What is Price-Volume Relationship?

Key Takeaways

● Price-Volume Relationship refers to the relationship between price and volume, which is a rather important indicator in the stock market.

● The volume of a stock index generally refers to the total amount of money traded; the volume of a single stock can refer to either the total number of shares transacted or the total amount of money traded.

● Price-Volume relationship can be interpreted in eight situations.

Understanding Price-Volume relationship

Price-Volume relationship is a term used in the stock market.

Volume is typically the trading volume of a stock index or a single stock during a given period of time, including the trading volume per minute, daily, monthly, or yearly. The volume of a stock index is the total amount of money traded during an amount of time, while that of a single stock can refer to either the total number of shares transacted or the total amount of money traded.

Price is the value of a stock index or the price of a single stock. It mainly refers to the closing price, but may also refer to opening, high, and low prices.

In the securities markets, there is a relationship between the rise/fall of a stock index or a stock and its trading volume during the same period. Such a relationship is called the price-volume relationship, a crucial indicator for investors to anticipate future trends.

How to make use of Price-Volume relationship

Investors often say that sky-high volume goes with sky-high price or rock-bottom volume goes with rock-bottom price. Both statements are trying to predict future trends of the stock market based on different price-volume relationships.

There are generally eight scenarios.

Volume is up while the price remains unchanged. If this occurs in a downtrend, it means that the downward momentum is weakening and a rebound is gathering strength; whereas in an upward or sideways trend, it suggests the rebound is being hampered, yet the trend is likely to continue as long as it's not clearly disrupted.

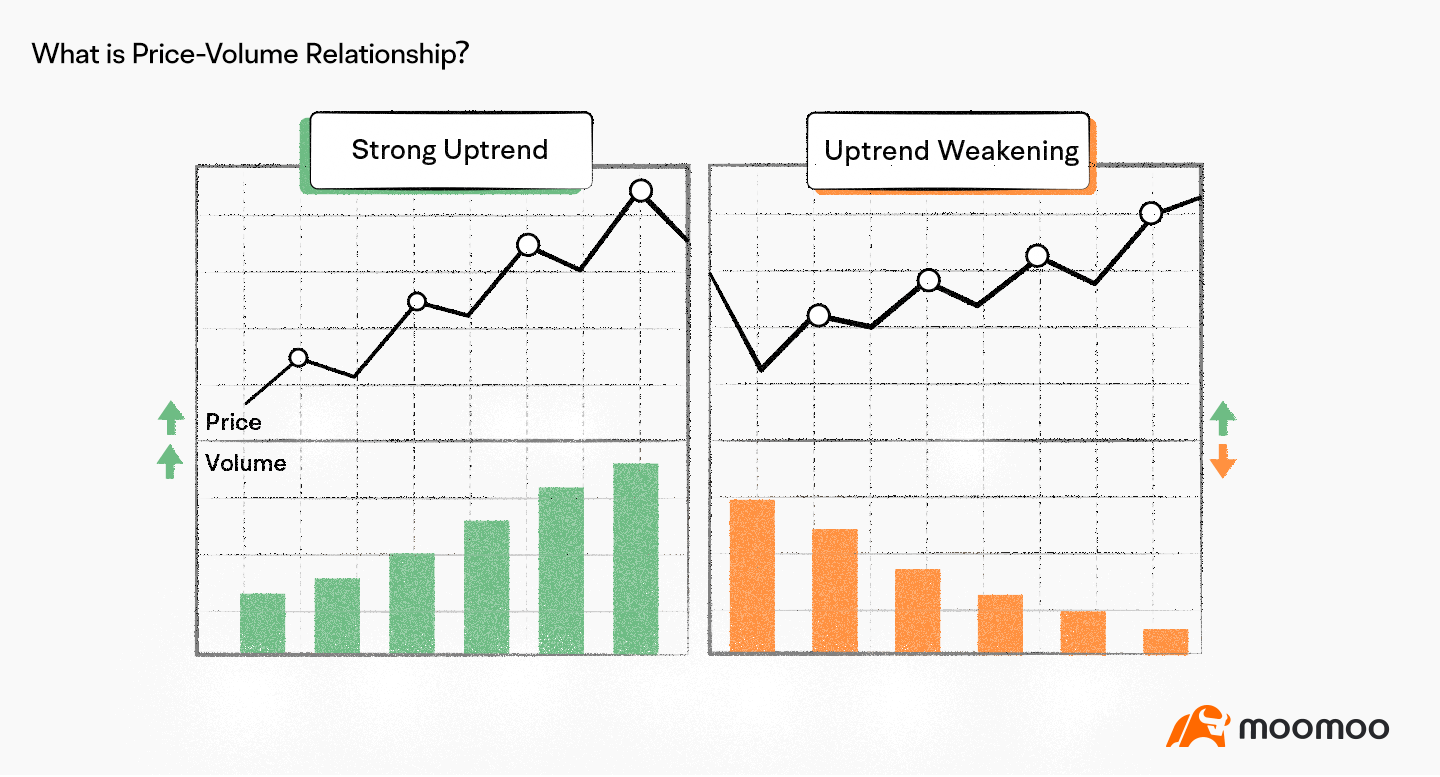

Volume is up and the price is up. Volume and price rising together presents a bullish signal for short and medium-term investments.

Volume remains unchanged while the price is up. When volume remains relatively stable and the price keeps rising, the uptrend is stabilizing.

Volume is down while the price is up. Declining volume and rising price indicate that the uptrend is ending.

Volume is down while the price remains unchanged. A bearish signal appears when volume falls dramatically, and price moves sideways after a significant increase. If a large number of bullish or bearish candlesticks with a large body appear at this stage, whether the news is positive or negative, it'd be better to view it as a bearish signal.

Volume is down and the price is down. Decreasing volume in parallel with falling price indicates a bearish trend.

Volume remains unchanged while the price is down. When volume stops decreasing, and the price keeps going down, it indicates a long-term bearish signal.

Volume is up and the price is down. Falling price with rising volume is a bullish signal. A rally off the bottom is expected to occur.

Summary

Trading volume is an indicator least likely to be manipulated by major funds and can reflect true capital flows. Combining volume with price to analyze their relationship may help assess the current stock price level.