Latest

Hot

$RH PetroGas (T13.SG)$ $Rex Intl (5WH.SG)$ $Dyna-Mac (NO4.SG)$ $SIA (C6L.SG)$ $Crude Oil Futures(JAN5) (CLmain.US)$

Airfare hikes loom as crude oil price surge hits airline industry.

European airline passengers could soon face higher ticket prices as the cost of crude oil has surged to its highest level this year at USD95 per barrel, due to production and export cuts by Saudi Arabia and Russia. This development has already caused a decline in share prices for US airlines and prompted profit warnings, des...

Airfare hikes loom as crude oil price surge hits airline industry.

European airline passengers could soon face higher ticket prices as the cost of crude oil has surged to its highest level this year at USD95 per barrel, due to production and export cuts by Saudi Arabia and Russia. This development has already caused a decline in share prices for US airlines and prompted profit warnings, des...

4

We havent see a more than 1% decline in s&p500 for quite a long time already. Will we finally see it today?

$SPDR S&P 500 ETF (SPY.US)$ $S&P 500 Index (.SPX.US)$ $Vanguard S&P 500 ETF (VOO.US)$

$SPDR S&P 500 ETF (SPY.US)$ $S&P 500 Index (.SPX.US)$ $Vanguard S&P 500 ETF (VOO.US)$

From YouTube

2

1

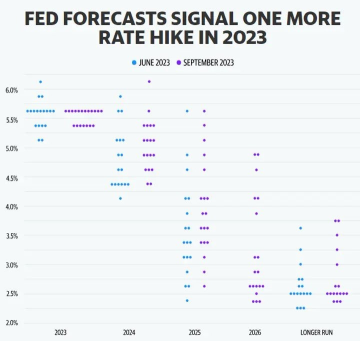

Whether a rate hike will occur again in 2023 is no longer the "core contradiction" in the current market. The key is to break the pattern of "maintaining at a higher level for a longer time", which is crucial for transitioning from rate hikes to rate cuts. This depends on when core inflation falls below the threshold of 3%. Specifically, the following incremental information from this meeting is particularly noteworthy:

Firstly, while retai...

Firstly, while retai...

3

The likes of Google, Apple, Nvida etc

![]()

![]()

![]()

$Invesco QQQ Trust (QQQ.US)$ $NVIDIA (NVDA.US)$ $Tesla (TSLA.US)$ $Apple (AAPL.US)$ $Amazon (AMZN.US)$ $Alphabet-A (GOOGL.US)$

$Invesco QQQ Trust (QQQ.US)$ $NVIDIA (NVDA.US)$ $Tesla (TSLA.US)$ $Apple (AAPL.US)$ $Amazon (AMZN.US)$ $Alphabet-A (GOOGL.US)$

From YouTube

3

I am wondering if the market is prematurely pricing in a rate cut?

CPI and PPI are still a little hot and sticky. Retail sales and spending still strong.

What if rate cut doesn’t come in till a year later?

$SPDR S&P 500 ETF (SPY.US)$ $Spenda Ltd (SPX.AU)$ $Activision Blizzard (ATVI.US)$ $Arm Holdings (ARM.US)$ $Tesla (TSLA.US)$ $Virtual Reality (LIST2139.US)$ $Microsoft (MSFT.US)$ $Advanced Micro Devices (AMD.US)$ $Taiwan Semiconductor (TSM.US)$ $Alphabet-A (GOOGL.US)$ $Amazon (AMZN.US)$ $Streaming Services (LIST2432.US)$ $Dow Jones Industrial Average (.DJI.US)$ $E-mini NASDAQ 100 Futures(DEC4) (NQmain.US)$ $SPDR Dow Jones Industrial Average Trust (DIA.US)$ $Meta Platforms (META.US)$ $ARK Innovation ETF (ARKK.US)$ $Spdr S&P Bank Etf (KBE.US)$ $Crude Oil Futures(JAN5) (CLmain.US)$ $E-mini Dow Futures(DEC4) (YMmain.US)$ $SPDR Portfolio S&P 500 ETF (SPLG.US)$ $ARK Genomic Revolution ETF (ARKG.US)$ $PayPal (PYPL.US)$ $Starbucks (SBUX.US)$ $Target (TGT.US)$ $Visa (V.US)$ $ProShares Ultra VIX Short-Term Futures ETF (UVXY.US)$ $NIO Inc (NIO.US)$

CPI and PPI are still a little hot and sticky. Retail sales and spending still strong.

