Latest

Hot

News Highlights

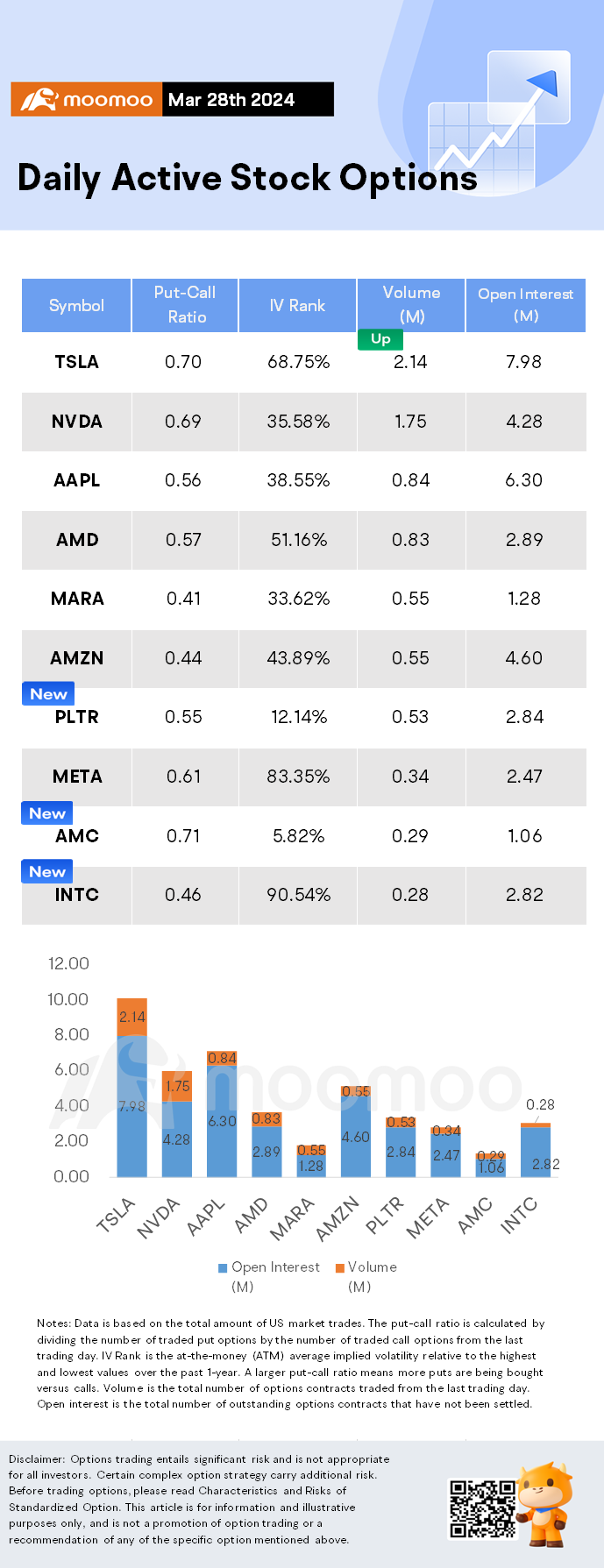

$Palantir (PLTR.US)$ shares fell by 6.12%, closing at $23.01. Its options trading volume was 0.53 million. Call contracts account for 64.6% of the total trading volume. The most traded calls are contracts of $25 strike price that expire on Mar. 28th. The total volume reaches 21,515 with an open interest of 17,495. The most traded puts are contracts ...

$Palantir (PLTR.US)$ shares fell by 6.12%, closing at $23.01. Its options trading volume was 0.53 million. Call contracts account for 64.6% of the total trading volume. The most traded calls are contracts of $25 strike price that expire on Mar. 28th. The total volume reaches 21,515 with an open interest of 17,495. The most traded puts are contracts ...

