Latest

Hot

This article contains 750 words and takes about 2 minutes to read.

What's Happening in the Oil Market?

Recently, there has been renewed attention on the oil market due to Saudi Arabia's production cut measures in July. The country reduced its daily output to9 million barrels in response to concerns about a global economic slowdown leading to a decrease in oil prices. This has put pressure on international oil pri...

What's Happening in the Oil Market?

Recently, there has been renewed attention on the oil market due to Saudi Arabia's production cut measures in July. The country reduced its daily output to9 million barrels in response to concerns about a global economic slowdown leading to a decrease in oil prices. This has put pressure on international oil pri...

![[Insights for Oct] Oil Prices Hit New High, Is a November Fed Rate Hike a Certainty?](https://ussnsimg.moomoo.com/feed_image/77777025/ca625d6b001634aeba01bf60d54c0ac4.webp/bigjpg)

![[Insights for Oct] Oil Prices Hit New High, Is a November Fed Rate Hike a Certainty?](https://ussnsimg.moomoo.com/feed_image/77777025/0e6a7004db80313ab566bfe8952da936.webp/bigjpg)

![[Insights for Oct] Oil Prices Hit New High, Is a November Fed Rate Hike a Certainty?](https://ussnsimg.moomoo.com/feed_image/77777025/da060c8179023eb289b33338c9d354a7.webp/bigjpg)

33

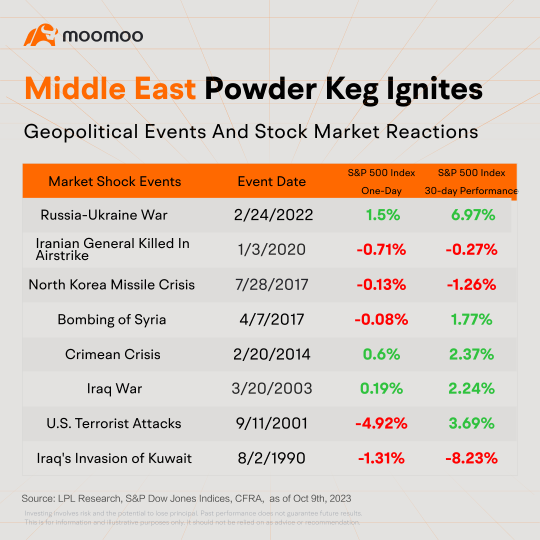

A new round of military conflict broke out between Israel and Palestine on the Oct 7th, with Hamas launching military action against Israel and Israeli forces launching multiple rounds of airstrikes on the Gaza Strip. The conflict is still ongoing, and its impact on the market will depend on its duration, intensity, and whether it spreads to other parts of the Middle East.

Agustin Carstens, General Manager...

Agustin Carstens, General Manager...

21

Iran has launched drones at Israel, will take hours to arrive: Israeli military

Oil prices will almost surely be affected. I would expect a gap up in price when futures markets open tomorrow. Expect gas price to jump as well. None of this will be good for inflation.

$Crude Oil Futures(JAN5) (CLmain.US)$ $Brent Last Day Financial Futures(JAN5) (BZmain.US)$ $RBOB Gasoline Futures(JAN5) (RBmain.US)$ $United States Oil Fund LP (USO.US)$ $United Sts Brent Oil Fd Lp Unit (BNO.US)$ $Direxion Daily S&P Oil & Gas Exp. & Prod. Bull 2X Shares (GUSH.US)$

���������...

Oil prices will almost surely be affected. I would expect a gap up in price when futures markets open tomorrow. Expect gas price to jump as well. None of this will be good for inflation.

$Crude Oil Futures(JAN5) (CLmain.US)$ $Brent Last Day Financial Futures(JAN5) (BZmain.US)$ $RBOB Gasoline Futures(JAN5) (RBmain.US)$ $United States Oil Fund LP (USO.US)$ $United Sts Brent Oil Fd Lp Unit (BNO.US)$ $Direxion Daily S&P Oil & Gas Exp. & Prod. Bull 2X Shares (GUSH.US)$

���������...

