What is the Debt Ratio?

Key Takeaways

● A company's debt ratio is the ratio of its total debt to total assets.

● Corporate debt can be classified into long-term debt and short-term debt, or current liabilities.

● The debt ratio measures a company's leverage and risks.

Understanding

The debt ratio divides a company's total debt by its total assets.

It represents the proportion of the company's assets financed with debt. The ratio shows the company's ability to raise capital from creditors.

Calculation

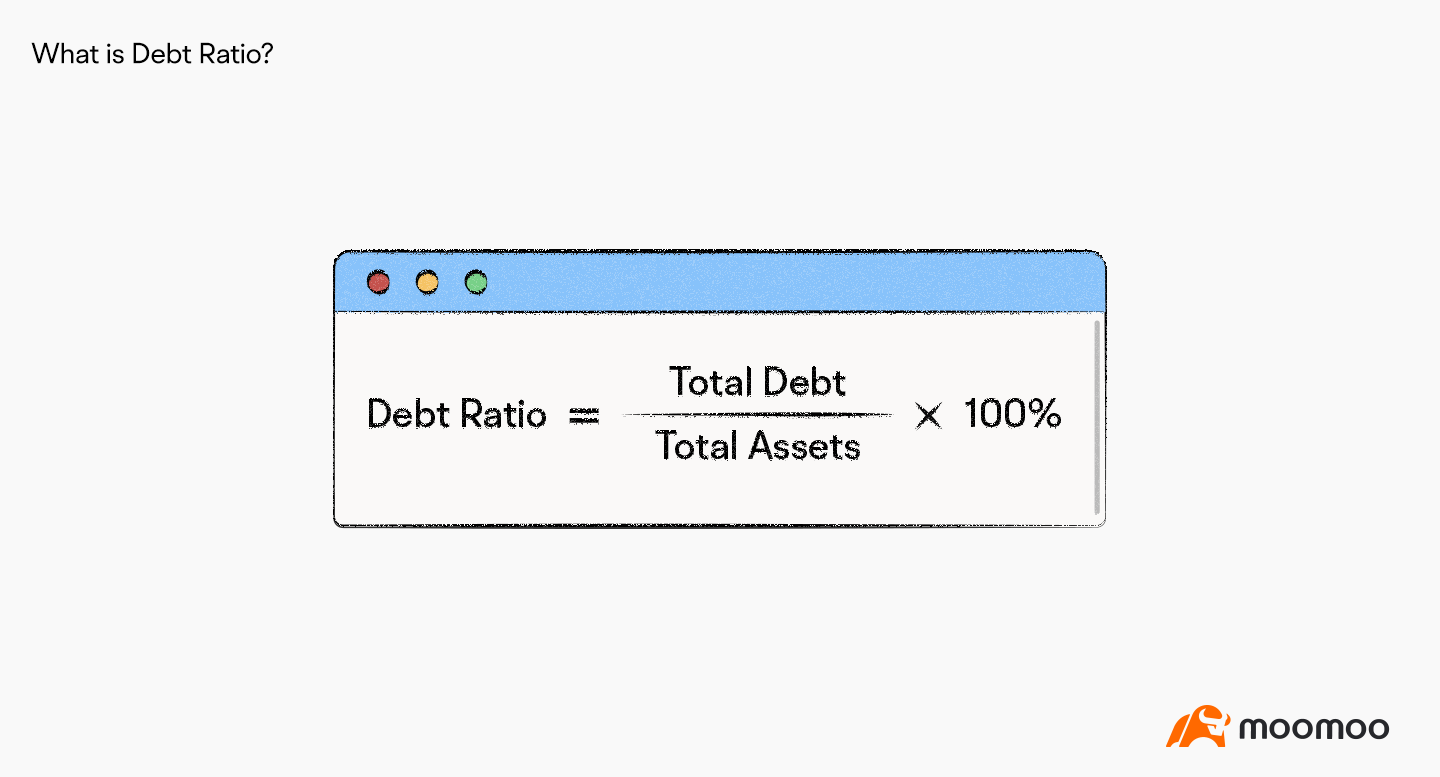

The formula for a company's debt ratio is:

Debt ratio = Total debt / Total assets

Total debt includes long-term and short-term debt, also known as current liabilities.

Total assets can be categorized into current assets, fixed assets, long-term investments, intangible assets, deferred assets, and more.

How to use the debt ratio

Investors can determine the overall risk of a company with this ratio.

Generally, a company with a 40-60% debt ratio is considered moderately leveraged.

Companies that face higher uncertainty in operation should lower their debt ratio to improve their financial health.

Yet, companies with robust performance may consider raising the debt ratio to add more value to their shareholders.