Latest

Hot

Bank of America's slower benefit realization from higher rates and steady maturing of its bond portfolio heralds promise for its future shares. The bank's unrealized loss on debt securities exceeds $130 billion.

Bond Holdings Become Less of a Burden at Bank of America and Other Big Banks -- Heard on the Street -- WSJ

Bond Holdings Become Less of a Burden at Bank of America and Other Big Banks -- Heard on the Street -- WSJ$Invesco QQQ Trust (QQQ.US)$ $SPDR S&P 500 ETF (SPY.US)$

1) every year US GOVT will sell 2 + trillin worth of bonds to fund their deficits

2) china selling slow and steady

3) FED doing QT

4) BRICS selling bonds as well

5) Japan selling bonds as well to save its currency.

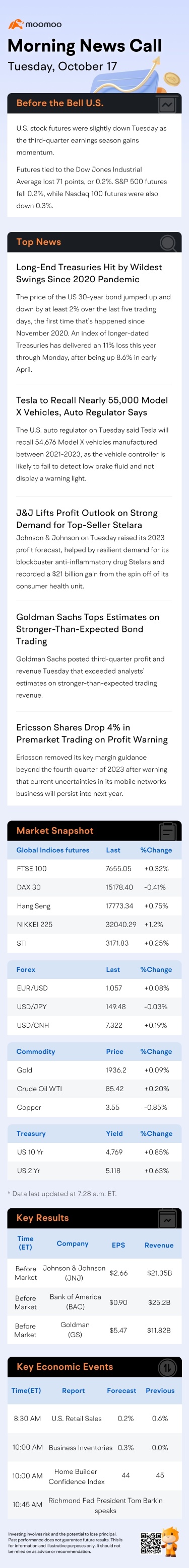

till now---2.3 trillin that is sit in reverse repo, i think that money mostly went to Bonds....

in less than 5 months....reverse repo drained from 2.4 trillin to 1.1 trillion

i dont know if its gone to long vs short dated bo...

1) every year US GOVT will sell 2 + trillin worth of bonds to fund their deficits

2) china selling slow and steady

3) FED doing QT

4) BRICS selling bonds as well

5) Japan selling bonds as well to save its currency.

till now---2.3 trillin that is sit in reverse repo, i think that money mostly went to Bonds....

in less than 5 months....reverse repo drained from 2.4 trillin to 1.1 trillion

i dont know if its gone to long vs short dated bo...

2

1

BlackRock predicts fluctuating long-term Treasury yields reflecting increased skepticism about investment-grade credit. They foresee potential 10-year yields at 5% or higher, suggesting substantial inflation and fiscal pressure.

As per John McClain from Brandywine Global Investment Management, rising costs will impact companies six to 12 months from now. Given the high US corporate bankruptcy rates and slowing economy, many companies may struggle under a 5% federal funds rate.

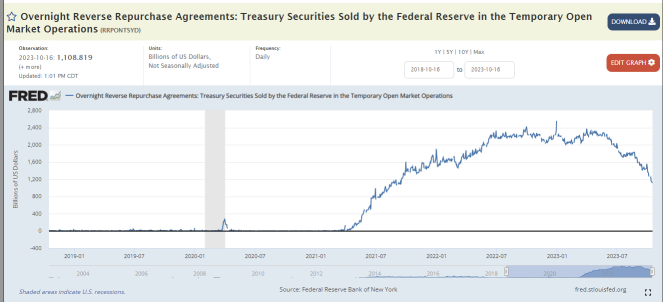

For those keeping track, US debt just jumped by another $40 billion in one day.

We are now at $33.55 trillion in Federal debt, just 25 days after it hit a record $33 trillion.

At the current pace, the US would add $1 trillion in Federal debt every 45 days.

Since 2008, the US has added $24 trillion in Federal debt, rising to 3.8x what it was in January 2008.

Total US debt is now officially up more than $2 trillion since the debt ceiling crisis "ended."

But, under the new bill, the debt ceili...

We are now at $33.55 trillion in Federal debt, just 25 days after it hit a record $33 trillion.

At the current pace, the US would add $1 trillion in Federal debt every 45 days.

Since 2008, the US has added $24 trillion in Federal debt, rising to 3.8x what it was in January 2008.

Total US debt is now officially up more than $2 trillion since the debt ceiling crisis "ended."

But, under the new bill, the debt ceili...

2

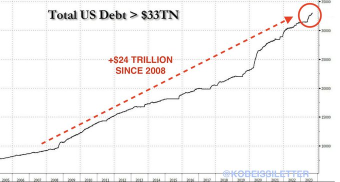

G'day, mooers! Check out the latest news on today's stock market!

• S&P 500 lower + Yields spike as US inflation holds at 3.7%

• ASX drops after hot US CPI

• Stocks to watch: Pact Group, Perpetual, Harvey Norman

- Moomoo News AU

Wall Street Summary

Major stock indexes fell Thursday, snapping a four-day winning streak, after fresh data showed inflation remains a concern.

Data Thursday showed recent progress in lowering inf...

• S&P 500 lower + Yields spike as US inflation holds at 3.7%

• ASX drops after hot US CPI

• Stocks to watch: Pact Group, Perpetual, Harvey Norman

- Moomoo News AU

Wall Street Summary

Major stock indexes fell Thursday, snapping a four-day winning streak, after fresh data showed inflation remains a concern.

Data Thursday showed recent progress in lowering inf...

3

Persistent inflation and US economic strength, not Fed officials, are believed to fuel the recent surge in long-term Treasury yields, hinting at a potential need for another interest rate hike.

$E-mini NASDAQ 100 Futures(DEC4) (NQmain.US)$

$U.S. 10-Year Treasury Notes Yield (US10Y.BD)$

$30-Year Yield Futures(NOV4) (30Ymain.US)$

keep eyes on 5.012 on the 30y and 4.887 on the 10y.

for those wondering what is the next resistance level for the bond yields i will show you this:

$U.S. 10-Year Treasury Notes Yield (US10Y.BD)$

$30-Year Yield Futures(NOV4) (30Ymain.US)$

keep eyes on 5.012 on the 30y and 4.887 on the 10y.

for those wondering what is the next resistance level for the bond yields i will show you this:

1

$30-Year Yield Futures(NOV4) (30Ymain.US)$

$U.S. 10-Year Treasury Notes Yield (US10Y.BD)$

$E-mini NASDAQ 100 Futures(DEC4) (NQmain.US)$

for those wondering why we dropped. these are new bond auction. what do you think will happen to existing bond that is at a way lower rate? and a particular moron was telling me 5% interest rates will not affect the stock market. lol.

for those that don't understand the bond market. let me put in plain simple English. the bond market collapse, you and I hold...

$U.S. 10-Year Treasury Notes Yield (US10Y.BD)$

$E-mini NASDAQ 100 Futures(DEC4) (NQmain.US)$

for those wondering why we dropped. these are new bond auction. what do you think will happen to existing bond that is at a way lower rate? and a particular moron was telling me 5% interest rates will not affect the stock market. lol.

for those that don't understand the bond market. let me put in plain simple English. the bond market collapse, you and I hold...

3

2