Latest

Hot

$Coca-Cola (KO.US)$ is expected to report the quarterly results for period ending 30 September 2024 on 23 October 2024 before the market open.

KO is expected to report a 2.6% decrease in revenue to $11.598 billion from $11.91 billion a year ago,

North America and Latin America have been key growth drivers, with notable revenue and profit increases despite flat volumes and foreign currency impacts.

Market forecast a...

KO is expected to report a 2.6% decrease in revenue to $11.598 billion from $11.91 billion a year ago,

North America and Latin America have been key growth drivers, with notable revenue and profit increases despite flat volumes and foreign currency impacts.

Market forecast a...

+1

7

‘In Berkshire Hathaway’s 2007 letter to shareholders,

Warren Buffett explains that the kind of companies he likes to invest in are ‘companies that have

a) a business we understand;

b) favourable long-term economics;

c) able and trustworthy management; and

d) a sensible price tag.

A truly great business must have an enduring “moat” that protects excellent returns on invested capital.’

$Warren Buffett Portfolio (LIST2999.US)$ $Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$ $Apple (AAPL.US)$ $Coca-Cola (KO.US)$ $Meta Platforms (META.US)$ $Microsoft (MSFT.US)$ $Occidental Petroleum (OXY.US)$ $Bank of America (BAC.US)$

Warren Buffett explains that the kind of companies he likes to invest in are ‘companies that have

a) a business we understand;

b) favourable long-term economics;

c) able and trustworthy management; and

d) a sensible price tag.

A truly great business must have an enduring “moat” that protects excellent returns on invested capital.’

$Warren Buffett Portfolio (LIST2999.US)$ $Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$ $Apple (AAPL.US)$ $Coca-Cola (KO.US)$ $Meta Platforms (META.US)$ $Microsoft (MSFT.US)$ $Occidental Petroleum (OXY.US)$ $Bank of America (BAC.US)$

8

1

From YouTube

6

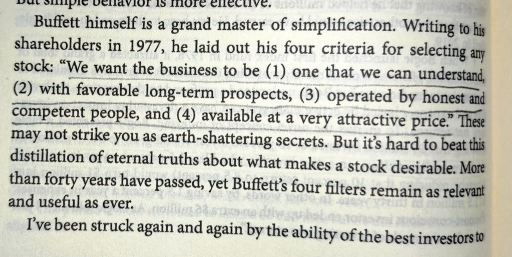

(1) one that we can understand,

(2) with favourable long-term prospects,

(3) operated by honest and

competent people, and

(4) available at a very attractive price.

Book: Richer, Wiser, Happier

$Warren Buffett Portfolio (LIST2999.US)$ $Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$ $Coca-Cola (KO.US)$ $Apple (AAPL.US)$

(2) with favourable long-term prospects,

(3) operated by honest and

competent people, and

(4) available at a very attractive price.

Book: Richer, Wiser, Happier

$Warren Buffett Portfolio (LIST2999.US)$ $Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$ $Coca-Cola (KO.US)$ $Apple (AAPL.US)$

