The role of technical analysis in investment strategies

Technical analysis is used by beginner and experienced investors alike to gain key insights into stock performance and potential. It’s a tool that helps traders and investors to look at the difference between intrinsic value and market price, using a wide range of techniques to inform their investment strategies. Technical analysis is often used alongside fundamental analysis to inform key investment decisions.

What is technical analysis?

Technical analysis uses historical market data, such as price and volume, alongside an understanding of market psychology, quantitative analysis and behavioural economics to predict the future behavior of the market based on its past performance. Investors make use of tools including chart patterns and technical indicators to form the basis of their technical analysis.

A brief history of technical analysis

Using technical analysis to identify investment opportunities isn’t new, with this kind of investment tool dating back across centuries. Its first adoption is widely attributed to Joseph de la Vega, who used early technical analysis techniques to predict the movements of Dutch markets as far back as the 17th century.

As the technical analysis of stocks has continued to evolve, it’s done so with key influence from individuals including Charles Dow, William P. Hamilton, Robert Rhea and Edson Gould. Each of these traders offered new perspectives on the market, bringing new ideas into the ongoing formation of technical analysis tools and perspectives. These wide ranges of theories were unified within the 1948 publishing of Technical Analysis of Stock Trends by authors Robert D. Edwards and John Magee.

One common form of technical analysis involves studying candlestick patterns, which owe their legacy to Japanese merchants, first employing the tool to identify trading patterns across rice harvests. Candlestick patterns grew in popularity in the US in the 1990s, brought to the forefront alongside the introduction of online internet day trading. Here, investors were able to analyze historical stock charts with more ease than ever before, bringing new patterns to light as they sought to maximize the profits from their trades.

Who is technical analysis for?

Professional analysts use technical analysis alongside other investment tools to inform their trading decisions, but technical analysis is open to all kinds of investors, including beginners. As technical analysis is applicable to any security that has historical trading data, it can be used to examine the past performance and future indicators of stocks, futures, commodities, currencies and other securities.

How does technical analysis help in forming investment strategies?

A large degree of technical analysis looks to determine whether or not current trends across stock prices will continue, or what kind of reversal might be in store. It’s not uncommon for most technical analysts to use a combination of tools to identify the strongest possible entry and exit points for trades, based on what’s visible within the market.

Technical analysis relies on a core belief that the market price is reflective of all of the available information that could possibly impact a market. This means that traders don’t need to examine other factors, such as economic, fundamental or new developments, as they’re priced into the security in focus. Technical analysts are likely to believe that history repeats itself, informing their approach to the market’s psychology and using chart patterns and technical indicators to understand which patterns may be revealed.

Chart patterns are subjective forms of technical analysis. They allow analysts to look for areas of support and resistance through the identification of specific patterns that are designed to point to where prices are headed. Varying patterns can inform investors as to likely market outcomes, fuelling investor strategies based on what that data reveals.

Technical indicators are, instead, a statistical form of analysis, using the application of mathematical formulas to prices and volumes. Common technical indicators include moving averages, which reveal trends within smoothed price data. The moving average convergence divergence (MACD) is also a popular technical indicator for traders, which examines the interplay between multiple moving averages. This form of technical analysis allows traders to create quantitative calculations that can then inform their investment decisions.

Technical analysis strategies for beginners

You don’t need to be an expert to make the most of technical analysis tools. Here’s our helpful guide to support you as you build your understanding of technical analysis strategies and the way they can benefit your investment journey.

Technical analysis approaches

Technical analysis is best approached through one of two options: a top-down approach or a bottom-up approach. A top-down approach uses macroeconomic analysis to examine the overall economy, before drilling down into a focus on individual securities. Here, an investor needs to first look at economies, then sectors, then companies. This top-down approach is best for traders looking to focus on opportunities for short-term gains, rather than long-term valuations, meaning this approach is often popular for short-term traders.

A bottom-up approach is often favored by long-term investors, who are focused on individual stocks, rather than a macroeconomic perspective. In a bottom-up approach, traders will analyze a stock that offers points of interest for potential entry and exit points. Should an investor discover an undervalued stock that’s currently in a downtrend, for example, technical analysis via a bottom-up approach can be used to identify a specific entry point that highlights when the stock is likely to bottom out.

Stock Charts

Stock charts are heavily used within technical analysis, giving traders a method of tracking patterns and transitions that can speak to trends or market shifts. Price patterns are identified through recognizable trendlines, indicating upwards or downwards movements of stocks. Many different kinds of patterns are used by traders in order to review the past performance of a security’s price and anticipate its next direction.

