Latest

Hot

• Last week, data released were mixed.

• Conference Board Consumer Index exceeded expectations, reaching 103.3 in August (vs consensus 100.7).

• While labor market conditions worsened as July’s labor market differential revised down to 17.1% and further declining to 16.4% in August, jobless claims remained steady, indicating no sudden worsening in job market conditions.

• Additionally, US real GDP growth for the second quarter was adjusted upwards by 0.2 per...

• Conference Board Consumer Index exceeded expectations, reaching 103.3 in August (vs consensus 100.7).

• While labor market conditions worsened as July’s labor market differential revised down to 17.1% and further declining to 16.4% in August, jobless claims remained steady, indicating no sudden worsening in job market conditions.

• Additionally, US real GDP growth for the second quarter was adjusted upwards by 0.2 per...

16

- 📈 The Dow Jones and S&P 500 indices recorded their most impressive performance in two weeks, securing significant gains for investors.

- 💰 Despite a lackluster 7-year Treasury note auction, the stock market received a boost from a decline in Treasury yields, contributing to its upward trajectory.

- 🛢️ A notable retreat in oil prices further bolstered the market's positive outlook, alleviating concerns related to inflation.

- 📊 Technology stocks demonstrated resilience...

- 💰 Despite a lackluster 7-year Treasury note auction, the stock market received a boost from a decline in Treasury yields, contributing to its upward trajectory.

- 🛢️ A notable retreat in oil prices further bolstered the market's positive outlook, alleviating concerns related to inflation.

- 📊 Technology stocks demonstrated resilience...

5

2

$SIA (C6L.SG)$ The article revealed that economists have become less optimistic about the growth of Singapore’s economy, with most expecting a 1.0% full-year increase. In 2Q23, economists were expecting a 1.5% GDP growth for 2023.

Singapore's economic growth slowdown will have a negative impact on the stock market. Despite a good fundamental, Singapore Airlines share price will face a downward pressure amid the negative macroeconomics condit...

Singapore's economic growth slowdown will have a negative impact on the stock market. Despite a good fundamental, Singapore Airlines share price will face a downward pressure amid the negative macroeconomics condit...

5

15

🇺🇸 USA debt: $33.1 trillion

🇺🇸 USA GDP: $27.0 trillion

🇬🇧 UK debt: $3.79 trillion

🇬🇧 UK GDP: $3.47 trillion

🇷🇺 Russia debt: $427 billion

🇷🇺 Russia GDP: $2.19 trillion $S&P 500 Index (.SPX.US)$ $Nasdaq Composite Index (.IXIC.US)$ $Dow Jones Industrial Average (.DJI.US)$ $Invesco QQQ Trust (QQQ.US)$ $SPDR S&P 500 ETF (SPY.US)$

🇺🇸 USA GDP: $27.0 trillion

🇬🇧 UK debt: $3.79 trillion

🇬🇧 UK GDP: $3.47 trillion

🇷🇺 Russia debt: $427 billion

🇷🇺 Russia GDP: $2.19 trillion $S&P 500 Index (.SPX.US)$ $Nasdaq Composite Index (.IXIC.US)$ $Dow Jones Industrial Average (.DJI.US)$ $Invesco QQQ Trust (QQQ.US)$ $SPDR S&P 500 ETF (SPY.US)$

7

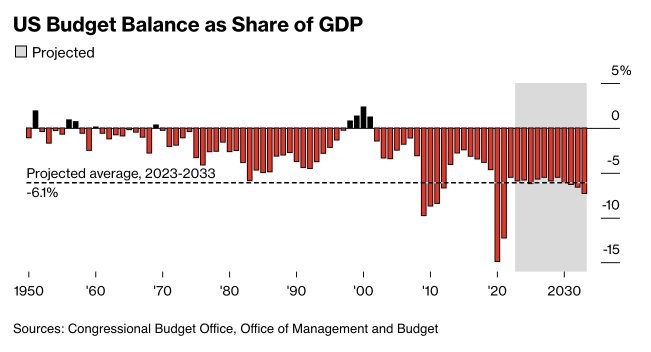

The US is now spending 44% of GDP per year, the same levels as World War 2.

