Latest

Hot

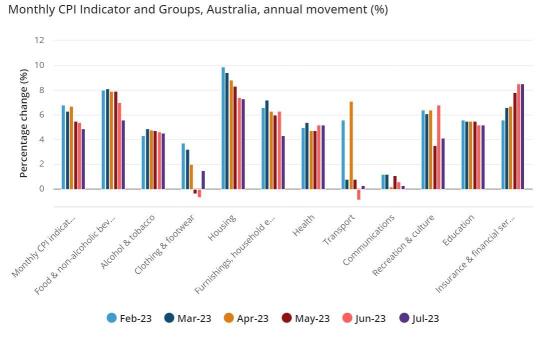

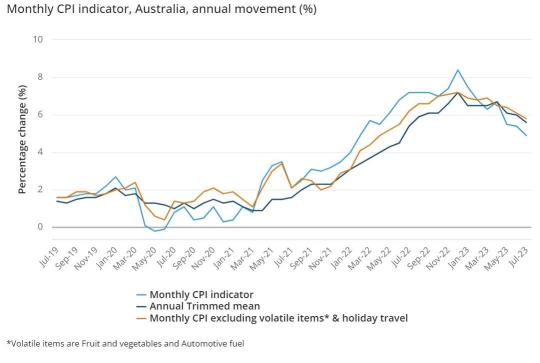

1. Australian CPI fell from 5.4% YoY to 4.9% YoY in July, with inflation recording a bigger drop than expected.

2. This means the RBA will likely keep interest rates as they are, at 4.1% at next week's meeting.

3. It's a bit of a reprieve for mortgage holders, who got burnt when they actually listened to the RBA governor who said 'rates won't rise till 2024'.

4. Since May 2022, the RBA ...

2. This means the RBA will likely keep interest rates as they are, at 4.1% at next week's meeting.

3. It's a bit of a reprieve for mortgage holders, who got burnt when they actually listened to the RBA governor who said 'rates won't rise till 2024'.

4. Since May 2022, the RBA ...

+1

3

In this video, Dr. Stock delves into the day's remarkable market performance and its implications. As a "Doctor of Education," he breaks down the significant numbers that shaped the trading day, emphasizing the impressive gains in various indices. The Dow surged by 0.85%, the Nasdaq skyrocketed by 1.74%, and the S&P experienced an impressive 1.45% increase.

With a backdrop of green across the markets, Dr. Stock shares the excitement among traders in his Discord community. He discusse...

With a backdrop of green across the markets, Dr. Stock shares the excitement among traders in his Discord community. He discusse...

1

In this video, Dr. Stock, a financial expert, discusses the critical week ahead in the stock market. He highlights key factors to watch for determining whether the market will rally or experience a stumble. Dr. Stock emphasizes his perspective as a bullish market supporter and outlines various economic events that will influence the Federal Reserve's rate decisions.

He delves into the implications of recent Fed discussions about potential rate hikes and how economic rep...

He delves into the implications of recent Fed discussions about potential rate hikes and how economic rep...

1

- According to the general belief, theextensive monetary tightening cycle is nearing its end. The pricing in the futures market indicates an anticipation that policymakers willmaintain interest rates during their meeting on September 19-20, with a33% probability of a 0.25% increase in November.

- During the Jackson Hole Conference, Jerome Powell stated thatthe Federal Reserve would approach the decision of raising interest rates again with caution, while...

- During the Jackson Hole Conference, Jerome Powell stated thatthe Federal Reserve would approach the decision of raising interest rates again with caution, while...

2

2

Maintaining Optimism During Challenging Times

Two key factors contribute to my positive viewpoint:

Technological Advancements

The pace of technological innovation continues to accelerate, reshaping industries and creating new avenues for growth. From artificial intelligence to renewable energy, breakthroughs drive companies forward and present compelling investmen...

Two key factors contribute to my positive viewpoint:

Technological Advancements

The pace of technological innovation continues to accelerate, reshaping industries and creating new avenues for growth. From artificial intelligence to renewable energy, breakthroughs drive companies forward and present compelling investmen...

2

One needs to know the market. I might have bought shares based on the news. Good to invest in what you know than hype

...regardless of where the hype comes from. To one's self be true... 🤔🤔🤔

...regardless of where the hype comes from. To one's self be true... 🤔🤔🤔

1

Welcome to my channel! In this video, I, Dr. Stock, a doctor of education, will break down the recent market movements and Jerome Powell's speech that caused quite a stir. Stick around as we dissect the implications for the future of the markets.

Initially, I thought the markets were heading for a red start, but the pre-market surprised me with a green opening. Despite my initial prediction, the volatility I anticipated did make an appearance, running beyond Powell's spe...

Initially, I thought the markets were heading for a red start, but the pre-market surprised me with a green opening. Despite my initial prediction, the volatility I anticipated did make an appearance, running beyond Powell's spe...

3

Good morning everyone! I hope your week has been filled with tendies entering your retirement fund.

This week really has been crazy. We've had huge up days and huge down days. But today is by far the most important day. Jerome Powell is speaking! At 10:05AM NYC. This will absolutely move markets, so be careful trading. Before he speaks, the market retracted all its gains from two days ago putting us at the level right before NVDA earnings. Will we get tho...

This week really has been crazy. We've had huge up days and huge down days. But today is by far the most important day. Jerome Powell is speaking! At 10:05AM NYC. This will absolutely move markets, so be careful trading. Before he speaks, the market retracted all its gains from two days ago putting us at the level right before NVDA earnings. Will we get tho...

5

2