Support/Resistance

Daily pivot point indicators are one of the forms of technical indicators that are used by traders to identify support and resistance levels. These are used when an investor is looking for a price level to enter or close out a trade. Pivot point levels can identify notable support or resistance levels. If trading increases significantly, or significantly falls, throughout the daily pivot and the associated support or resistance levels, traders will often identify this as a breakout trident. This can lead to shifts in market prices that are either markedly higher or lower, following the direction of the breakout.

Stock/Volume

Traders who use technical analysis will often look to volume indicators in order to measure buying or selling pressure. For stocks and indices that have volume figures available, these can be used to look at whether buying pressure or selling pressure is dominant for that particular asset type.

Trends

One of the great strengths of technical analysis is its flexibility. As it can be applied to varying timeframes, this can help traders monitor and identify short-term and long-term trends within specified trading periods. As the goal of technical analysis is to learn from these trends and spot opportunities for potential investment growth, learning to analyze the signifiers of different trends is a crucial part of growing technical analysis skills.

Price Indicators (Past Price as an Indicator of Future Performance)

Technical analysis is based on the fundamental belief that past trading activity and historic price changes across a security can speak to the security’s future price movements. While fundamental analysis is, instead, focused on reviewing a company’s financials, technical analysis is about how historical price patterns or stock trends may reveal the likelihood of future outcomes.

Charting on Different Time Frames

Traders may choose to chart across different time frames in order to assess the likelihood of a stock’s rise or fall in value. This is known as multiple time frame analysis, or multi-time frame analysis, which looks at the same currency pair across different time frames. Often, the larger time frame will establish a long-term trend, while shorter time frames can be used to look for prime entries into the market. It’s advisable not to focus on too small a time frame, as the price movement within smaller frames can often have little bearing on overall trade, creating challenging trading conditions if the market then moves quickly.

Daily time frames or four-hour charts are often used by analysts who can only spend a small amount of time each day reviewing charting data, as they can provide insight into entry triggers within limited research time frames.

Candlestick Patterns

Candlestick charts are a fundamental element of technical analysis, bringing data from multiple time frames into single price bars for easy readability. Many traders find that candlestick patterns can provide more insight than open-high or low-close bars, or from reading lines that connect multiple closing prices. The addition of color coding can also enhance the readability of candlestick patterns, providing key insights at a glance for traders and investors.

Learning how to read candlestick charts is foundational to technical analysis. Find moomoo’s guide to candlestick charts here.

Technical Indicators

Technical indicators provide necessary insights for traders looking to use technical analysis to inform their investment decisions. With a wide range of technical indicator tools available to analysts, it’s important to familiarise yourself with the role of each technical indicator, and what they may demonstrate.

Moving Averages

Moving averages are a form of technical indicator that identifies the direction of the trend across securities price movements. Moving averages are calculated by adding up data points within the specific period under study and dividing that sum by the number of periods. These are particularly useful for technical traders in creating trading signals.

Pivots and Fibonacci Numbers

A pivot point is a form of technical analysis indicator that can determine the trend of the market within different time frames. This is calculated through averaging the intraday high and low, evaluating this alongside the closing price from the previous trading period. If an asset is trading above the pivot point the following day, this is believed to indicate a bullish sentiment. If it’s trading below, this is read as indicating a bearish sentiment.

Fibonacci numbers are sequences of numbers where every number is the sum of the previous two numbers, with 0 and 1 as the first two numbers. This famous mathematical formula is often found in plant and animal structures, which is why they’re commonly referred to as nature’s secret code.

Fibonacci Retracements

Fibonacci retracement levels are used by traders to connect any two points that they view as relevant, most often a high point and a low point. These levels then reveal areas where the price could stall or reverse. Fibonacci numbers, such as 23.6, are viewed by traders as having relevance in financial markets, with commonly used ratios of 23.6%, 38.2%, 50%, 61.8%, and 78.6%.

Fibonacci retracements are useful in placing entry orders, determining stop-loss levels or setting relevant price targets. Certain forms of technical analysis such as Gartley patterns and Elliott Wave theory also find that reversals tend to occur close to certain Fibonacci levels after significant price movements either up or down.

Traders will often look to Fibonacci retracement levels to identify where is most viable for them to enter a trade, with Fibonacci levels indicating good times to buy.

Fibonacci Extensions

Fibonacci extensions apply percentages to moves in the direction they’re trending, in comparison to Fibonacci retracements, which apply percentages to a pullback. This tool can be used by traders to establish profit targets, or to estimate the height a price may reach after a pullback is completed. Fibonacci extensions are drawn at three points on a chart, indicating the price levels of potential importance.

