What Is the Ease of Movement Indicator?

What Does the Movement Ease Indicator Mean?

The Ease of Movement indicator, often known as EOM or EMV, was developed by Richard Arms. It is a technical analysis that aims to quantify a blend of momentum and volume information into a single number.

The purpose of using this number is to determine whether or not prices can go up or down with minimal opposition in the directional movement of the market.

If prices could fluctuate freely, they would continue to do so for an extended length of time, during which stocks could be potentially traded for a profit.

The Ease of Mobility Indicator: An Overview

Richard W. Arms Jr. invented an oscillator called the Ease of Movement indicator, also called the Ease of Movement Value (EMV) indicator. This oscillator's purpose is to assist traders in determining the "ease" of price movement. When determining the intensity of a trend, many traders find it helpful since it considers both the price volatility and the volume.

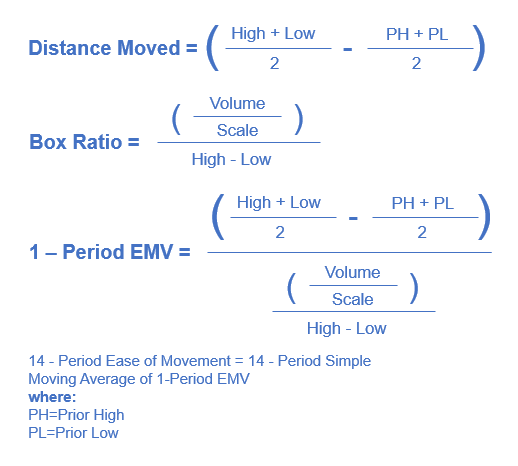

The EMV indicator is comprised of several distinct formulas, one of which is a simple moving average:

Depending on the typical daily trading volume of the stock, the scale represents anywhere from 1,000 to 1,000,000,000. If you want the indicator value to be in the single or double digits, you need to make the scale higher. The more actively traded the stock is, the larger the scale should be.

The price rises on the low trading volume when the indicator generates positive output values and rises above zero. Conversely, when the indicator generates output values that are falling negatively, the price falls on the low trading volume.

Considerations

Some experts believe the EMV line may be improved by including a moving average and then using this new line as the trigger line for generating trading signals. Traders may also watch for divergences and convergences among the price and the ease of movement as an indication of potential forthcoming reversals in the market. As a consequence of the computations used to determine the EMV, a line that is very similar to a movement or rate-of-change indicator is produced. As a result, the EMV is comparable to a volume-weighted velocity line. Comparing the EMV to the momentum indicator might reveal relevant information regarding the relationship between volume and price.

EMV is often used in combination with many other kinds of technical analysis, including technical indicators & chart patterns, by the majority of traders in order to make better investment choices. Rather than relying solely on an indicator, a trader may potentially notice a bullish reversal chart pattern, notice the improvement of the Ease of Movement, and may consider buying the stock after it breaks out of a specific price point. This is because the trader does not want to be caught off guard by a sudden change in price.

How is the Indicator of Ease of Moving Supposed to Be Used?

Traders may initiate positions when there is a high degree of ease of movement since this may imply buying into a continuing rally or short selling into a selloff already underway. It is typically suggested that the ease of movement be combined with other instruments, as with most technical indications.

Moomoo stock trading app provides investors with powerful stock charting tools to meet various investors' charting needs and help to make investing decisions. Moomoo stock charting tools consist of 63+ technical indicators, 38 types of charts, support for saving and synchronization of charts, and customized color patterns, etc. Sign up and download the moomoo app today to unlock these free charting tools!

Images provided are not current and any securities are shown for illustrative purposes only.

*This article discusses technical analysis, other approaches, including fundamental analysis, may offer very different views. The examples provided are for illustrative purposes only and are not intended to be reflective of the results you can expect to achieve. Specific security charts used are for illustrative purposes only and are not a recommendation, offer to sell, or a solicitation of an offer to buy any security.