Moomoo Becoming Top-10 Most Downloaded Financial App in Canada and Launching RRSP/TFSA Accounts

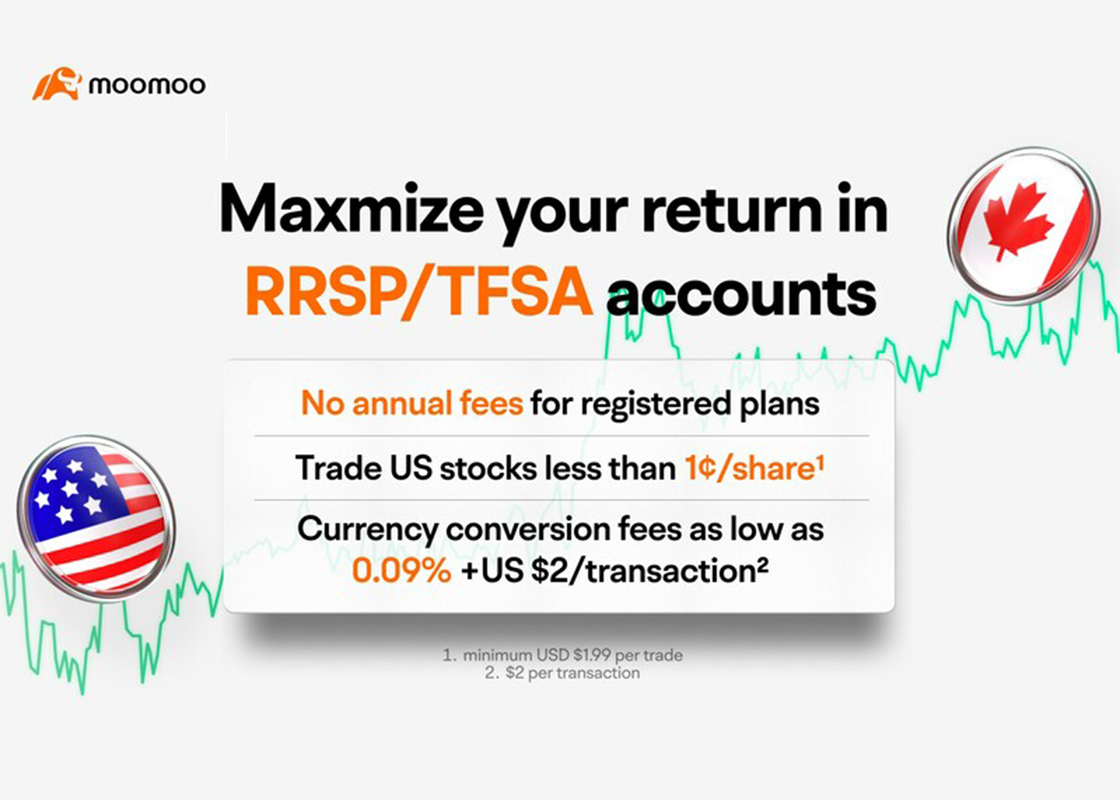

TORONTO, CANADA - Jan. 11 2024 -- February 29, 2024 will be the last day to make Registered Retirement Savings Plan (RRSP) contributions for the 2023 tax year. As the deadline for 2023 RRSP contribution approaches, moomoo has launched self-directed RRSP and Tax-Free Savings Account (TFSA) accounts, providing Canadian investors with more tax-efficient options and revolutionary US and Canadian stock and ETFs trading experiences.

Since moomoo made its debut in Canada last September, its award winning app has quickly gained popularity among local users. Three months after entering the Canadian market, the moomoo app became top-10 most downloaded Android financial app on Google Play in Canada [1].

Steve Zeng, moomoo's Head of Global Strategy, said, "Since our debut in the Canadian market, moomoo has garnered the trust of Canadian users through our world-class app features and trading services. Over the past few months, we've received numerous requests from Canadians eager to open registered accounts on moomoo. As a global investment and trading platform committed to addressing the needs of local investors, making this initiative a top priority was paramount. We are now excited to announce the commencement of offering RRSP and TFSA accounts to Canadian investors."

Why open a moomoo RRSP/TFSA account?

Traditional banks' registered accounts usually have more constrains on customers' investment options. In many cases, the capacity to make independent investment decisions in registered accounts is given as a privilege to customers with large assets. The needs of customers with fewer assets but would like to take control over their own investments have been easily overlooked.

Moomoo understands and values all customers' needs and launched self-directed RRSP/TFSA accounts, allowing account holders to have complete control over their investment choices by managing their own portfolio rather than having it managed by an institution and take advantage of market opportunities in Canada and the US. To learn more about moomoo's self-directed TFSA/RRSP accounts, please visit: Moomoo Canada - The best US stock trading platform

Open a RRSP/TFSA account on moomoo today and moomoo will give you amazing rewards! From 3rd January 2023 - 29th February 2024, eligible users who deposit $100 in RRSP/TFSA can receive a $50bonus, and up to $1,550 if they deposit more. For more information regarding the promotional offer, please visit: Moomoo Canada - New Client Promotions - May & June 2024-moomoo Help Center

In Canada, moomoo is regulated by the Canadian Investment Regulatory Organization (CIRO) and is a member of the Canadian Investor Protection Fund (CIPF). And moomoo is the best choice for self-directed investments in Canada. For Canadian investors, moomoo offers world class investment features with competitive low rates on trading, borrowing interest, and currency conversion.

With moomoo, Canadian users will have free access to a wealth of features, including free Level 2 quotes for the US and Canadian stocks, free 45+ advanced drawing tools and 100+ indicators, free detailed analyst rating from over 4000 Wall Street analysts, and free 24/7 financial news from credible sources including Bloomberg, Dow Jones, etc.

Another distinctive feature that sets moomoo apart is its vibrant online community, connecting investors of all levels globally. This interactive platform facilitates the sharing of investment ideas, insights, and experiences, bringing together an environment of collaborative learning and growth.

For those seeking a structured and customized learning experience, moomoo offers over 3,000 free investment courses delivered in multiple languages, complete with customized study plans that include trackers for monitoring a user's learning progress and results.

Opening a registered account on moomoo requires 0 capital threshold and 0 account management fees. Additionally, moomoo offers competitive and transparent fees. The following table shows how moomoo's trading fees and currency conversion fees compared with other Canadian brokerages.

"Since our inception in 2018 in the U.S., moomoo has been steadfast in its commitment to providing global investors with comprehensive, professional, and user-friendly investment tools and capabilities. Moomoo's expansion into new markets such as Singapore, Australia, Japan, and others has been guided by this unwavering goal, ensuring that our development across regions aligns seamlessly with our dedication to offering top-notch investment and trading solutions." said Steve Zeng.

For more information, please visit moomoo's official website at www.moomoo.com/ca or feel free to email: pr@moomoo.com.

[1] According to data.ai, in December 2023, moomoo became the Top-10 most downloaded Android app on Google Play, and its iOS ranking increase dramatically in the Apple App Store in Canada.

[2] For more information regarding the promotional offer, please visit:Moomoo Canada - New Client Promotions - May & June 2024-moomoo Help Center

[3] The rates provided are for informational purposes only and may not represent the complete range of available rates. It is possible that you may discover rates that are more favorable than those presented in this comparison. (For information on moomoo CA's Rates and Pricing, please visit: https://www.moomoo.com/ca/pricing)

[4] Other Brokerages include only certain brokerages that we compared and our data source is based on published fee schedules on their official websites. Official website of brokerages as of 8/26/2023. The brokers we refer to may have different rates for different tiers. Please visit their official websites to see details.