Latest

Hot

but cant solve the problem in my solution ...i hove u cant forgive me for the issues.. what the problems of all...

![]()

![]()

1

What is happening with the Tech sector of the market? it has been on a huge down swing for over a week? Have i missed something last month?

Tesla, Meta, Apple, Microsoft, Alphabet, Nvidia and Amazon - the so called magnificent 7 were all red yesterday.

Can we recover today?

The market will likely continue to digest the Fed minutes and come up with their own assumption and probability of the next potential rate hike.

It’s all noise in my opinion. I’ve deployed more cash for the last 1 month than the last 3-4 months.

$SPDR S&P 500 ETF (SPY.US)$ $S&P 500 Index (.SPX.US)$ $Invesco QQQ Trust (QQQ.US)$ $Dow Jones Industrial Average (.DJI.US)$ $ProShares UltraPro QQQ ETF (TQQQ.US)$ $ProShares UltraPro Short QQQ ETF (SQQQ.US)$ $JPMorgan (JPM.US)$ $Tesla (TSLA.US)$ $Apple (AAPL.US)$ $Microsoft (MSFT.US)$ $Amazon (AMZN.US)$ $NVIDIA (NVDA.US)$ $Advanced Micro Devices (AMD.US)$ $Taiwan Semiconductor (TSM.US)$ $Alphabet-A (GOOGL.US)$ $Alphabet-C (GOOG.US)$ $Enphase Energy (ENPH.US)$ $Financial Select Sector SPDR Fund (XLF.US)$ $HP Inc (HPQ.US)$ $Adobe (ADBE.US)$ $iShares 20+ Year Treasury Bond ETF (TLT.US)$ $E-mini S&P 500 Futures(DEC4) (ESmain.US)$ $E-mini NASDAQ 100 Futures(DEC4) (NQmain.US)$ $E-mini Dow Futures(DEC4) (YMmain.US)$ $Boeing (BA.US)$

Can we recover today?

The market will likely continue to digest the Fed minutes and come up with their own assumption and probability of the next potential rate hike.

It’s all noise in my opinion. I’ve deployed more cash for the last 1 month than the last 3-4 months.

$SPDR S&P 500 ETF (SPY.US)$ $S&P 500 Index (.SPX.US)$ $Invesco QQQ Trust (QQQ.US)$ $Dow Jones Industrial Average (.DJI.US)$ $ProShares UltraPro QQQ ETF (TQQQ.US)$ $ProShares UltraPro Short QQQ ETF (SQQQ.US)$ $JPMorgan (JPM.US)$ $Tesla (TSLA.US)$ $Apple (AAPL.US)$ $Microsoft (MSFT.US)$ $Amazon (AMZN.US)$ $NVIDIA (NVDA.US)$ $Advanced Micro Devices (AMD.US)$ $Taiwan Semiconductor (TSM.US)$ $Alphabet-A (GOOGL.US)$ $Alphabet-C (GOOG.US)$ $Enphase Energy (ENPH.US)$ $Financial Select Sector SPDR Fund (XLF.US)$ $HP Inc (HPQ.US)$ $Adobe (ADBE.US)$ $iShares 20+ Year Treasury Bond ETF (TLT.US)$ $E-mini S&P 500 Futures(DEC4) (ESmain.US)$ $E-mini NASDAQ 100 Futures(DEC4) (NQmain.US)$ $E-mini Dow Futures(DEC4) (YMmain.US)$ $Boeing (BA.US)$

From YouTube

4

1

Wall Street was lower on Wednesday after the release of the Federal Reserve's minutes showed central bank officials were divided over the need for more interest rate hikes at their last meeting.

At 3:02 pm ET, the S&P 500 was down 15.86 points, or 0.36%, to 4,422 and the Nasdaq Composite dropped 59.84 points, or 0.44%, to 13,571.21 points and the Dow Jones Industrial Average fell 61.97 points, or 0.18%, to 34,884.42.

- Fed polic...

At 3:02 pm ET, the S&P 500 was down 15.86 points, or 0.36%, to 4,422 and the Nasdaq Composite dropped 59.84 points, or 0.44%, to 13,571.21 points and the Dow Jones Industrial Average fell 61.97 points, or 0.18%, to 34,884.42.

- Fed polic...

3

Federal Reserve officials expressed concern at their most recent meeting about the pace of inflation and said more rate hikes could be necessary in the future unless conditions change, minutes released Wednesday from the session indicated.

That discussion during a two-day July meeting resulted in a quarter percentage point rate hike that markets generally expect to be the last one of this cycle.

Howeve...

That discussion during a two-day July meeting resulted in a quarter percentage point rate hike that markets generally expect to be the last one of this cycle.

Howeve...

2

1. Most officials still see need for higher rates

2. Some officials worry about over-tightening

3. Fed sees tighter bank credit conditions

4. Fed sees no recession in 2023 forecast

5. Commercial real estate value decline is hurting some banks

Can the Fed really avoid a recession?

$Invesco QQQ Trust (QQQ.US)$ $SPDR S&P 500 ETF (SPY.US)$

2. Some officials worry about over-tightening

3. Fed sees tighter bank credit conditions

4. Fed sees no recession in 2023 forecast

5. Commercial real estate value decline is hurting some banks

Can the Fed really avoid a recession?

$Invesco QQQ Trust (QQQ.US)$ $SPDR S&P 500 ETF (SPY.US)$

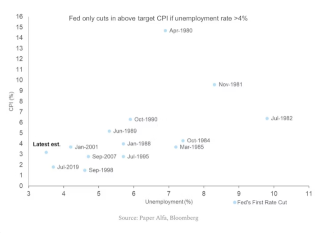

- CPI was above 3%

and the

- unemployment rate below 4%

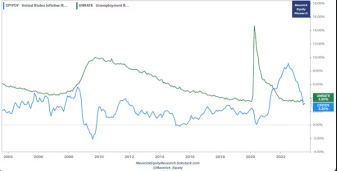

Unemployment Rate & CPI:

U.S. interest rates 1y 2y 3y 5y 10y 30y with a 20-year lookback period:

- 3 hiking cycles in 20 years: not the 1st one nor the last one I tell you that

- currently above the 2015-2019 period, though below the 2004-2009 cycle with the exception of the very short end of the curve which is above

- peak interest rates aka ‘peak FED’ should be around here rather sooner than late...

and the

- unemployment rate below 4%

Unemployment Rate & CPI:

U.S. interest rates 1y 2y 3y 5y 10y 30y with a 20-year lookback period:

- 3 hiking cycles in 20 years: not the 1st one nor the last one I tell you that

- currently above the 2015-2019 period, though below the 2004-2009 cycle with the exception of the very short end of the curve which is above

- peak interest rates aka ‘peak FED’ should be around here rather sooner than late...

2

Federal Reserve officials are still worried that inflation could rise again, which would necessitate more interest rate hikes, according to minutes from the July meeting. Officials were also concerned that the decline of value in commercial real estate could affect banks and other financial institutions, sending ripples throughout the economy.

U.S. markets fell for a second straight day and Treasury yields rose as traders digeste...

1

Academic now. Any finance 101 student would recognize fundamentals are no longer essential when we have entered a media popularizing stocks and guessing at targets by every Tom, Dick and Harry. Wallstreet the shameless scams and manipulation of stock reporting . The corrupt and unskilled SEC. They too pick and choose who to persue for prosecution. How to play the market. Inside Information, knowing a member of Congress or underwriters of legislation, Early information on mergers and ta...

3