6

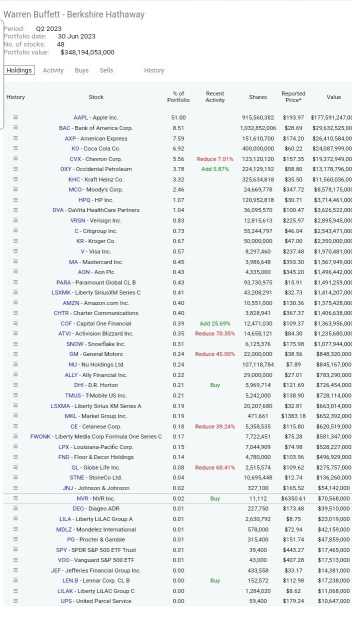

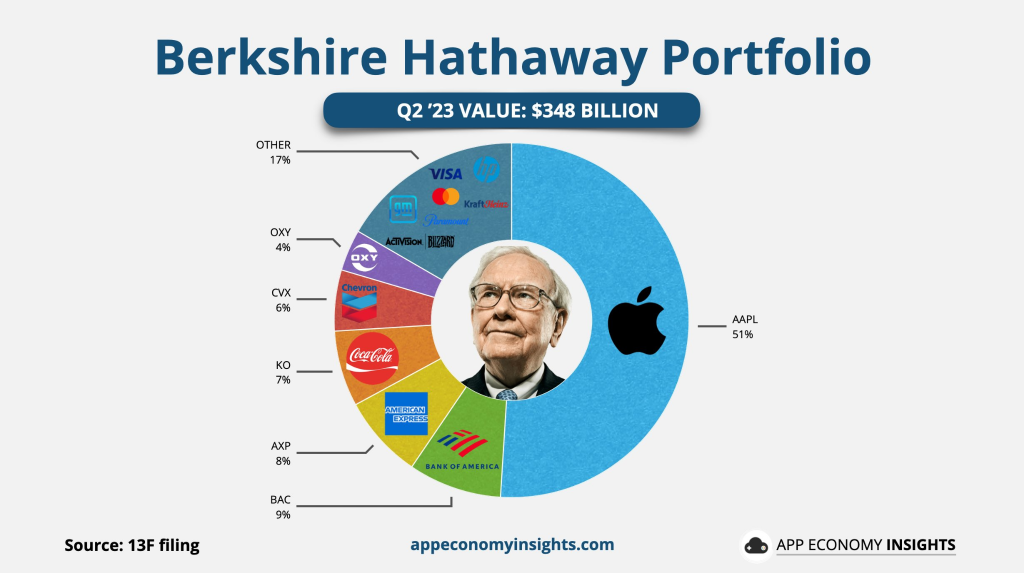

The portfolio is mostly Apple

$Warren Buffett Portfolio (LIST2999.US)$ $Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$ $Apple (AAPL.US)$ $Bank of America (BAC.US)$ $American Express (AXP.US)$ $Coca-Cola (KO.US)$ $Chevron (CVX.US)$ $Occidental Petroleum (OXY.US)$ $The Kraft Heinz (KHC.US)$ $Moody's (MCO.US)$ $HP Inc (HPQ.US)$ $DaVita (DVA.US)$ $Citigroup (C.US)$

$Warren Buffett Portfolio (LIST2999.US)$ $Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$ $Apple (AAPL.US)$ $Bank of America (BAC.US)$ $American Express (AXP.US)$ $Coca-Cola (KO.US)$ $Chevron (CVX.US)$ $Occidental Petroleum (OXY.US)$ $The Kraft Heinz (KHC.US)$ $Moody's (MCO.US)$ $HP Inc (HPQ.US)$ $DaVita (DVA.US)$ $Citigroup (C.US)$

6

7

From YouTube

3

4

He works 70+ hours a week (probably more).

Warren Buffett owns 3% of Coca-Cola and gets paid a $218 million dividend every year.

He works 0 hours every week for Coca-Cola.

Don't just work for businesses - make sure you own them too.

$Warren Buffett Portfolio (LIST2999.US)$ $Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$ $Coca-Cola (KO.US)$

Warren Buffett owns 3% of Coca-Cola and gets paid a $218 million dividend every year.

He works 0 hours every week for Coca-Cola.

Don't just work for businesses - make sure you own them too.

$Warren Buffett Portfolio (LIST2999.US)$ $Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$ $Coca-Cola (KO.US)$

4

"Our favorite holding period is forever."

- Warran Buffett

$Warren Buffett Portfolio (LIST2999.US)$ $Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$ $Citigroup (C.US)$ $Apple (AAPL.US)$ $Coca-Cola (KO.US)$

- Warran Buffett

$Warren Buffett Portfolio (LIST2999.US)$ $Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$ $Citigroup (C.US)$ $Apple (AAPL.US)$ $Coca-Cola (KO.US)$

6