What is Volume-Weighted Average Price (VWAP)?

Key Takeaways

● Volume-Weighted Average Price(VWAP) measures the average asset price weighted by the total trading volume.

● VWAP is usually used on intraday charts.

● The current stock price is on the rise if it moves above the VWAP.

Understanding VWAP

Volume-Weighted Average Price (VWAP) is a technical analysis tool to weight the average asset price by the total trading volume.

How to calculate VWAP

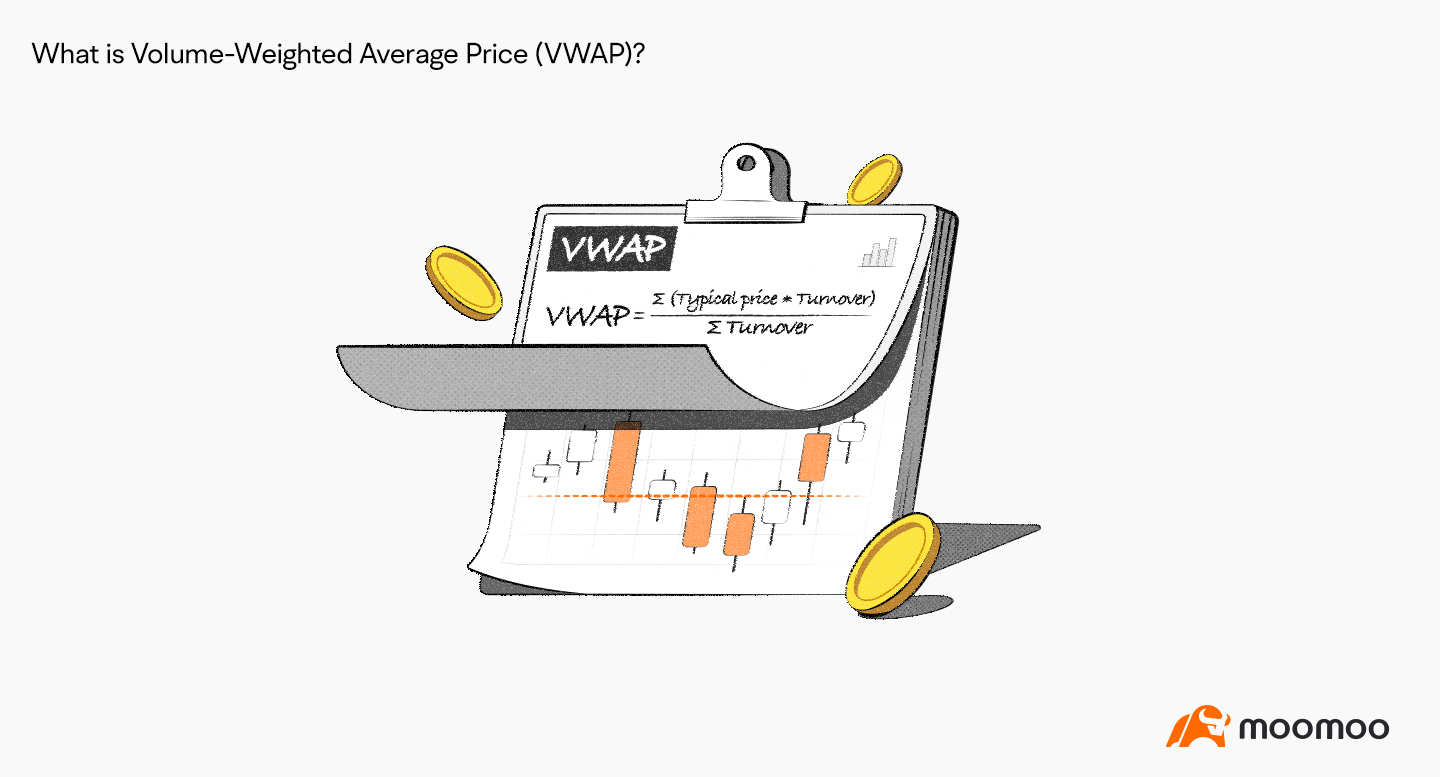

The basic formula for VWAP is as follows:

VWAP = ∑ (Typical Price * Volume) / ∑ Volume

Here, Typical Price = (High Price + Low Price + Closing Price) / 3.

How to use VWAP

VWAP is usually used on intraday charts to ascertain the basic intraday price moves.

VWAP is similar to SMA (Simple Moving Average).

When the stock price moves above the VWAP, it sends a bullish signal, where the current stock price is on the rise.

By contrast, when the stock price falls and moves below the VWAP, it suggests that the stock is in a downtrend.

Summary

VWAP reflects the average asset price relative to the trading volume within a specific time period.

As a lagging indicator, however, VWAP is unable to predict future prices.

As a result, many investors use it to analyze intraday trading.