Latest

Hot

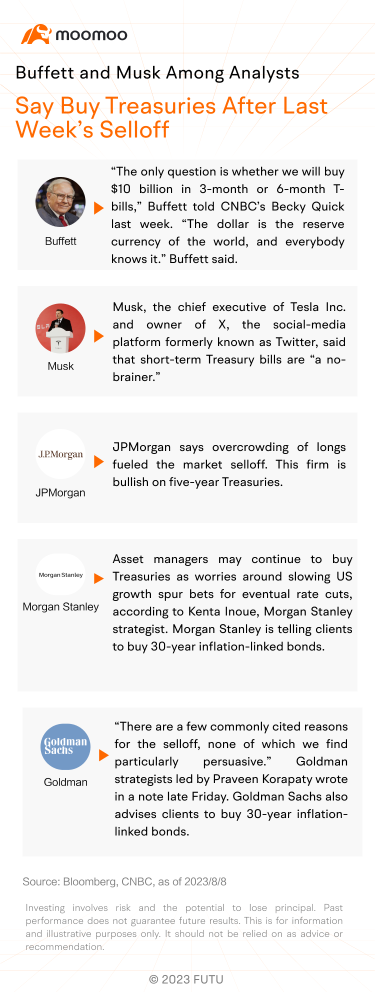

A few days ago, Berkshire Hathaway, led by Warren Buffett, confirmed a $10 billion purchase of U.S. Treasuries, underscoring their consistent investment plans despite Fitch's downgrade of the U.S. long-term foreign currency issuer default rating from AAA to AA+. Here are several things you might want to know:

What Are U.S. Treasury Bonds?

A U.S. Treasury bond is essentially a loan provided to the U.S. government. Whe...

What Are U.S. Treasury Bonds?

A U.S. Treasury bond is essentially a loan provided to the U.S. government. Whe...

21

The $25 trillion treasury market under siege: Bond supply surge, fitch ratings downgrade, and BOJ capital repatriation speculation. Wall street unites in view that last week's treasury sell-off was excessive, as 10-year and 30-year yields approach multi-year peaks. $Goldman Sachs (GS.US)$ and $Morgan Stanley (MS.US)$ are recommending clients to purchase 30-year inflation-linked bonds, while $JPMorgan (JPM.US)$ is optimistic ...

Expand

Expand 16

WATCH my video here for a live demo on how to see what Billionaires have in their portfolios. And what they're buying and selling.

The first thing to do is head to the moomoo. Click on the Markets tab, then institutional tracker.

After clicking on Buffett's Berkshire $Berkshire Hathaway-A (BRK.A.US)$ , you can all the holdin...

The first thing to do is head to the moomoo. Click on the Markets tab, then institutional tracker.

After clicking on Buffett's Berkshire $Berkshire Hathaway-A (BRK.A.US)$ , you can all the holdin...

18

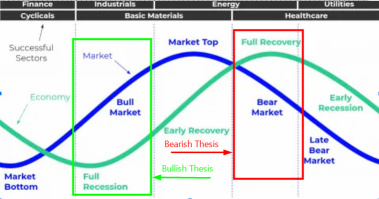

Where Are We in the Cycle?

The bulls think that we are at the beginning of a bull market, but the bears think we are near the end of the cycle. Are you bullish or bearish about the economy? Give me your reasons in the comments section.

The recent sell-off in the markets has bolstered the bears viewpoint. The chinese real estate debacle, inflation persisting, the Fed signaling higher for longer, bearish seasonality, the Fitch downgrade, and skyrocketing credit card deli...

The bulls think that we are at the beginning of a bull market, but the bears think we are near the end of the cycle. Are you bullish or bearish about the economy? Give me your reasons in the comments section.

The recent sell-off in the markets has bolstered the bears viewpoint. The chinese real estate debacle, inflation persisting, the Fed signaling higher for longer, bearish seasonality, the Fitch downgrade, and skyrocketing credit card deli...

17

6

As of the recent quarterly report, Berkshire Hathaway has $44 billion in cash and $97 billion in short-term U.S. Treasury Bills.

Assuming a 5.5% interest rate on those Treasury Bills, Buffett is making $5.3 billion per year alone, risk free!

The power of compound interest.

$Warren Buffett Portfolio (LIST2999.US)$ $Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$ $Bank of America (BAC.US)$ $Citigroup (C.US)$

Assuming a 5.5% interest rate on those Treasury Bills, Buffett is making $5.3 billion per year alone, risk free!

The power of compound interest.

$Warren Buffett Portfolio (LIST2999.US)$ $Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$ $Bank of America (BAC.US)$ $Citigroup (C.US)$

3

Berkshire Hathaway is on track to generate over $500 Million in annualized interest income from this purchase

Berkshire Hathaway keeps its massive cash horde in US Treasury Bills

They buy $10 Billion worth of Treasury Bills each week, using new cash and cash from Bills that have matured

Higher interest rates have been a bonus for its massive insurance float

$Warren Buffett Portfolio (LIST2999.US)$ $Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$ $Bank of America (BAC.US)$ $Citigroup (C.US)$ $S&P 500 Index (.SPX.US)$

Berkshire Hathaway keeps its massive cash horde in US Treasury Bills

They buy $10 Billion worth of Treasury Bills each week, using new cash and cash from Bills that have matured

Higher interest rates have been a bonus for its massive insurance float

$Warren Buffett Portfolio (LIST2999.US)$ $Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$ $Bank of America (BAC.US)$ $Citigroup (C.US)$ $S&P 500 Index (.SPX.US)$

8

Getting a guaranteed 5%+, zero volatility, return right now is the BRILLIANT. Definitely boring, and NOT a buy and hold, but a great place to park money for at least a few months.

2

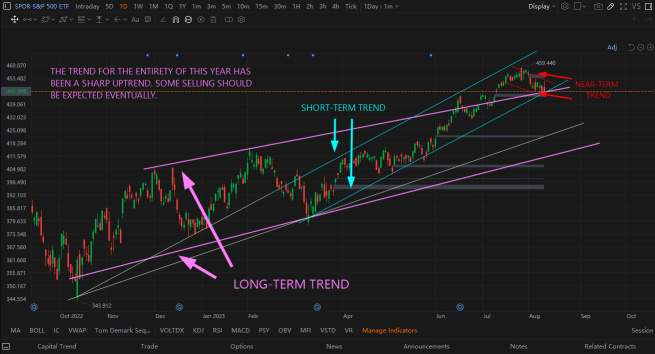

$SPDR S&P 500 ETF (SPY.US)$

The market has been on a downward trajectory for the past two weeks, with value and defensive stocks performing relatively better than their peers. This is following a massive rally that has produced very nice gains for investors. Are investors taking a little profit after the rally? Or is this selloff just the beginning of more to come?

Feel free to leave a comment about why you think the market has been selling off for the past two weeks...

The market has been on a downward trajectory for the past two weeks, with value and defensive stocks performing relatively better than their peers. This is following a massive rally that has produced very nice gains for investors. Are investors taking a little profit after the rally? Or is this selloff just the beginning of more to come?

Feel free to leave a comment about why you think the market has been selling off for the past two weeks...

+1

19

14