31

4

News Highlights

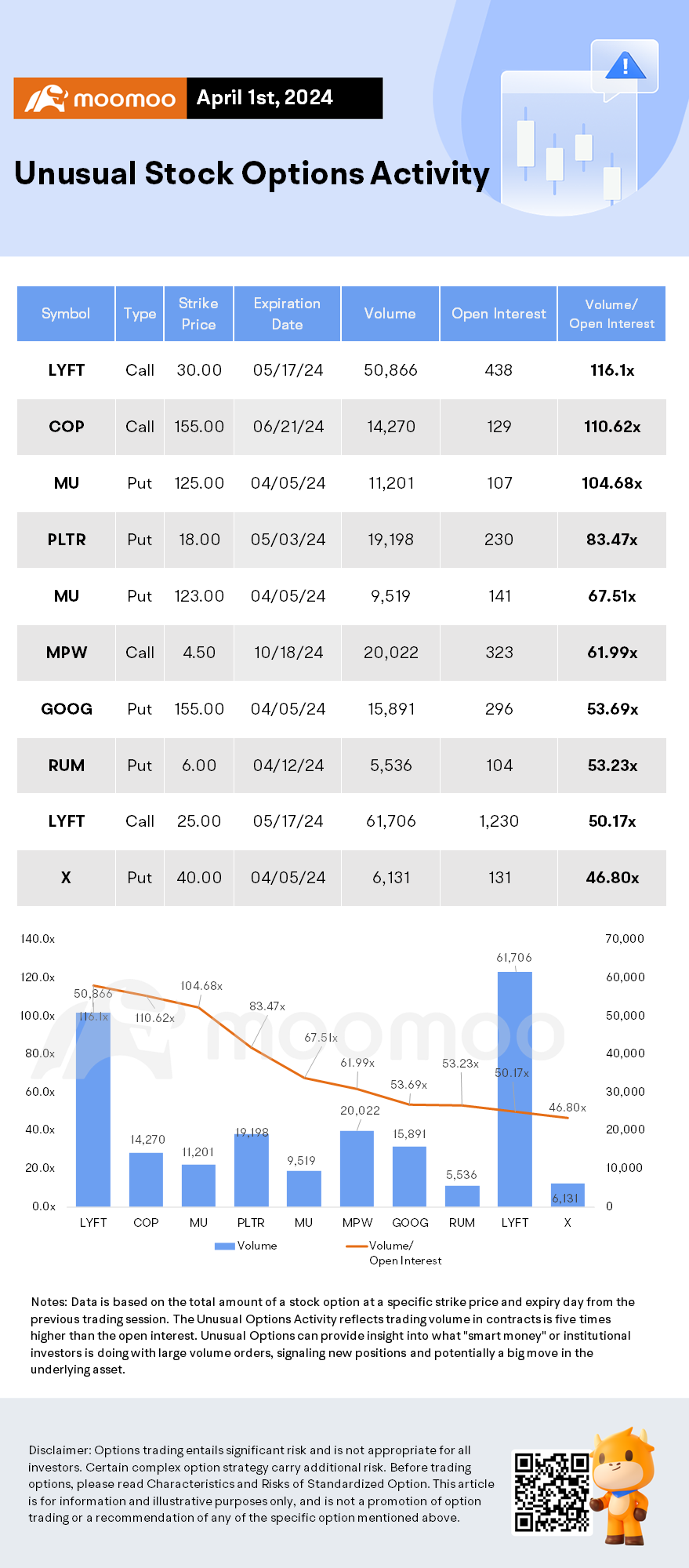

$Micron Technology (MU.US)$ shares rose by 5.44%, closing at $124.30. Its options trading volume was 0.51 million. Call contracts account for 68.4% of the total trading volume. The most traded calls are contracts of $120 strike price that expire on Apr. 5th. The total volume reaches 7,652 with an open interest of 10,443.

Micron Technology shares jumped to a record h...

$Micron Technology (MU.US)$ shares rose by 5.44%, closing at $124.30. Its options trading volume was 0.51 million. Call contracts account for 68.4% of the total trading volume. The most traded calls are contracts of $120 strike price that expire on Apr. 5th. The total volume reaches 7,652 with an open interest of 10,443.

Micron Technology shares jumped to a record h...

