Understanding Underlying Asset in Financial Markets

In the world of options trading, a key component of an options contract is the underlying asset. An underlying asset is the financial instrument on which a derivative's value is based.

A derivative is a financial instrument with a price that is derived from a different asset; an option is one example of a derivative and its underlying assets can include stocks, bonds, commodities, and more.

What is An Underlying Asset

So what is underlying asset? An underlying asset is the financial instrument on which a derivative's value is based. It can include different financial assets to form the foundation upon which various derivative contracts are built.

With this flexibility, it enables investors to gain exposure to different financial instruments without necessarily owning them. This can include stocks, bonds or currencies.

The performance of the underlying asset directly influences the value of the derivative contract, while its price movements will determine whether your derivative becomes more or less valuable over time.

The Relationship Between Underlying Assets and Derivatives

Underlying assets and derivatives are fundamentally connected. An underlying asset, also referred to as the underlying instrument, serves as the basis for a derivative and it provides the context and underlying structure for the derivative contract. For a derivative, its value is derived from the underlying asset's price movement. If the underlying asset price changes, it directly impacts the worth of the derivative.

Here's an example with a stock option contract. The underlying asset is the stock. The option allows the holder the right, but not the obligation, to buy or sell the stock at a predetermined price (the strike price) while an option seller, (option writer) is a party in an options contract who creates and sells the contract to an option buyer. The seller collects a premium from the buyer and in turn is obligated to fulfill the terms of the contract, if assigned.

Derivative Contracts

Derivative contracts are financial instruments whose value is derived from the performance of an underlying asset. Their value depends on changes in the prices of the underlying asset or benchmark.

Underlying assets can include commodities, stocks, currencies, market indexes, and more. Derivative contracts are flexible, enabling investors to participate in price movements of underlying assets, speculate on price changes, manage risk, and gain exposure to assets — all without directly owning them.

Keep in mind that derivative contracts with different derivative financial assets serve different purposes. Whether it's risk management or speculative trading, it's important to understand their complexities and nuances before participating in derivatives transactions.

Types of Underlying Assets

Underlying assets come with their own set of unique charteractistics affecting the structure and risk associated with the derivatives linked to them. They give a derivative contract its value and there are many types of underlying assets that traders may choose for their investment strategies and goals. This may vary depending on investment goals, market activity, and strategies.

By knowing the underlying value and underlying asset meaning, it can help traders decide on an appropriate action to take on the derivative contract whether it's to buy, sell, or hold.

Here are a few common underlying asset types.

Stocks

Also known as equities, stocks represent a fractional ownership in specific companies. When you buy a company’s stock, you become a partial owner of that company and you may also be eligible for dividends.

ETFs

ETFs track a basket of underlying assets (such as stocks, bonds, or commodities) and are traded on stock exchanges. ETFs are not derivatives, but some ETFs will incorporate derivatives as part of their investment strategies. Some investors may use ETF derivatives in an attempt to enhance flexibility and risk management for their portfolios.

Commodities

Commodities are tangible goods essential in different industries. This can include gold, oil, wheat, and other materials. As an underlying asset in a derivative contract (a futures contract), this can allow some investors to speculate on price changes without needing to create a physical inventory of oil barrels or piles of wheat bags, for example.

Currencies

In the foreign exchange (forex) market, different currencies can serve as underlying assets for currency derivatives. This can encompass frequently-traded major global currencies including the U.S. dollar (USD), the Euro (EUR), the Japanese Yen (JPY) or the British Pound (GBP). Through currency options, some traders can hedge currency risk or speculate on currency moves.

Bonds

Bonds, including treasury, municipal, and corporate varieties, can also serve a significant role in the derivatives market. Fluctuating bond prices in response to overall economic and market conditions may make them appealing as underlying assets. They can aim to exploit the dual fluctuations in bond interest rates and their prices to potentially gain leverage in their investment strategies.

Index

Stock market indices, such as the S&P 500, NASDAQ, Dow Jones Industrial Average, act as underlying assets for index futures and options. These indices represent a basket of stocks but generally any other index can be an underlying for an option.

Examples of Underlying Assets

Now that we've introduced some underlying assets, here's some examples of them within options contracts.

Stocks: The underlying asset is the actual stock itself. For example, if you hold an option to buy 100 shares of a company stock at a price of $50, the underlying asset is the stock of the company.

ETFs: ETFs track various indexes, sectors, commodities, or other financial instruments. For example, precious metal ETFs provide an opportunity to invest in gold without the need to physically hold the metal.

Commodities: With corn as an underlying asset, a trader could buy a July corn options trade. With July corn futures hypothetically priced at $5, options contracts could include $4.80, $4.90 or $5.00 strike prices and delivery months for options aligning with the underlying futures contracts (e.g., December, March, May, July, and September for corn).

