Latest

Hot

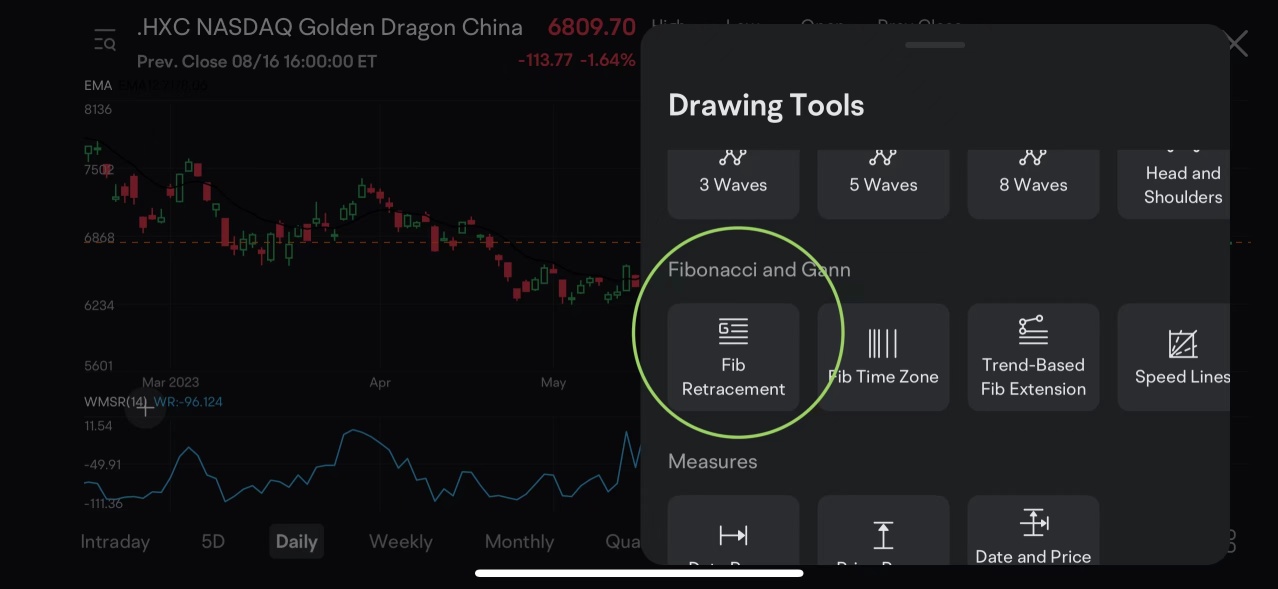

As we know, the stock price does not simply move in one way. Instead, after a period of upward or downward movement, stocks may experience a retracement - a pullback in the price that represents an adjustment rather than a complete reversal of the trend.

Sometimes we are unsure when there is a potential opportunity to buy stock. In such cases, Fibonacci could be a helpful tool to assist us in making investment decisions.![]()

By connecting the pe...

Sometimes we are unsure when there is a potential opportunity to buy stock. In such cases, Fibonacci could be a helpful tool to assist us in making investment decisions.

By connecting the pe...

12

3

The $S&P 500 Index(.SPX.US)$ finished barely in positive territory at 4,468, while the $Nasdaq Composite Index(.IXIC.US)$ gained 15.97 points, or 0.1%, to 13,737.99 and the $Dow Jones Industrial Average(.DJI.US)$ rose 52.79 points, or 0.2%, to 35,176.15, FactSet data show. The blue-chip gauge had risen more than 450 points at its highs of the session. The $U.S. 10-Year Treasury Notes Yield(US10Y.BD)$jumped to 4.081%, its second highest level of the year, according to Dow Jones Market Data

