Latest

Hot

Key Takeaway

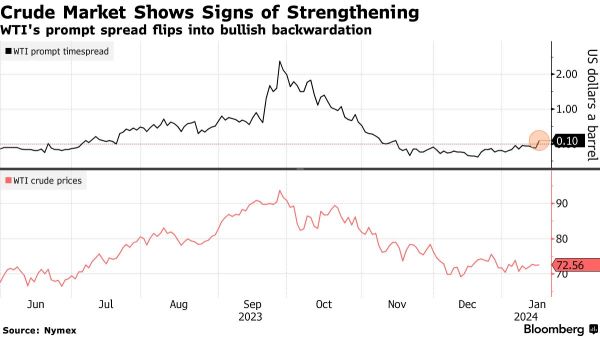

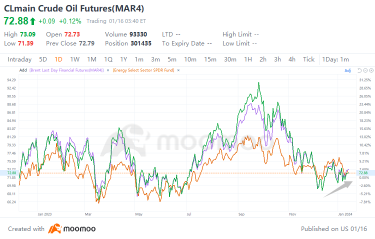

- Oil prices rise with WTI nearing $73 and Brent close to $78 as US strikes in Yemen escalate Middle East tensions, impacting trade routes.

- The oil market shows signs of tightening with WTI's prompt spread entering a bullish backwardation for the first time since November.

- American Petroleum Institute reports a slight increase in US crude inventories but a decrease at Cushing, signaling mixed supply conditions.

Middle Ea...

- Oil prices rise with WTI nearing $73 and Brent close to $78 as US strikes in Yemen escalate Middle East tensions, impacting trade routes.

- The oil market shows signs of tightening with WTI's prompt spread entering a bullish backwardation for the first time since November.

- American Petroleum Institute reports a slight increase in US crude inventories but a decrease at Cushing, signaling mixed supply conditions.

Middle Ea...

Although the S&P 500 is inches away from a new history high, a trader bought call options linked to the Cboe Volatility Index, positioned for a spike in stock market swings within the next month.

Volume in options on the $CBOE Volatility S&P 500 Index (.VIX.US)$, or the "Wall Street's fear gauge," are typically used to guard against stock market gyrations, saw the largest purchase of $16.8 million call options last Friday...

Volume in options on the $CBOE Volatility S&P 500 Index (.VIX.US)$, or the "Wall Street's fear gauge," are typically used to guard against stock market gyrations, saw the largest purchase of $16.8 million call options last Friday...

15

1

RECAP

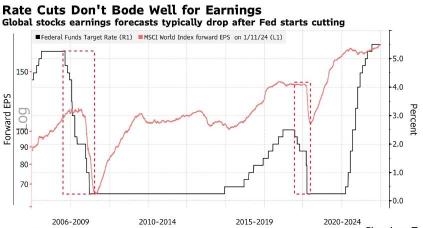

U.S. stocks traded lower on a cold Tuesday in Manhattan as investors weighed corporate earnings and Fed's Waller mid-day comments called interest rate cuts and inflation a chill situation, "no need to rush."

The $Dow Jones Industrial Average (.DJI.US)$ lost 231 points, or 0.62%, to 37,360. The $S&P 500 Index (.SPX.US)$ fell 17 points, or 0.37%, to 4,750. $Nasdaq Composite Index (.IXIC.US)$ lost 28 points, or 0.19%, to 14,944.

MAC...

U.S. stocks traded lower on a cold Tuesday in Manhattan as investors weighed corporate earnings and Fed's Waller mid-day comments called interest rate cuts and inflation a chill situation, "no need to rush."

The $Dow Jones Industrial Average (.DJI.US)$ lost 231 points, or 0.62%, to 37,360. The $S&P 500 Index (.SPX.US)$ fell 17 points, or 0.37%, to 4,750. $Nasdaq Composite Index (.IXIC.US)$ lost 28 points, or 0.19%, to 14,944.

MAC...

