What Is the Rate of Change?

Key Takeaways

The rate of change (ROC) is a momentum indicator that measures the percentage change in a security's price.

In general, the ROC shows whether the price is rising or falling, and the movement of the ROC indicates the price trend.

ROC signals include centerline crossovers, as well as overbought-oversold and divergence readings.

Understanding the ROC

The ROC is a momentum oscillator that measures the percentage change between the current closing price and the previous closing price over a certain period of days.

(Images provided are not current and any securities are shown for illustrative purposes only.)

For example, the closing price of $Apple (AAPL.US)$ was $143.11 on May 23, 2022, and $156.54 on May 05, 2022, then the 12-day ROC is -8.579, calculated as [(143.11-156.54)/156.54]*100.

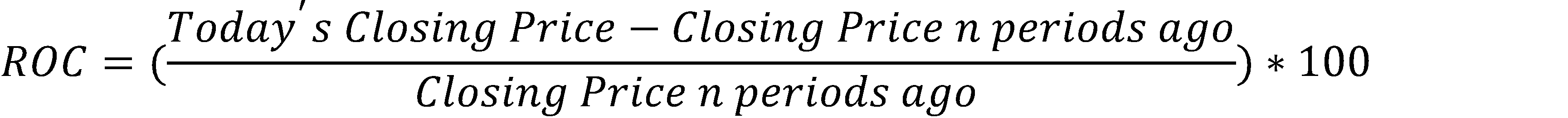

This formula can be expressed as:

How to interpret the ROC

Trend Identification

As a momentum-based price indicator, the ROC measures the trend and strength of price changes.

In general, prices are rising as long as the ROC remains positive. Conversely, prices are falling when the ROC is negative.

Furthermore, a rising ROC above zero shows that the speed of the uptrend is accelerating, while a falling ROC above zero indicates that the speed of the uptrend is slowing down.

There is no upward boundary on the ROC but there is a downward limit because the price has a maximum decline of 100%.

The ROC crossing the zero line in either direction may indicate a trend change. However, ROC can easily hover around the zero line. Therefore, this signal mainly alerts the trader that the price may be trending instead of providing a trading signal.

Overbought or Oversold Signal

The ROC can be used to identify extreme cases and predict turning points. When the ROC rises to a relatively high level, it indicates that the stock is overbought and is usually seen as a sell signal.

(Images provided are not current and any securities are shown for illustrative purposes only.)

Conversely, when the ROC falls to a relatively low level, indicating that the stock is oversold, it is often seen as a buy signal.

(Images provided are not current and any securities are shown for illustrative purposes only.)

Divergence Indicator

The ROC is also widely used as a divergence indicator that signals a possible upcoming trend change.

In most cases, the ROC moves in a similar direction to the stock price.

However, if the ROC curve is trending downward, but the stock price has a new peak, a divergence occurs, indicating that the stock price may not be able to maintain an upward trend in the future. This situation is shown in the chart below of Tesla's stock price.

(Images provided are not current and any securities are shown for illustrative purposes only.)

Nevertheless, ROC divergences sometimes give false signals. When the ROC starts to diverge, the price can still run in the trending direction for some time, so a trader should also look at other indicators and analysis methods to further confirm a trend change.