1

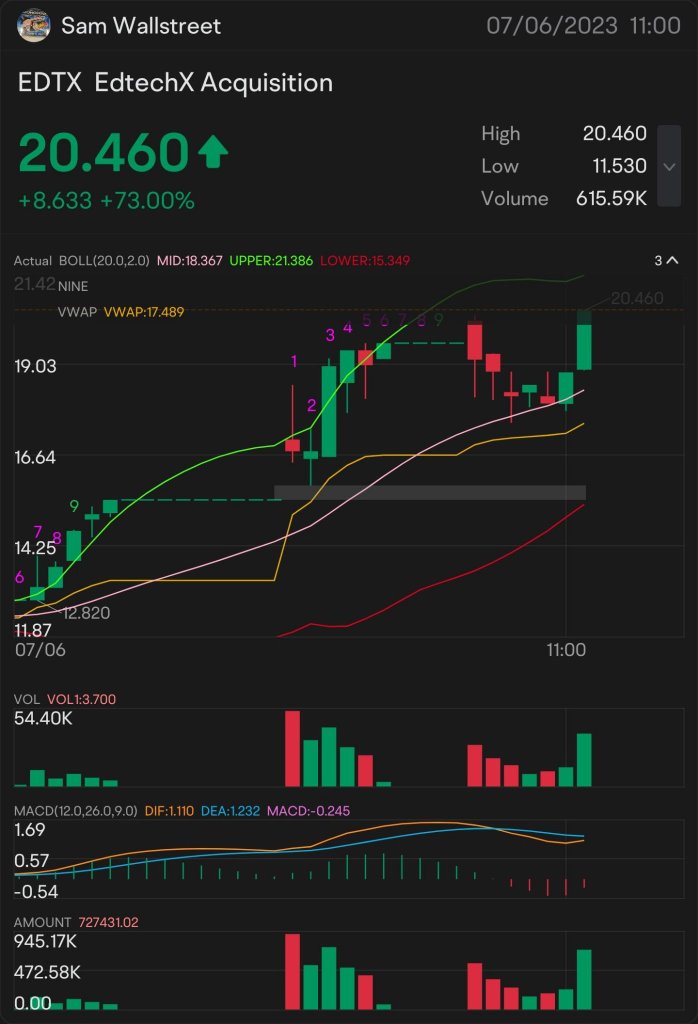

QUICK SCALP 20 $EDTX— STOCK PLAY

ALERT ON: $20.01

ON THE WATCH: $20.17

🥇 SIGNED OF MORE UPTREND: $20.23

NEED IT TO BREAK OVER: $20.34

key indicator for MORE uptrend $20.45

confirmation uptrend - $20.55

OK I SEE YOU - $20.67

mini breakout - $20.72

Prepare for a bigger breakout: $20.89. $EdtechX Acquisition (EDTX.US)$

ALERT ON: $20.01

ON THE WATCH: $20.17

🥇 SIGNED OF MORE UPTREND: $20.23

NEED IT TO BREAK OVER: $20.34

key indicator for MORE uptrend $20.45

confirmation uptrend - $20.55

OK I SEE YOU - $20.67

mini breakout - $20.72

Prepare for a bigger breakout: $20.89. $EdtechX Acquisition (EDTX.US)$

2

$NIO Inc (NIO.US)$

Technical Analysis July 2023

Technical analysis for NIO is Double Top Breakout trending.... strong Bullish technical indicators.

Average Directional Movement Rating is very strong Bullish .. well above 20 which is bullish indicator.

Money Flow ( funds inflow ) and OBV show Bullish trends in the intermidiate term

NIO $NIO Inc (NIO.US)$ is a BUY...

Technical Analysis July 2023

Technical analysis for NIO is Double Top Breakout trending.... strong Bullish technical indicators.

Average Directional Movement Rating is very strong Bullish .. well above 20 which is bullish indicator.

Money Flow ( funds inflow ) and OBV show Bullish trends in the intermidiate term

NIO $NIO Inc (NIO.US)$ is a BUY...

6

The $Nasdaq Composite Index (.IXIC.US)$ is in a bull market having surged more than 30% since last Oct's lows. But it is in a rising wedge pattern within an ascending channel as shown in the figure below.

The Nasdaq Composite started to struggle a lot just above the key 13174 swing level. The index has been underperforming $S&P 500 Index (.SPX.US)$ and $Dow Jones Industrial Average (.DJI.US)$ recently, prompting some speculation that it may be pea...

The Nasdaq Composite started to struggle a lot just above the key 13174 swing level. The index has been underperforming $S&P 500 Index (.SPX.US)$ and $Dow Jones Industrial Average (.DJI.US)$ recently, prompting some speculation that it may be pea...