Currencies: For example, a trader wants to trade options on a EUR/USD currency pairing, the underlying asset (or underlying rate) is the EUR/USD exchange rate—the price of one euro in dollars. Some traders can buy or sell options based on their expectations about the future movement of this exchange rate.

Bonds: An investor buys a bond call option with a strike price of $950 and the underlying bond’s par value is $1,000. Over the contract term, interest rates decrease, pushing the bond’s value up to $1,050. The option holder will exercise the right to purchase the bond for $950. Similar to stock options, the underlying bond's value may change before the contract's expiration, affecting the option's overall value.

Index: The underlying asset for an index option is typically a stock index (e.g., S&P 500, NASDAQ, Dow Jones) so with a hypothetical index called Index X, it's currently at a level of 500. Index X options would allow investors to speculate on its future movements without directly buying or selling individual stocks.

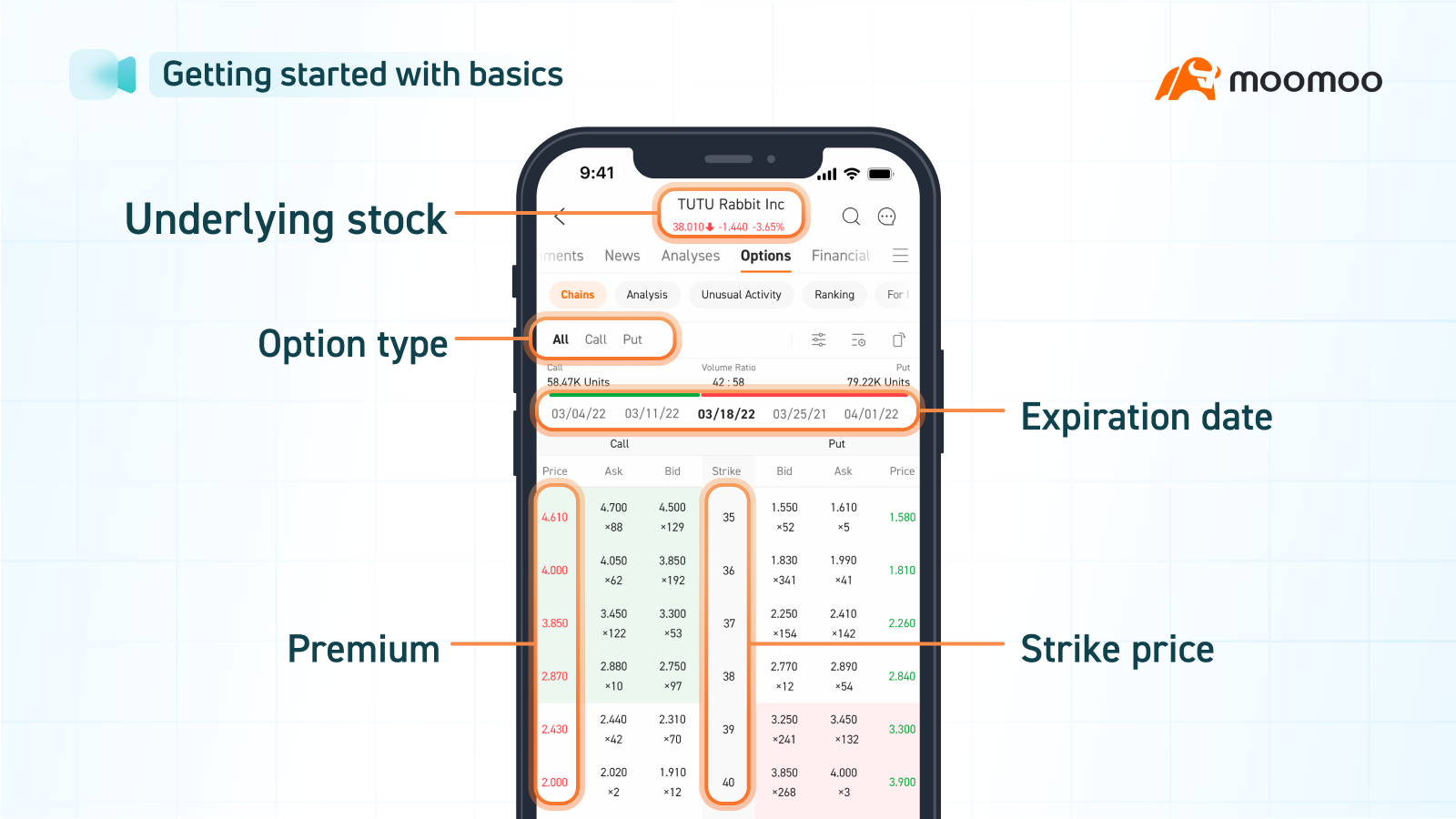

How to Trade Options Using Moomoo

Moomoo provides a user-friendly platform for trading options. Here's a step-by-step guide:

