What is Short Selling?

Key Takeaways

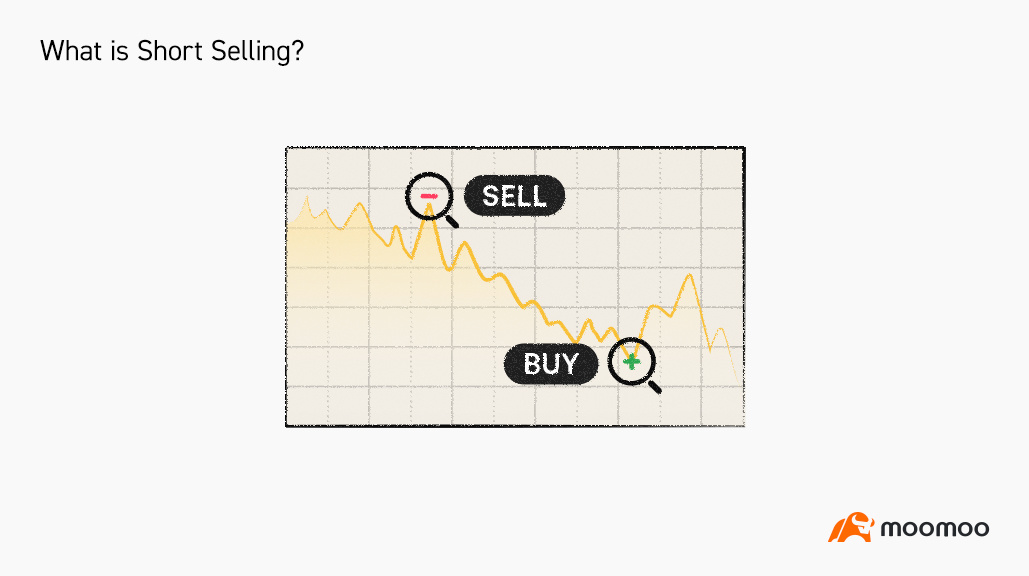

Short selling means that you expect the price of a stock to fall, then you sell some borrowed shares at a higher price, hoping to buy the same number of shares back at a lower price and return them to lenders.

Speculators short sell to profit from a price drop while hedgers go short to protect gains or reduce losses.

Short selling requires margin and incurs some costs. It can occur in assets like stocks, currencies, commodities and through derivatives like futures, forwards, options.

The risks of short selling are high, and your losses may be unlimited. So short selling is not suitable for those who have low or moderate risk tolerances.

Understanding Short Selling

When we invest in a stock, we usually buy it first and expect to sell it later at a higher price. In fact, we can also do it in a reverse order by selling a stock first and buying it later. This is called short selling.

You have no stocks at hand initially, but you predict that the stock price will fall. So you borrow some stocks from lenders, which are often broker-dealers, then you sell them.

If the stock price falls, you will profit from the price decline by selling high and buying low. But if the stock rises, you will suffer a loss.

Assets and Tools

Apart from stocks, we can short sell other assets as well, such as currencies and commodities.

In addition to going short directly, short positions can also be achieved through financial derivatives, such as futures, forwards, and options.

Take options for example, if you’ve bought an option, you have the right to buy or sell the underlying asset at an agreed price, but you don't necessarily have to exercise the right. As a result, it helps limit your losses as opposed to short selling directly.

Purposes

People exercise short selling for different purposes. Speculators short sell to profit from a price decline, while hedgers go short of protecting gains or reducing losses.

What is hedging? For example, if you have long positions in a stock and want to limit losses caused by potential price declines, you can get short positions through tools to offset the risk.

Requirements and Fees

You can short sell only when you have a margin account with funding or securities. As the asset price rises, you need to put more money or securities into it if the remaining doesn't meet the minimum requirement.

Short selling also incurs some costs, such as stock borrowing interest and transaction fees. You may also need to pay dividends to lenders.

Pros and Cons

Short selling may increase your chance of high profits with little initial funding required. It provides more liquidity and makes trading more efficient.

However, it also magnifies the risks which should be taken seriously.

1. You may get it wrong in predicting the price trend, which will lead to losses.

2. With the market changes, your margin may fail to meet the minimum requirement. If you don't replenish your margin in time, your positions may be liquidated.

3. It is possible for short sellers to suffer from unlimited losses. Since an asset price can theoretically rise forever, you may lose much more than 100% of your initial investment with no upper limit on losses.

4. When you want to buy the same number of your borrowed assets back, there may not be enough of them in supply, or you may face a short squeeze in which short sellers are flocking to buy back the assets to close their positions, sending the price skyrocketing.

5. Sudden bans on short selling imposed by regulators may cause panic and trading pressure.

Suggestions

Short selling is not suitable for investors with low or moderate risk tolerances.

Moreover, it is better to go short only when you are very confident about your judgment. Reliable market signals for short selling may include market fundamentals deterioration, clear technical indicators, and abnormally high asset valuation.

One more thing, because you may need to pay dividends, stocks with high dividends may incur more costs.

Learn more of why short selling can be dangerous.