What Is a Detrended Price Oscillator

In technical analysis, a detrended price oscillator is a tool that removes the influence of price trends to calculate an estimate of the duration of price cycles from peak to peak or trough to trough.

The divergence of prices over time is not a momentum indicator like some other oscillators, such as moving average convergence divergence (MACD). Instead, it draws attention to price highs and lows, which are then used to help identify buy and sell positions in a manner that is consistent with the historical cycle.

What Can You Infer from the Detrended Price Oscillator?

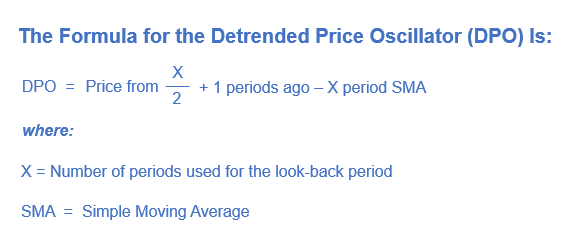

The aim of the detrended price oscillator is to assist traders in determining an asset's price cycle. This is accomplished by comparing a simple moving average (SMA) to a historical price close to the lookback period's center.

By looking at the indicator's historical highs and lows, peaks, and valleys. Traders often draw vertical lines at these junctures and count the time since the last line was removed. These lines will be lined with price peaks and valleys.

If each bottom occurs two months after the previous base, this helps determine when the next chance to purchase may present itself. This is accomplished by identifying the most recent low point in the indicator or price and then using that point as a reference point to predict the next low point two months into the future.

A trader might locate the high that occurred the most recently and then assume that the next peak would occur 1.5 months after that one if peaks tend to occur at intervals of 1.5 months. This anticipated high point and time provide an opportunity to be taken advantage of to sell a position before the price falls.

The distance between a peak and a trough may be used to estimate the length of a long trade, while the distance between a mountain and a track can be used to estimate the duration of a short transaction. Both of these measurements can help with the timing of trades.

The indicator is considered to be in a positive state when the price from x/2+1 periods ago is located above the SMA. When the price x/2 + 1 period ago is lower than the SMA, the indicator is said to be negative.

The detrended price oscillator does not completely update to reflect the most recent price. The DPO compares the price over the last x/2+1 periods to the SMA to determine its value. As a result, the maximum weight the indicator may reach is limited to x/2 + 1 period ago. Yet, this is not a problem since the purpose of the indicator is to draw attention to historical highs and lows.

Since the indicator fluctuates and is also shifted into the past, there needs to be a better real-time gauge for determining the direction of the trend. By its very nature, the indicator cannot be used for trend analysis. Because of this, it is up to the trader to decide which deals to participate in. During an upswing, the cycle bottoms will likely provide good chances for purchasing, and the cycle peaks will present substantial selling opportunities.

Detrended Price Oscillator (DPO) Usage Restrictions

The DPO is not a stand-alone indicator that may be used to time trades; it is an extra tool that can be used in this capacity. It achieves this by analyzing the times in the past when the price reached its highest and lowest points. Although this information could serve as a point of reference or a baseline for future expectations, it is essential to note that. There is no assurance that the duration of the cycles that have occurred in the past will be repeated in the future. In the end, the length of cycles may either lengthen or shrink.

The trend is not taken into account by the indicator either. The trader is the one who is responsible for deciding which direction to trade in. Even if the price of an asset has reached its cycle low, it may not be worthwhile to purchase it if it is now in free fall since the price may continue to decline soon anyway.

Not all peaks and troughs on the DPO will simultaneously move to the same level. As a result, it is essential to keep an eye on the price to identify the significant highs and lows represented by the indicator. Sometimes the indicator will go down very little or up very far. But, a price reversal from such a level still has the potential to be substantially moving forward.

Technical analysis with moomoo

Moomoo stock trading app provides powerful stock charting tools to meet various investors' technical analysis needs and help to make investing decisions. Moomoo stock charting tools consist of 63+ technical indicators, 38 types of charts, support for saving and synchronization of charts, and customized color patterns, etc. Download the moomoo app today to get access to these free charting tools!