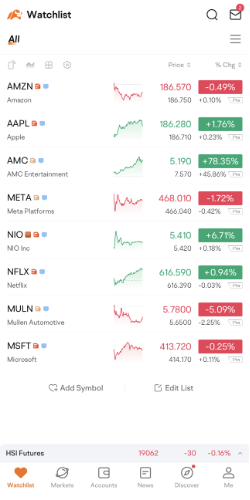

Step 1: Navigate to a stock on your Watchlist and choose its "Detailed Quotes" page.

Disclaimer: Images provided are not current and any securities are shown for illustrative purposes only and is not a recommendation.

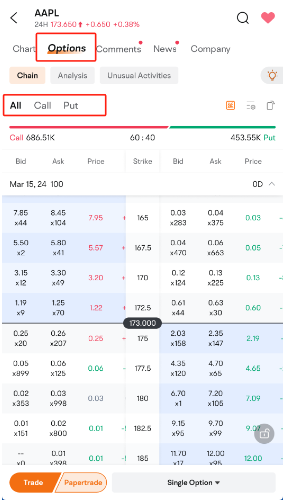

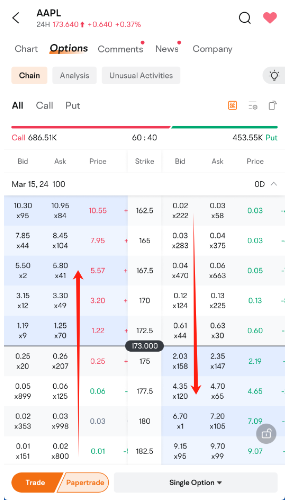

Step 2: Tap Options> Chain on top of the page

Step 3: By default, all options with a specific expiration date are shown. To filter the options and view only calls or puts, select "Call/Put."

Disclaimer: Images provided are not current and any securities are shown for illustrative purposes only and is not a recommendation.

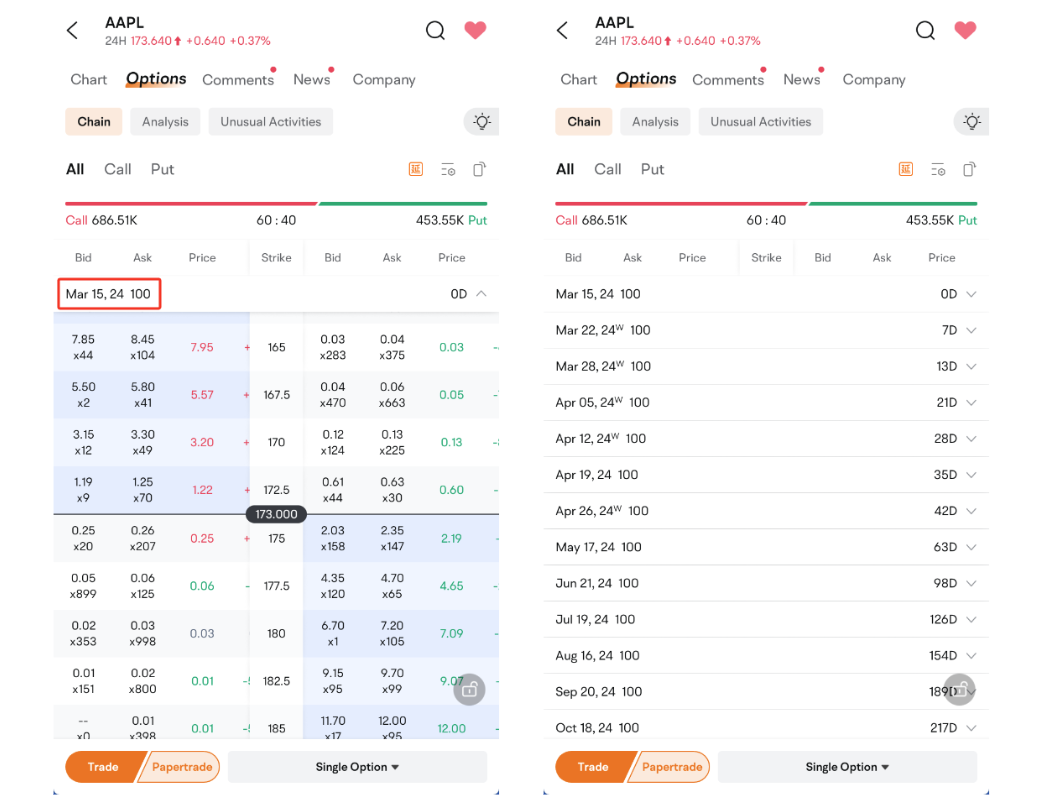

Step 4: To switch to a different expiration date, simply choose the date you desire.