21

40

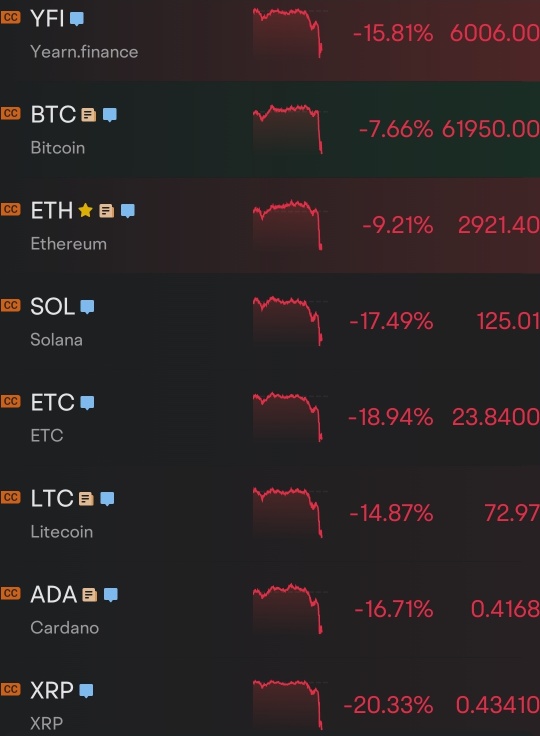

$Bitcoin (BTC.CC)$

Cryptos have been acting like safe haven assets ever since the Israeli-Hammas conflict started started. With the Isreali shekel collapsing, I am wondering if people are piling into Bitcoin just like they are into gold. Since the war started, gold and BTC have had relatively the same price action.

$E-mini S&P 500 Futures(DEC4) (ESmain.US)$ $E-mini Dow Futures(DEC4) (YMmain.US)$

Cryptos have been acting like safe haven assets ever since the Israeli-Hammas conflict started started. With the Isreali shekel collapsing, I am wondering if people are piling into Bitcoin just like they are into gold. Since the war started, gold and BTC have had relatively the same price action.

$E-mini S&P 500 Futures(DEC4) (ESmain.US)$ $E-mini Dow Futures(DEC4) (YMmain.US)$

2

Gold prices have risen nearly 5% in the last week and are approaching its all-time high of $2,074.88 per ounce as investors flock to the safe-haven asset with the conflict between Israel and Hamas escalating.

The price of gold reached its all-time high in August 2020 during the peak of the Covid-19 pandemic, which was another event that rattled markets and sent investors running for safe havens. This is typical of gold, which tends to pe...

The price of gold reached its all-time high in August 2020 during the peak of the Covid-19 pandemic, which was another event that rattled markets and sent investors running for safe havens. This is typical of gold, which tends to pe...

5

$HUB Cyber Security (HUBC.US)$ with everything going in gaza considering iran is fighting a proxy war from the different fronts northern and southern borders of israel its only natural this stock is going to ramp upward and IMO being that were hearing this is going to be a long generational conflict my bets are with israel. LOADING TIME

2

2

$Lockheed Martin (LMT.US)$

In my opinion, LMT might be a unique situation whereby earnings drop but stock price might not drop that much reasons being 1. dividend payout is high and will be given within this year 2. Everyone is aware current situation that this industry is in demand

In my opinion, LMT might be a unique situation whereby earnings drop but stock price might not drop that much reasons being 1. dividend payout is high and will be given within this year 2. Everyone is aware current situation that this industry is in demand

7

Despite the US budget impasse, Lockheed Martin anticipates sales growth this year, though significant lift from conflicts won't arrive until 2024 and beyond. The firm's order backlog ended the quarter at $156 billion, driven by various deals.

“Risk sentiment appears tentatively to be taking hold, but this could swiftly change as investors are still grappling with the complex dynamics of the Middle-East crisis and its potential repercussions on the global economy,” said Stephen Innes, managing partner at SPI Asset Management.

He noted that efforts to prevent a wider regional conflict in the Middle East from both the White House and other players could have contributed to a rally in financial markets, though such sentiment could chan...

He noted that efforts to prevent a wider regional conflict in the Middle East from both the White House and other players could have contributed to a rally in financial markets, though such sentiment could chan...

7