16

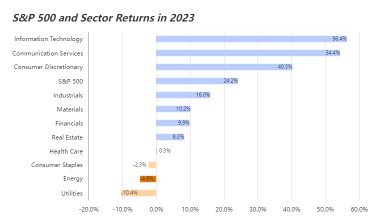

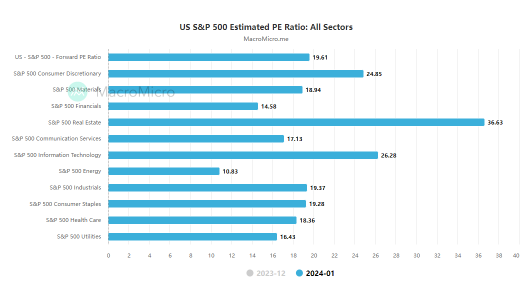

Energy stocks were among the worst-performing sectors in the US stock market last year. While the S&P 500 achieved a return of 24% in 2023, the energy sector fell by 4.8% for the whole year, second only to Utilities. However, analysts point out that the current valuation of energy stocks is at a "historical low" and their profitability is improving. The intensification of geopolitical risks in the Red Sea may push up oil prices in the short term, thus triggering a rebound in energy stocks that are struggling.

���������...

���������...

+1

23

$Tesla (TSLA.US)$

Escalation continues and Iran too strikes Israel “ Spy Headquarters “ in iraq.

Now everything seems not clear and thus it is too difficult to predict currently.

Escalation continues and Iran too strikes Israel “ Spy Headquarters “ in iraq.

Now everything seems not clear and thus it is too difficult to predict currently.

Natural Gas Has Already Ripped

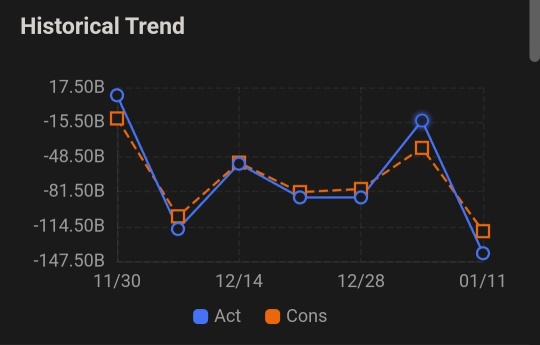

Recently, natural gas futures had a big rally. This was mostly due to the spat of severely cold weather that came unexpectedly and spread across the entire United States.

Economic data in the U.S. has shown that natural gas in storage has been dropping since the beginning of December. Based on the laws of supply and demand, this could have added upward pressure on the price of the commodity.

It should be noted that nat...

Recently, natural gas futures had a big rally. This was mostly due to the spat of severely cold weather that came unexpectedly and spread across the entire United States.

Economic data in the U.S. has shown that natural gas in storage has been dropping since the beginning of December. Based on the laws of supply and demand, this could have added upward pressure on the price of the commodity.

It should be noted that nat...

8

2

Barclays revises Brent crude price forecast for 2024, reducing it to $85 per barrel

An ICYMI (like I did!) from Barclays on their oil price forecasts for 2024:

Brent crude prices forecast for this year slashed by $8 to $85 per barrel

![]() primarily due to "a higher starting point for inventories and a potentially longer path to OPEC spare capacity normalization."

primarily due to "a higher starting point for inventories and a potentially longer path to OPEC spare capacity normalization."

![]() "inventories remain higher than expected and the chance remains that ...

"inventories remain higher than expected and the chance remains that ...

An ICYMI (like I did!) from Barclays on their oil price forecasts for 2024:

Brent crude prices forecast for this year slashed by $8 to $85 per barrel

This is a Bursa energy services company. My analysis shows that over the past decade, there was a 0.72 correlation between the Brent crude oil prices and T7 Global revenue for the next year. This meant that Brent crude prices for the year can explain for about half of T7 Global revenue for the coming year.

For the short term fundamental investor, this is must be a useful forward indicator. Unfortunately the average Brent crude oil prices in 2023 i...

For the short term fundamental investor, this is must be a useful forward indicator. Unfortunately the average Brent crude oil prices in 2023 i...

$RTX Corp (RTX.US)$

The unfortunate trajectory of what’s happening in the midddle east and new attack on U.S. military vessels, has now moved the needle from a defensive protection posture to a now, NEW and expected offensive cooordinated with The U.K. & U.S. Navy’s Rear Admiral confirmed that last night, …..War ships from both countries began firing offensive missiles in ...

The unfortunate trajectory of what’s happening in the midddle east and new attack on U.S. military vessels, has now moved the needle from a defensive protection posture to a now, NEW and expected offensive cooordinated with The U.K. & U.S. Navy’s Rear Admiral confirmed that last night, …..War ships from both countries began firing offensive missiles in ...

2