Latest

Hot

🇺🇸 US CPI Report:

📈 CPI: +0.4% (Sep vs. Aug) & +3.7% (YoY) 📊

🔮 Economists Missed Projections! 🔍

📉 Core Inflation: +0.3% (Sep) & +4.1% (YoY) ✅

📈 PPI Surpasses Expectations! 💹

📈 Chance of Dec. Rate Hike: ↑ 28% ➡ 38%

🏦 Market Still Sees No Rate Change - Oct 31 to Nov 1 $Nasdaq Composite Index (.IXIC.US)$ $Dow Jones Industrial Average (.DJI.US)$ $S&P 500 Index (.SPX.US)$ $SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$

📈 CPI: +0.4% (Sep vs. Aug) & +3.7% (YoY) 📊

🔮 Economists Missed Projections! 🔍

📉 Core Inflation: +0.3% (Sep) & +4.1% (YoY) ✅

📈 PPI Surpasses Expectations! 💹

📈 Chance of Dec. Rate Hike: ↑ 28% ➡ 38%

🏦 Market Still Sees No Rate Change - Oct 31 to Nov 1 $Nasdaq Composite Index (.IXIC.US)$ $Dow Jones Industrial Average (.DJI.US)$ $S&P 500 Index (.SPX.US)$ $SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$

6

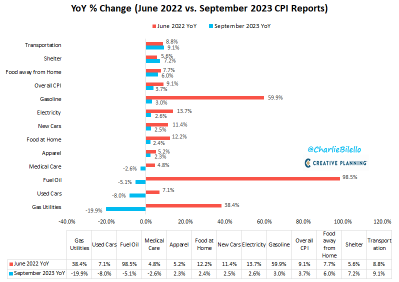

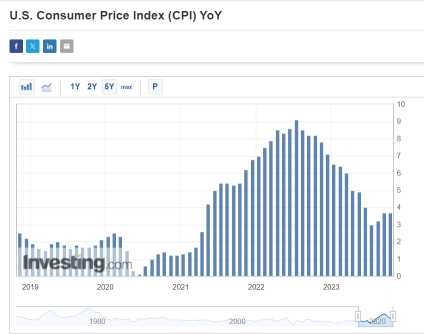

US CPI has moved down from a peak of 9.1% in June 2022 to 3.7% today.

What's driving that decline? Lower rates of inflation in Gas Utilities, Used Cars, Fuel Oil, Medical Care, Apparel, Food at Home, New Cars, Electricity, Gasoline, and Food away from Home.

Shelter and Transportation are the only major components that have a higher inflation rate today than June 2022.

$Invesco QQQ Trust (QQQ.US)$ $SPDR S&P 500 ETF (SPY.US)$ $S&P 500 Index (.SPX.US)$ $Dow Jones Industrial Average (.DJI.US)$ $Nasdaq Composite Index (.IXIC.US)$

What's driving that decline? Lower rates of inflation in Gas Utilities, Used Cars, Fuel Oil, Medical Care, Apparel, Food at Home, New Cars, Electricity, Gasoline, and Food away from Home.

Shelter and Transportation are the only major components that have a higher inflation rate today than June 2022.

$Invesco QQQ Trust (QQQ.US)$ $SPDR S&P 500 ETF (SPY.US)$ $S&P 500 Index (.SPX.US)$ $Dow Jones Industrial Average (.DJI.US)$ $Nasdaq Composite Index (.IXIC.US)$

2

Key Takeaway: Sticky and persistent in...

3

Good morning mooers! Here are things you need to know about today's market:

●US stocks drop,ending winning streak after inflation data

●Oil price to remain elevated in the medium term

●Industrial production in focus

●Targeted subsidies to assist Malaysia's fiscal reformation, says economist

●SSF Home Makes Flat Debut on ACE Market

●Stocks to watch: IJM, Capital A

-moomoo News MY

Wall Street Summary

Major stock indexes fell Thursday...

●US stocks drop,ending winning streak after inflation data

●Oil price to remain elevated in the medium term

●Industrial production in focus

●Targeted subsidies to assist Malaysia's fiscal reformation, says economist

●SSF Home Makes Flat Debut on ACE Market

●Stocks to watch: IJM, Capital A

-moomoo News MY

Wall Street Summary

Major stock indexes fell Thursday...

6

Benoit Anne and Venkat Balakrishnan express persistent inflation concerns, amidst rising Treasury yields weighing on stocks. Gene Goldman expects improvement in corporate earnings and economy resilience.

The article revealed that minutes from the Fed's September meeting, released Wednesday, reflected divisions within the rate-setting Federal Open Market Committee. The meeting concluded with the committee opting not to raise interest rates, but the summary showed lingering concern about inflation and worries that upside risks remain.

There's still fear that Fed may raise interest rate sooner than expected.

Quote:

The consumer price index, ...

There's still fear that Fed may raise interest rate sooner than expected.

Quote:

The consumer price index, ...

Umm, did the stock market just crash? lol. Nah, people are selling all around the board and I think because the report on persistent inflation. Any thoughts?

Increasing inflation and high interest rates present financing difficulties for U.S. corporate borrowers. Higher proportions of lower-rated issuers and distressed companies pose significant default risk. Meanwhile, potential danger is rising in the investment-grade segment, but these firms are predicted to maintain market access and absorb higher interest costs.

FARAMARZ AKBARY OP :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)