What Is a Bullish Engulfing Pattern?

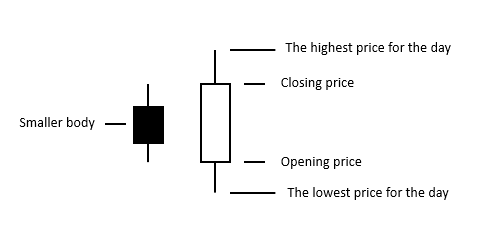

A bullish engulfing pattern is characterized by a white candlestick that opens lower than the previous day's close and then closes higher than the last day's opening price. This occurs when the pattern opens inferiorly to the previous day's closure. When a little black candlestick that indicates a bearish trend is followed the following day by a vast white candlestick that indicates a bullish trend, and the body of the large white candlestick fully overlaps or engulfs the body of the small black candlestick that was seen, the day before, this pattern may be recognized.

Comparing and contrasting a bullish engulfing pattern with a bearish engulfing pattern is possible.

Learning the Bullish Engulfing Pattern

The bullish engulfing pattern is a reversal pattern that consists of two candles. Regardless of the length of the tail shadows, the second candle totally "engulfs" the first candle's body.

This pattern is identified by a combination of one black candle followed by a giant hollow candle, manifesting during a downward trend. On the second day of the convention, the price begins at a level that is lower than the previous low; nevertheless, buying pressure drives the price up to a level that is higher than the previous high, which ultimately results in a clear victory for the buyers.

What Does the Bullish Engulfing Pattern Indicate?

The formation of a bullish engulfing pattern should not be merely the appearance of a white candlestick, which indicates an upward movement in price, after a black candlestick, which means a downward trend in price. For a bullish engulfing pattern to develop, the stock's opening price on Day 2 must be lower than the price at which it ended on Day 1. If there had not been an initial drop in price, the body of the white candlestick would not have had the opportunity to swallow up the body of the black candlestick from the previous trading day.

Because the stock begins lower than it closed on Day 1 and closes higher than it started on Day 1, the white candlestick in a bullish engulfing pattern shows a day in which bears dominated the price of the company in the morning, but bulls decisively took over by the end of the day. This is because the stock opens lower than it closed on Day 1 and closes higher than it opened on Day 1.

If there is one at all, the top wick of the white candlestick that represents a bullish engulfing pattern will typically be relatively short. This indicates that the stock finished the day at or very close to its highest price, which suggests that the price was still climbing as the trading day ended.

Due to the absence of an upper wick, it is more probable that the next day will generate another white candlestick that will finish higher than where the bullish engulfing pattern ended. However, it is also conceivable that the following day may create a black candlestick after gapping up at the start of the trading session. As a result of their propensity to indicate reversals in the prevailing trend, analysts pay extra attention to bullish engulfing patterns.

Comparison of the Bullish Engulfing Pattern and the Bearish Engulfing Pattern

Both of these patterns are opposed to one another. After a price increase, a bearish engulfing pattern will appear, which signals that prices will continue to fall. The first candle in this two-candle arrangement is an up candle, as is the case here. The second candle is a more significant down candle with a natural body that completely encapsulates the first candle, an up candle with a lower diameter.

Engulfing pattern's restrictions during usage

Although a bullish engulfing pattern may be a relatively strong indication, particularly when paired with the current trend, it is essential to remember that these patterns are not foolproof. Engulfing patterns are most helpful after a clean downward price move. This is because the pattern displays the change in momentum to the upside. Engulfing patterns are most beneficial following a clean downward price move. If the price movement is choppy, even if the price is increasing overall, the importance of the engulfing pattern is decreased since it is a typical indication. This is the case even if the price is rising overall.

The engulfing candle, sometimes known as the second candle, could be rather large. If traders follow through with trading the pattern, they risk a significant stop loss.

Because candlesticks don't provide a price goal, identifying the potential profit that might be gained from engulfing patterns can also be challenging. Instead, traders will need to pick a price target using other techniques, such as indicators or trend analysis, to determine when it is appropriate to exit a successful trade or when to enter a business.

Technical analysis with moomoo

Moomoo stock trading app provides powerful stock charting tools to meet various investors' technical analysis needs and help to make investing decisions. Moomoo stock charting tools consist of 63+ technical indicators, 38 types of charts, support for saving and synchronization of charts, and customized color patterns, etc. Download the moomoo app today to get access to these free charting tools!