Latest

Hot

$Cboe Interest Rate 10 Year T Note (.TNX.US)$

Interesting Fact: When bond price drop, bond yield increases

Looking at how 2y and 10y treasuries are moving, you might be wondering why are the yields rising when there is a good economic data?

The reason is because bond traders are selling their existing bonds (Example: 4% yield) and anticipating that the Fed will do another interest rate hike. If the Fed hikes, these bond traders will get a chance to buy a higher yield...

Interesting Fact: When bond price drop, bond yield increases

Looking at how 2y and 10y treasuries are moving, you might be wondering why are the yields rising when there is a good economic data?

The reason is because bond traders are selling their existing bonds (Example: 4% yield) and anticipating that the Fed will do another interest rate hike. If the Fed hikes, these bond traders will get a chance to buy a higher yield...

2

Columns Stocks & ETFs to watch for end of Qtr + 5 stocks that were upgraded including Volkswagen and Micron

What to watch and consider now

- This September, global markets have seen their biggest monthly pullback since December 2022, with the US benchmark index, the S&P500 down 4.2%, the Nasdaq 100 shed 5.2%, and Australia's benchmark index, the ASX200 is 3.6% lower (month to date). Stocks such as global chip maker giant, Nvidia are down 16%, Australia' s second biggest lithium company Allkem is down 17%...

- This September, global markets have seen their biggest monthly pullback since December 2022, with the US benchmark index, the S&P500 down 4.2%, the Nasdaq 100 shed 5.2%, and Australia's benchmark index, the ASX200 is 3.6% lower (month to date). Stocks such as global chip maker giant, Nvidia are down 16%, Australia' s second biggest lithium company Allkem is down 17%...

27

7

$YFI/USD (YFIUSD.CC)$

$BitNile Metaverse (BNMV.US)$

$Bitcoin Depot (BTM.US)$ $Bitcoin (BTC.CC)$

definitely don’t sleep on the first one is easily hitting that 10K again

$BitNile Metaverse (BNMV.US)$

$Bitcoin Depot (BTM.US)$ $Bitcoin (BTC.CC)$

definitely don’t sleep on the first one is easily hitting that 10K again

2

Welcome to follow me and communicate together~

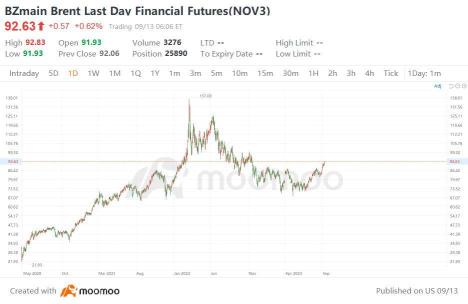

Similar to other asset prices, the price of oil is driven by the relationship between supply and demand. The supply side is primarily impacted by geopolitical factors, while the demand side is mainly driven by the economic performance of major economies.

By taking a historical perspective and examining the reasons for the significant decline in oil prices from 2014...

Similar to other asset prices, the price of oil is driven by the relationship between supply and demand. The supply side is primarily impacted by geopolitical factors, while the demand side is mainly driven by the economic performance of major economies.

By taking a historical perspective and examining the reasons for the significant decline in oil prices from 2014...

1

1

Tesla has received an upgrade from MS and looking to breakout of the flag pattern.Price has been holding above the 20ema daily running up to the upgrade.I will be targeting gap close at the $290 zone eventually while $242 holds.A bullish flag is a price action pattern that indicates a continuation of an uptrend. It consists of two parts: a pole and a flag. The pole is a sharp rise in price, and the flag is a period...

$Nasdaq Composite Index (.IXIC.US)$ Falling is the biggest test, and patience is often the prerequisite for obtaining excess returns. The golden pit is an excellent opportunity to buy at the bottom and build a position

Hola Mooers! ![]()

Here are 3 reasons why S&P 500 ( $S&P 500 Index (.SPX.US)$ ) and Nasdaq 100 ( $NASDAQ 100 Index (.NDX.US)$ ) stocks remains attractive.![]()

![]() 1. Right from the start of 2023, it was already mentioned that the US economy was stronger than reported (*1).

1. Right from the start of 2023, it was already mentioned that the US economy was stronger than reported (*1). ![]()

![]() 2. The second-quarter performance is so strong that it defies recession fears in the US economy (*2).

2. The second-quarter performance is so strong that it defies recession fears in the US economy (*2). ![]()

![]() 3. The US economy was so strong that it is now the strongest in the G7 (*3).

3. The US economy was so strong that it is now the strongest in the G7 (*3). ![]()

���������...

Here are 3 reasons why S&P 500 ( $S&P 500 Index (.SPX.US)$ ) and Nasdaq 100 ( $NASDAQ 100 Index (.NDX.US)$ ) stocks remains attractive.

���������...

14

We are expecting the both the CPI (Consumer Price Index) and Core CPI for August on 13 September 2023.

For July Consumer Price Index report, it showed that prices rose 3.2% year over year, a tick below the 3.3% forecast by economists, according to Dow Jones.

The 0.2% month-over-month change in prices was in line with estimates. Shelter inflation, which is seen by many economists as lagged data that will fall sharply in the coming mon...

For July Consumer Price Index report, it showed that prices rose 3.2% year over year, a tick below the 3.3% forecast by economists, according to Dow Jones.

The 0.2% month-over-month change in prices was in line with estimates. Shelter inflation, which is seen by many economists as lagged data that will fall sharply in the coming mon...

+3

1

$Alibaba (BABA.US)$

If you were able to catch my previous baba updates, then you would have had some great swing trade opportunities when BABA's price reached trending support. You can check out the last BABA update in the link below.

BABA is back at support on once again. Will we see another bounce off of this trending support level? The price action has rebounded a few times in the past at this imaginary line. If the price drops below this trending support level and makes...

If you were able to catch my previous baba updates, then you would have had some great swing trade opportunities when BABA's price reached trending support. You can check out the last BABA update in the link below.

BABA is back at support on once again. Will we see another bounce off of this trending support level? The price action has rebounded a few times in the past at this imaginary line. If the price drops below this trending support level and makes...

14

10

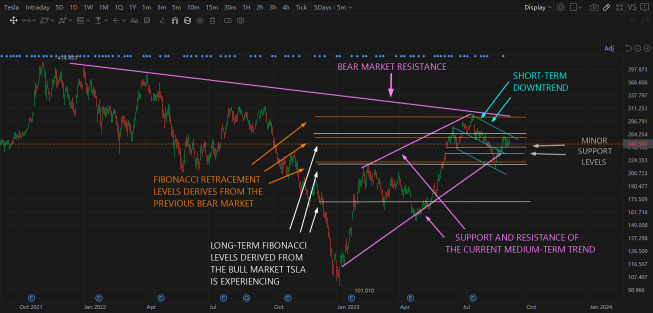

Tesla's share price is near an inflection point. There could possibly be a very good short-term trade opportunity next week.

$Tesla (TSLA.US)$

Tesla has been in a bear market since the beginning of 2022. So the long-term trend is down so far. In the medium term, since the beginning of this year, TSLA's share price has rallied over 100%. But the short-term trend has been downward for the past couple of months.

In the chart below, I have highlighted the su...

$Tesla (TSLA.US)$

Tesla has been in a bear market since the beginning of 2022. So the long-term trend is down so far. In the medium term, since the beginning of this year, TSLA's share price has rallied over 100%. But the short-term trend has been downward for the past couple of months.

In the chart below, I have highlighted the su...

+3

11

5

So far it is still moving upward. below 83$ would worry me

So far it is still moving upward. below 83$ would worry me