27

2

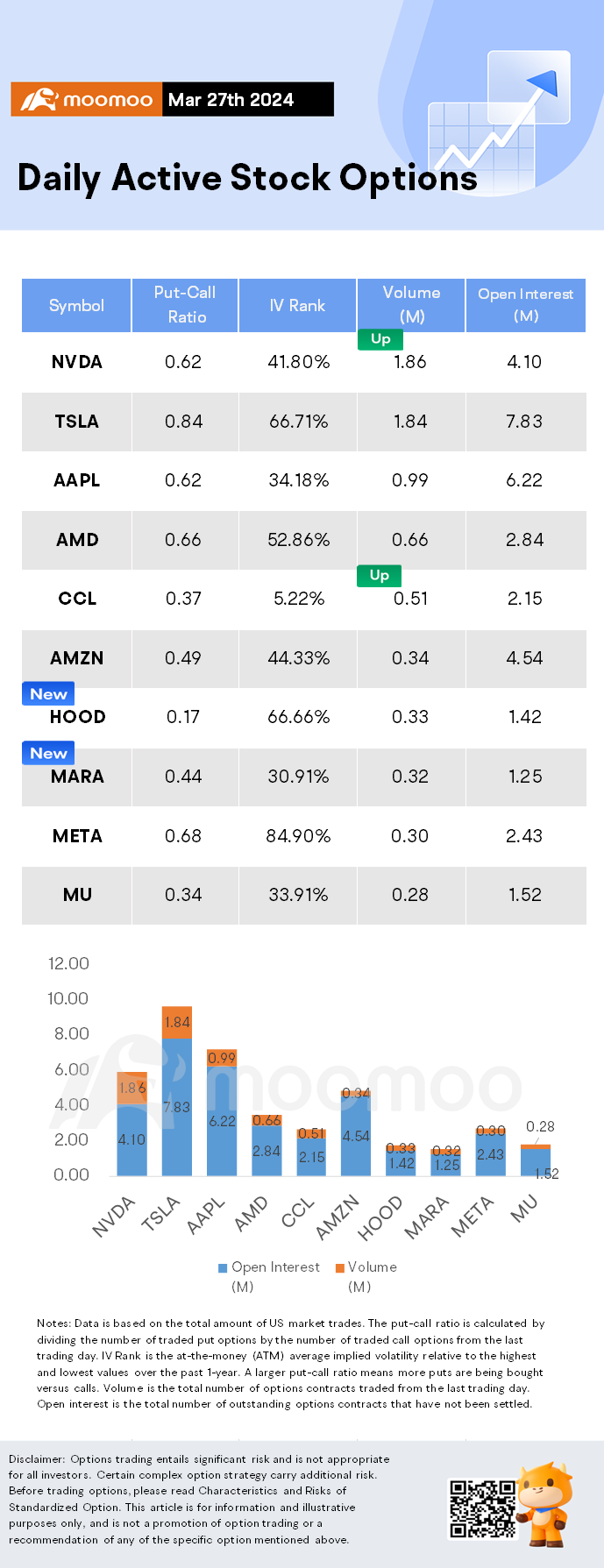

Columns Options Market Statistics: HOOD Shares Jump and Options Pop After Unveiling Its Robinhood Gold Card

News Highlights

$NVIDIA (NVDA.US)$ shares fell by 2.50%, closing at $902.50. Its options trading volume was 1.86 million. Call contracts account for 61.8% of the total trading volume. The most traded calls are contracts of $1000 strike price that expire on Mar. 28th. The total volume reaches 100,374 with an open interest of 21,373. The most traded puts are contracts of a $900 strike price that expir...

$NVIDIA (NVDA.US)$ shares fell by 2.50%, closing at $902.50. Its options trading volume was 1.86 million. Call contracts account for 61.8% of the total trading volume. The most traded calls are contracts of $1000 strike price that expire on Mar. 28th. The total volume reaches 100,374 with an open interest of 21,373. The most traded puts are contracts of a $900 strike price that expir...

26

1

$Carnival (CCL.US)$ is seeing a sell-off in call options as shares fall further below their strike price. Calls accounted for about 84% of total options traded so far, as prices tracked the slump in the stock price.

Shares fell 68.5 cents, or about 4% after the cruise line yesterday forecast a hit of as much as $10 million from the collapse of the Key Bridge in Baltimore Harbor, muddying the outlook for the full year. The downtrend ...