Momentum Indicators

This form of technical analysis indicator is used to determine the strength or weakness of a stock’s price, with momentum measuring the rate across stock price rises and falls. Two forms of common momentum indicators are the relative strength index (RSI) and moving average convergence divergence (MACD).

Momentum indicators are useful indicators of how strong or weak a stock’s price is, with history revealing that momentum is most useful during rising markets, as opposed to falling markets.

Technical Analysis Indicators using Moomoo

Moomoo offers traders easy and comprehensive access to a wide range of technical analysis tools. With these tools accessible within moomoo’s desktop and mobile apps, this allows investors to analyze and review market trends within the same place where they place their corresponding trades.

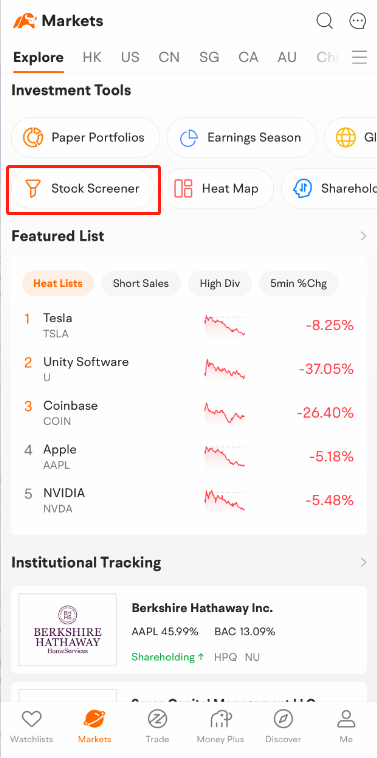

Stock Screener (Filter Stocks to Meet Your Criteria)

With thousands of stocks listed across exchanges, identifying stocks that meet your investment strategy criteria can be challenging. Moomoo’s stock screener fights the overwhelm of navigating through stocks, with the ability to filter stocks to meet your criteria.

Choose the Search box in the upper right corner, then select the Screener button. You can also find it under Markets - Opportunity/US/HK/CN/SG/Stock Connect/Futures/Forex - Screener.

Moomoo’s screener tool allows you to filter by Range, Quotes, Financial Indicators and Technical Indicators.

Heat Map (Direct View of the Market)

Heat maps are hugely useful in technical analysis, providing traders with key insights via graphical representations of data. They enable fast dissemination of statistical or data-driven insights, suitable for all kinds of data. Moomoo offers heat map tools for technical analysts that can be drawn by Market Cap, Volume and Turnover.

Side-by-side Stock Comparison

Moomoo enables side-by-side Stock Comparison, which can be of great benefit to traders looking to understand the performance of two particular stocks alongside each other. This comparison tool points to price trends, previous closes, market caps, circulated values, volume, turnover and 52wk highs and lows, as well as Valuations.

Institutional Tracking

Moomoo’s Institutional Tracking feature provides the position and investment data for close to 6,000 asset management companies. This is designed to increase the public’s understanding of securities held by institutional investors, and is also a tool that enables traders to maintain an overview of the flow of smart money.

Advanced Drawing Tool

Moomoo provides traders with access to advanced drawing functionality that can build comprehensive insights within their technical analysis. Learn more about the advanced drawing tool here.

Strengths of Technical Analysis

Technical analysis, like any other form of investment tool, can’t guarantee stock outcomes. However, technical analysis offers the strength of placing importance on the market’s herd psychology over a single valuation of a publicly traded company. Rather than relying on fundamental data, technical analysis looks for insights from fluctuations in share prices and trading volumes.

Focus on price

Technical analysis can be useful in allowing investors to focus on past performance and future indicators, looking at pricing factors, rather than ancillary factors, in assessing investment viability.

Supply, Demand, and Price Action

Supply and demand zones are of particular interest to day traders, with a supply zone forming before a downtrend and a demand zone forming before an uptrend. These zones are the periods of sideway price actions that often occur before major price moves, which can be identified through technical analysis.

Support/Resistance

Support and resistance levels are used by technical analysts to identify price points on a chart, indicating where they’re likely to see a pause or a reversal of a major trend.

Pictorial Price History

Price charts reveal valuable data for traders, offering an easily digestible historical account of a security’s price movements over defined periods. This allows traders to monitor market reactions to major events, volatility, volume and trading levels, and the stock’s strength against the overall market.

Assist with Entry Point

Many traders use technical analysis to inform their decisions around entry points into the market. Often, they’re looking to identify demand and supply levels, alongside relevant data on breakouts.

Start Trading with Moomoo

Find all the tools you need to complete your technical analysis and complete investment transactions in moomoo’s desktop and mobile apps. Benefit from a one-stop trading platform that’s packed full of features to support your trading journey. Download the app and begin trading today!