the strike price has an enormous bearing on how your option trade will play out including potential losses and risk.

What is the difference between strike price and stock price?

The strike price meaning for an option refers to the price the holder can either buy or sell the underlying security of an options contract if the option is exercised.

A stock price is its current market price and it's where a stock is being bought or sold in the open marketplace. It can change, depending on where the market currently values it.

What is the difference between strike price and spot price?

The strike price of an option represents the price at which the underlying security can be bought or sold upon exercise of the option contract.

The spot price, on the other hand, signifies the current market price of the underlying asset, indicating where it is currently traded in the market. However, it's worth noting that "spot price" could refer to either the spot price of the option contract or the spot price of the underlying stock, which might lead to confusion.

To determine an option's moneyness, you can calculate the difference between its strike price and the relevant spot price, clarifying whether the option is in-the-money, at-the-money, or out-of-the-money.

How does the strike price affect call options?

If an investor purchases a call option, they can buy the underlying asset at the strike price until the contract expires. An options call buyer will want the underlying security's market price to be higher than the call option's strike price for an ITM call option. The call option is in the money because the call option buyer has the right to buy the stock below its current trading price.