Shares fell 68.5 cents, or about 4% after the cruise line yesterday forecast a hit of as much as $10 million from the collapse of the Key Bridge in Baltimore Harbor, muddying the outlook for the full year. The downtrend ...

18

2

$Trump Media & Technology (DJT.US)$ has become the center of attention on WallStreetBets, the popular Reddit forum favored by American retail investors, leading to discussions reminiscent of the GameStop frenzy that shook Wall Street.

In a reversal of recent trends, Trump Media saw its shares dip by roughly 5% on Thursday morning, interrupting a streak of robust gains. Despite this pullback, the company had witnessed a signif...

In a reversal of recent trends, Trump Media saw its shares dip by roughly 5% on Thursday morning, interrupting a streak of robust gains. Despite this pullback, the company had witnessed a signif...

19

1

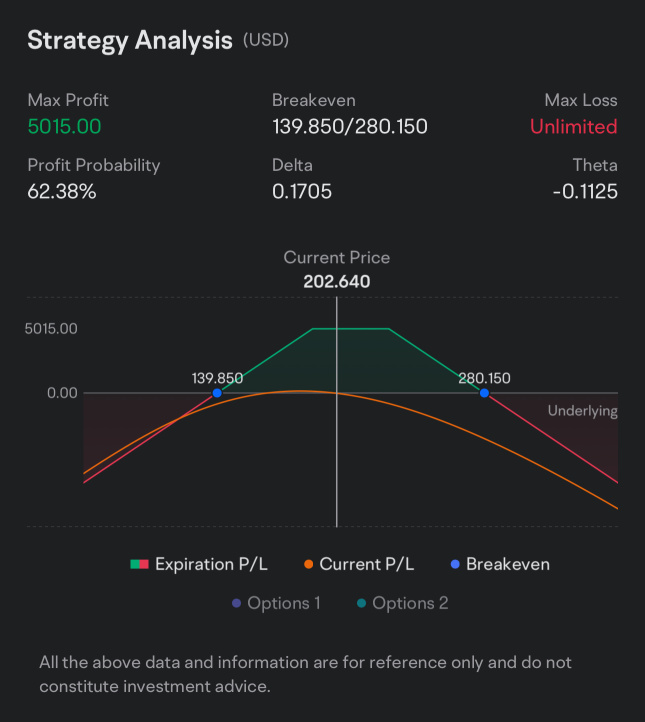

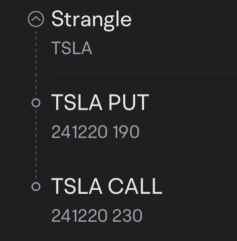

Sharing my recent take on Strangle option strategy with $Tesla (TSLA.US)$ .

I’ve recently undertaken a position with the following analysis.

It’s scary when the loss says Max loss Unlimited while the Max profit is only USD5k.

Note: different Strike prices selected to create a Strangle Strategy with same contract expiry date.

If your new to options a quick reference with link below.

What is a Strangle Strategy?

A strangle is an options strategy in which the investor hold...

I’ve recently undertaken a position with the following analysis.

It’s scary when the loss says Max loss Unlimited while the Max profit is only USD5k.

Note: different Strike prices selected to create a Strangle Strategy with same contract expiry date.

If your new to options a quick reference with link below.

What is a Strangle Strategy?

A strangle is an options strategy in which the investor hold...

+3

6

14

What options combinations can be used to bet on a range rather than just a single price?

The naked strangle strategy, simultaneously selling both call and put options with different strike prices but the same expiration date, to bet on a price range.

Next, I will first present the logic behind predicting stock prices, and then explain how to construct a naked strangle for profit.

*The following is for refe...

The naked strangle strategy, simultaneously selling both call and put options with different strike prices but the same expiration date, to bet on a price range.

Next, I will first present the logic behind predicting stock prices, and then explain how to construct a naked strangle for profit.

*The following is for refe...

12

2

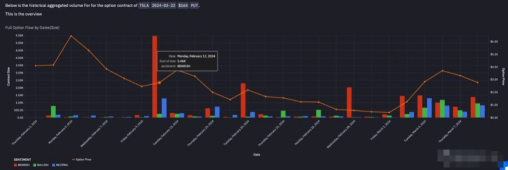

$Tesla (TSLA.US)$ has been facing continuous turbulence recently, with its stock price continuing to decline after falling below $200.