29

6

1. Do you think nasdaq composite is entering a rising wedge pattern?

Based on the diagram, the rising wedge pattern is predicting a breakout in Q3 for Nasdaq Composite. I don't think the price reversal or crash will happen. If there's any, it's merely a short correction or pull-back.

I always believe that technical Analysis (TA) needs the support of macro factor. I see many positive macro factors that support a US bull market: AI rally, EV Tax incentives...

Based on the diagram, the rising wedge pattern is predicting a breakout in Q3 for Nasdaq Composite. I don't think the price reversal or crash will happen. If there's any, it's merely a short correction or pull-back.

I always believe that technical Analysis (TA) needs the support of macro factor. I see many positive macro factors that support a US bull market: AI rally, EV Tax incentives...

14

2

1. Short term upward trend to continue

2. Once technical recession in the US is confirmed the trend will go downward, coinciding with the start of the downward trend. The US dollar is also expected to start to decline around the same time.

3. Aggressive rate cuts from the fed will kick in leading to further US dollar weakness, but would also cause a base to be set for US stocks . This will form the head and ahoulders pattern with the right shoulder higher than the left one.

4. Thereafter, expe...

2. Once technical recession in the US is confirmed the trend will go downward, coinciding with the start of the downward trend. The US dollar is also expected to start to decline around the same time.

3. Aggressive rate cuts from the fed will kick in leading to further US dollar weakness, but would also cause a base to be set for US stocks . This will form the head and ahoulders pattern with the right shoulder higher than the left one.

4. Thereafter, expe...

6

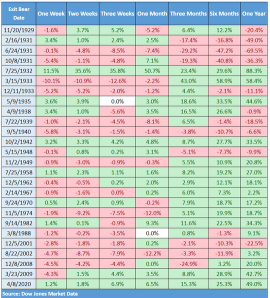

The S&P 500 on Thursday closed above the threshold that marked its exit from the longest bear market since 1948.

Here are some key stats from Dow Jones Market Data:

- $S&P 500 Index (.SPX.US)$ had been in bear-market territory for 248 trading days; the longest bear market since the 484 trading days ending on May 15, 1948.

- Excluding this most recent bear market, the average bear market lasts 14...

Here are some key stats from Dow Jones Market Data:

- $S&P 500 Index (.SPX.US)$ had been in bear-market territory for 248 trading days; the longest bear market since the 484 trading days ending on May 15, 1948.

- Excluding this most recent bear market, the average bear market lasts 14...

11

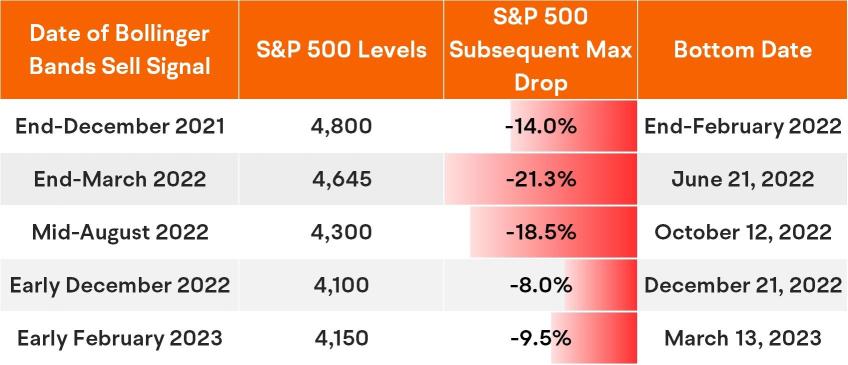

The Bollinger Bands indicator has just delivered a bearish signal for the S&P 500 index, known for accurately predicting past market downturns. Developed by John Bollinger, this indicator helps traders identify oversold conditions and potential trend reversals.

The Bollinger Bands indicator signals a sell when prices reach the upper band (located two standard deviations away from the moving average) and a buy signa...

The Bollinger Bands indicator signals a sell when prices reach the upper band (located two standard deviations away from the moving average) and a buy signa...

39

16

Fairy Maiden : hi Cici, where to find Fibonacci tool in mobile apps? thx u

Invest With Cici OP Fairy Maiden : It’s been updated in the post![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

wooper : thanks