Deficit spending alone is a massive 6% of GDP per year.

This means that after just ~8 years, the US deficit will grow by HALF of the US GDP.

Since the debt ceiling crisis, the US has been borrowing ~$14 billion PER DAY to cover deficit spending.

By 2033, Bloomberg projects deficit spending will be ~7% of GDP.

The US is spending like we are in a recession while calling for a "soft landing."

How does this make any sense?

$SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$ $S&P 500 Index (.SPX.US)$ $Dow Jones Industrial Average (.DJI.US)$ $Nasdaq Composite Index (.IXIC.US)$

Deficit spending alone is a massive 6% of GDP per year.

This means that after just ~8 years, the US deficit will grow by HALF of the US GDP.

Since the debt ceiling crisis, the US has been borrowing ~$14 billion PER DAY to cover deficit spending.

By 2033, Bloomberg projects deficit spending will be ~7% of GDP.

The US is spending like we are in a recession while calling for a "soft landing."

How does this make any sense?

$SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$ $S&P 500 Index (.SPX.US)$ $Dow Jones Industrial Average (.DJI.US)$ $Nasdaq Composite Index (.IXIC.US)$

5

An economy is about the production of goods and services in a country. In a market economy, the goods and services are mostly produced by companies.

The stock market generally comprising the better companies in an economy. If the economy does well you would expect these companies to do well and vice versa.

Of course, in the short term the stock market is affected by market sentiments. But in the long run you would expect the stock market to reflect...

The stock market generally comprising the better companies in an economy. If the economy does well you would expect these companies to do well and vice versa.

Of course, in the short term the stock market is affected by market sentiments. But in the long run you would expect the stock market to reflect...

Morgan Stanley has cut China's growth forecast for this year on the back of property woes. It now sees China's gross domestic product (GDP) growing a very slow 4.7% this year, down from an earlier forecast of 5%.

On the other hand, Morgan Stanley expects the U.S. to grow rapidly by 1.6% this year.

$S&P 500 Index (.SPX.US)$ $Nasdaq Composite Index (.IXIC.US)$ $General Motors (GM.US)$ $Ford Motor (F.US)$ $BAYER MOTOREN WERK (BMWYY.US)$ $MERCEDES-BENZ GROUP AG (MBGAF.US)$ $Stellantis NV (STLA.US)$ $Rivian Automotive (RIVN.US)$ $Tesla (TSLA.US)$ $BYD COMPANY (01211.HK)$ $BYD Co. (BYDDF.US)$ $NIO Inc (NIO.US)$ $Li Auto (LI.US)$ $XPeng (XPEV.US)$ $AEM SGD (AWX.SG)$ $RH PetroGas (T13.SG)$ $Rex Intl (5WH.SG)$ $Geo Energy Res (RE4.SG)$ $EVERGRANDE (03333.HK)$ $COUNTRY GARDEN (02007.HK)$

On the other hand, Morgan Stanley expects the U.S. to grow rapidly by 1.6% this year.

$S&P 500 Index (.SPX.US)$ $Nasdaq Composite Index (.IXIC.US)$ $General Motors (GM.US)$ $Ford Motor (F.US)$ $BAYER MOTOREN WERK (BMWYY.US)$ $MERCEDES-BENZ GROUP AG (MBGAF.US)$ $Stellantis NV (STLA.US)$ $Rivian Automotive (RIVN.US)$ $Tesla (TSLA.US)$ $BYD COMPANY (01211.HK)$ $BYD Co. (BYDDF.US)$ $NIO Inc (NIO.US)$ $Li Auto (LI.US)$ $XPeng (XPEV.US)$ $AEM SGD (AWX.SG)$ $RH PetroGas (T13.SG)$ $Rex Intl (5WH.SG)$ $Geo Energy Res (RE4.SG)$ $EVERGRANDE (03333.HK)$ $COUNTRY GARDEN (02007.HK)$

4

4