Let's take a look at how traders holding short positions in Tesla have been operating during this pullback and how they've been able to spot trend signals.

Firstly, widely noticed by the market was the surge in bearish sentiment on March 1st, just after the market opened, around 9:42 AM ET. A large volume of bearish funds emerged,...

Let's take a look at how traders holding short positions in Tesla have been operating during this pullback and how they've been able to spot trend signals.

Firstly, widely noticed by the market was the surge in bearish sentiment on March 1st, just after the market opened, around 9:42 AM ET. A large volume of bearish funds emerged,...

+3

4

6

Options Wheel strategy is a popular strategy that offers traders and investors the opportunity to generate passive income, with certain level of risks that can be properly managed.

Anyone doing the “Wheel” here?

$Tesla (TSLA.US)$ $Palantir (PLTR.US)$ $NVIDIA (NVDA.US)$ $SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$ $Apple (AAPL.US)$ $Palantir (PLTR.US)$ $Coinbase (COIN.US)$

Anyone doing the “Wheel” here?

$Tesla (TSLA.US)$ $Palantir (PLTR.US)$ $NVIDIA (NVDA.US)$ $SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$ $Apple (AAPL.US)$ $Palantir (PLTR.US)$ $Coinbase (COIN.US)$

11

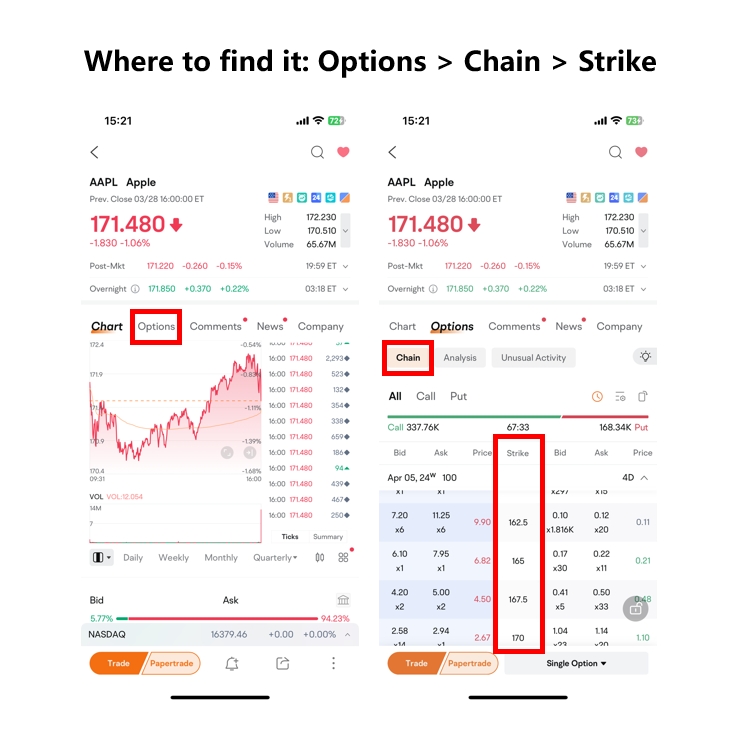

I am also keen to gain insights on how to select strike price for options.

Personally when selling option to collect premium, I pick strike price that is below support level.

If I do want to get assign the stock, I will pick strike price above support level.

Support level together with trend line serve as guidance to the strike price I pick as strike price.

Personally when selling option to collect premium, I pick strike price that is below support level.

If I do want to get assign the stock, I will pick strike price above support level.

Support level together with trend line serve as guidance to the strike price I pick as strike price.

4

2

It is not too wide of a strangle compared to how the big moves that TSLA makes. And there is plenty of time for the price to move. I think this is a safe bet for sure. Good call out on this one.

It is not too wide of a strangle compared to how the big moves that TSLA makes. And there is plenty of time for the price to move. I think this is a safe bet for sure. Good call out on this one.

Tun Lwin7 : Hello Sir

Tun Lwin7 : Accept the account, sir

Tonyco : yeah everyone knows government contracts are always a deathknell $Palantir (PLTR.US)$ ...

billlovesivy : Lol