Disclaimer: Images provided are not current and any securities are shown for illustrative purposes only and is not a recommendation.

Step 5: Out-of-the-money options are displayed in white, while in-the-money options are displayed in blue. Scroll horizontally to view more information about the available options.

Disclaimer: Images provided are not current and any securities are shown for illustrative purposes only and is not a recommendation.

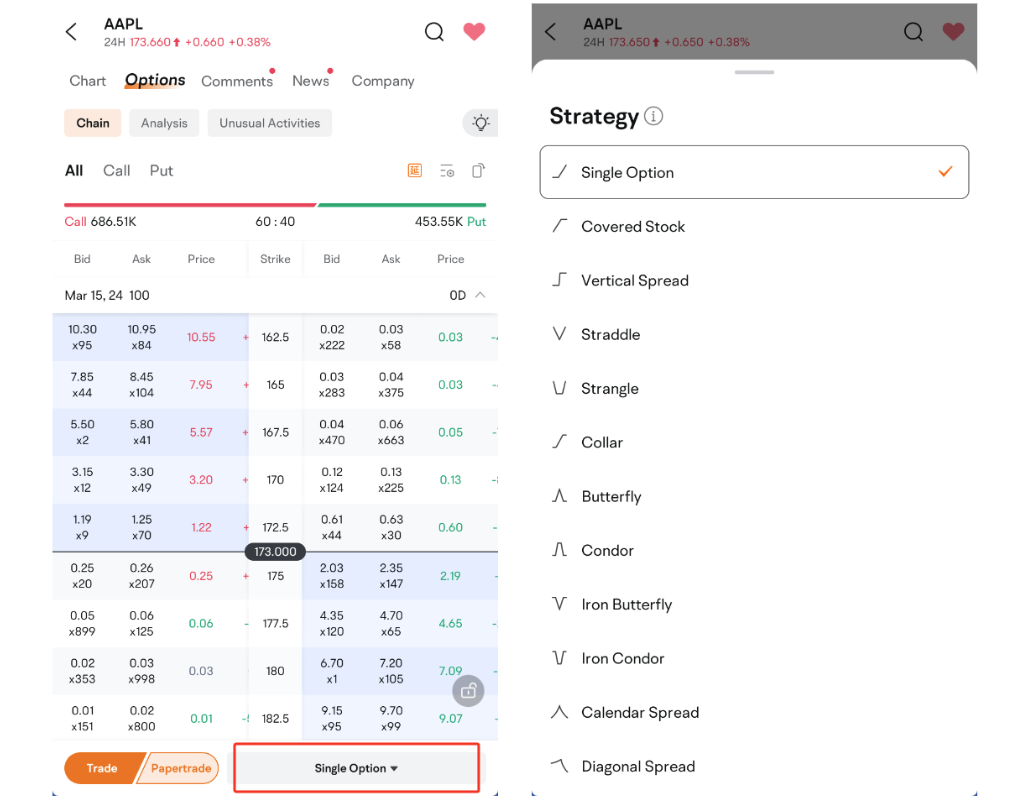

Step 6: At the bottom of the screen, you can switch between different trading strategies.

Disclaimer: Images provided are not current and any securities are shown for illustrative purposes only and is not a recommendation.

FAQs About Underlying Assets

Do you own the underlying asset in a derivatives contract?

No. When you participate in a derivatives contract, such as futures or options, you don't own the underlying asset itself but the contract gives you the right or obligation (depending on if you're the holder or seller) to buy or sell the asset at a specific price by the option's expiration date. This enables some investors to speculate on price movements or hedge against potential losses without the need for physical ownership.

What is the difference between an underlying asset and stock?

A stock refers to shares of ownership in a company, representing a fraction of the corporation's assets and earnings. Owning stock can give an investor the right to vote in shareholder meetings, in some cases receive dividends, and potentially benefit from the company’s growth.

An underlying asset is broader as it can include stocks, bonds, commodities, currencies, and more, serving as the foundation for derivative contracts. Underlying assets in the context of derivatives represent the items of value from which derivatives derive their price.

Does an investor buy the underlying asset in an ETF?

No, investors don’t directly buy the underlying assets in an ETF, such as stocks or bonds. ETFs can provide investors with exposure to a diversified portfolio based on the assets they track. When you invest in an ETF, you're basically participating in the underlying securities' performance without outright owning them.