Latest

Hot

$Netflix (NFLX.US)$ $Tesla (TSLA.US)$ $SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$ Cramer is bullish on Netflix and Tesla

2

1

$Netflix (NFLX.US)$ drops the $9.99 /mo deal

FCF improves for 2H - due to Actor/Writer Strike

Cutting the password-sharing makes for V difficult 2024 comps

2% beat on Paid memberships 238m vs 234m

2H23 is peak for comps, FCF (IMHO)

2024 will be much much much slower growth.

FCF improves for 2H - due to Actor/Writer Strike

Cutting the password-sharing makes for V difficult 2024 comps

2% beat on Paid memberships 238m vs 234m

2H23 is peak for comps, FCF (IMHO)

2024 will be much much much slower growth.

1

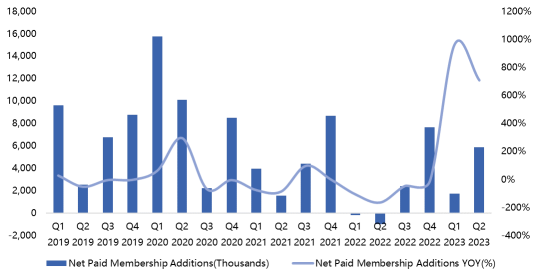

$Netflix (NFLX.US)$ The company added 5.9 million paid net subscribers in Q2 as it successfully rolled out paid sharing to more than 100 countries, representing over 80% of its total revenue. Buyside expectations were around 4M net subscriber additions.

Management expects revenue growth to accelerate in H2/23 as the company starts to see the full benefits of paid sharing plus continued steady growth in its ad-supported plan. For Q3, the company expects revenue of $8.5B, representing a 7% year-ove...

Management expects revenue growth to accelerate in H2/23 as the company starts to see the full benefits of paid sharing plus continued steady growth in its ad-supported plan. For Q3, the company expects revenue of $8.5B, representing a 7% year-ove...

1

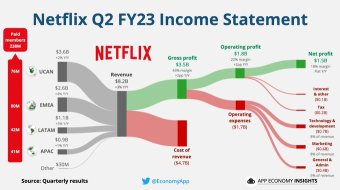

$Netflix (NFLX.US)$

Subscribers +5.9M Q/Q to 238.4M.

ARM -1% Y/Y fx neutral.

• Revenue +3% Y/Y to $8.2B ($100M miss).

• +6% Y/Y fx neutral.

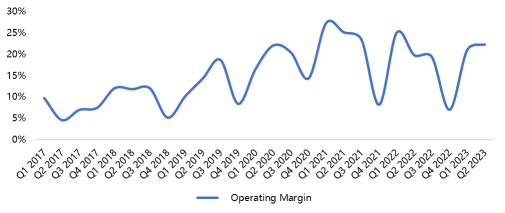

• Operating margin 22% (3pp beat).

• EPS $3.29 ($0.44 beat).

Q3 FY23 Guidance:

• Revenue +7% Y/Y.

• Operating margin 22%.

Subscribers +5.9M Q/Q to 238.4M.

ARM -1% Y/Y fx neutral.

• Revenue +3% Y/Y to $8.2B ($100M miss).

• +6% Y/Y fx neutral.

• Operating margin 22% (3pp beat).

• EPS $3.29 ($0.44 beat).

Q3 FY23 Guidance:

• Revenue +7% Y/Y.

• Operating margin 22%.

5

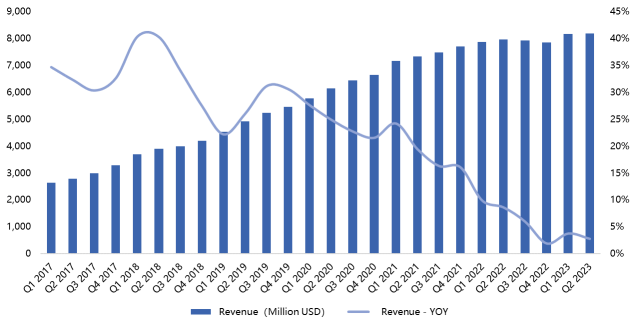

Netflix (NFLX.O) is expected to release its second-quarter earnings report on July 19, Eastern Time. Since November 2021, Netflix's stock price has experienced large fluctuations, which has aroused widespread concern in the market. I will conduct a forward-looking analysis of Netflix's financial report for the second quarter of 2023 , and discuss its future development trends and possible risk factors.

1. Revenue fell sho...

1. Revenue fell sho...

+3

5

The Dow Jones, S&P 500, and Russell 2000 ended higher, while the Nasdaq-100 ended lower. Real estate and utilities were today's best performers and materials and technology were the worst. Tesla beat 2Q adjusted EPS and revenue estimates. Netflix beat 2Q adjusted EPS, but missed on revenue. Apple spiked to a new all-time high on "Apple GPT" report.

$S&P 500 Index (.SPX.US)$ $Tesla (TSLA.US)$ $Apple (AAPL.US)$ $Netflix (NFLX.US)$

$S&P 500 Index (.SPX.US)$ $Tesla (TSLA.US)$ $Apple (AAPL.US)$ $Netflix (NFLX.US)$

3

Netflix subscriptions rose 8% in the second quarter as its revenue climbed year over year.

While Netflix beat earnings estimates, it missed on revenue. The company reported $8.19 billion in revenue.

The company is cracking down on password sharing.

Netflix said Wednesday that its quarterly revenue and subscriptions rose, as efforts to curb password sharing took hold.

Here’s what the company reported for the sec...

While Netflix beat earnings estimates, it missed on revenue. The company reported $8.19 billion in revenue.

The company is cracking down on password sharing.

Netflix said Wednesday that its quarterly revenue and subscriptions rose, as efforts to curb password sharing took hold.

Here’s what the company reported for the sec...

1

1