What if rate cut doesn’t come in till a year later?

$SPDR S&P 500 ETF (SPY.US)$ $Spenda Ltd (SPX.AU)$ $Activision Blizzard (ATVI.US)$ $Arm Holdings (ARM.US)$ $Tesla (TSLA.US)$ $Virtual Reality (LIST2139.US)$ $Microsoft (MSFT.US)$ $Advanced Micro Devices (AMD.US)$ $Taiwan Semiconductor (TSM.US)$ $Alphabet-A (GOOGL.US)$ $Amazon (AMZN.US)$ $Streaming Services (LIST2432.US)$ $Dow Jones Industrial Average (.DJI.US)$ $E-mini NASDAQ 100 Futures(DEC4) (NQmain.US)$ $SPDR Dow Jones Industrial Average Trust (DIA.US)$ $Meta Platforms (META.US)$ $ARK Innovation ETF (ARKK.US)$ $Spdr S&P Bank Etf (KBE.US)$ $Crude Oil Futures(JAN5) (CLmain.US)$ $E-mini Dow Futures(DEC4) (YMmain.US)$ $SPDR Portfolio S&P 500 ETF (SPLG.US)$ $ARK Genomic Revolution ETF (ARKG.US)$ $PayPal (PYPL.US)$ $Starbucks (SBUX.US)$ $Target (TGT.US)$ $Visa (V.US)$ $ProShares Ultra VIX Short-Term Futures ETF (UVXY.US)$ $NIO Inc (NIO.US)$

From YouTube

4

4

Follow me on Moomoo to stay informed and connected!

With the recent surge in oil prices, the market is slowly beginning to accept the new logic of "long-term high interest rates replacing interest rate hikes".

The impact on the market is mainly reflected in:

1. The sharp rise in oil prices has caused the differentiation of exchange rate trends between oil-importing and exporting countries. The US dollar is strong, and non-US currencies are w...

With the recent surge in oil prices, the market is slowly beginning to accept the new logic of "long-term high interest rates replacing interest rate hikes".

The impact on the market is mainly reflected in:

1. The sharp rise in oil prices has caused the differentiation of exchange rate trends between oil-importing and exporting countries. The US dollar is strong, and non-US currencies are w...

4

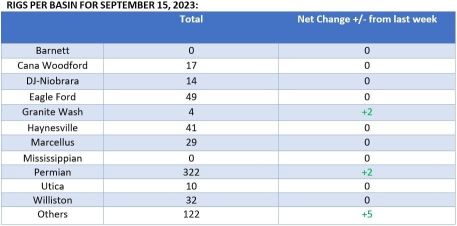

Oil prices continued to climb on Tuesday morning as the EIA predicted a continued slowdown in U.S. shale production, adding to concerns about a tightening oil market.

Chart of the Week

- Low inquiry levels stemming from Saudi Arabia’s production cuts, reoccurring congestion in China, and seasonally declining demand have driven freight rates to their lowest since May 2022.

- Losing steam after their November 2022 peaks, freight rates from West Af...

Chart of the Week

- Low inquiry levels stemming from Saudi Arabia’s production cuts, reoccurring congestion in China, and seasonally declining demand have driven freight rates to their lowest since May 2022.

- Losing steam after their November 2022 peaks, freight rates from West Af...

+2

9

Same old monthly story. US gov should do something better for it own country. Focus on citizen well fare, jobs and education etc. Do something good, not finding trouble around the world.

2

Strikes in the U.S. are hitting the economy at a level not seen in decades. 4.1 million labor hours were lost in August, the most in 23 years. Year to date, 7.4 million hours have been lost, compared with 636 hours for the same period last year. And more strikes could come. "If you're … not anticipating labor demands, you're not tethered to reality," Joseph Brusuelas, chief economist at RSM, said. $SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$ $S&P 500 Index (.SPX.US)$ $Nasdaq Composite Index (.IXIC.US)$ $Dow Jones Industrial Average (.DJI.US)$

1