Latest

Hot

What's happening in markets: US earnings season is at the half-way mark; eyes on Apple, EVs, the Bitcoin proxy & Macquarie

- So far we've seen the strongest US earnings in a year. This week 150 S&P 500 companies are due to report with all eyes on Apple's $Apple (AAPL.US)$ results on Thursday and its outlook, particularly in China. Overall, Apple's earnings a...

- So far we've seen the strongest US earnings in a year. This week 150 S&P 500 companies are due to report with all eyes on Apple's $Apple (AAPL.US)$ results on Thursday and its outlook, particularly in China. Overall, Apple's earnings a...

33

1

___________________________________________________

Markets are playing a balancing act and tug of war. Here is what to watch and consider

On one side of markets, good news is good. Or is it?

1- The market will likely be contending with a round of hotter-than-expected economic news. This week's release of Aussie CPI and US GDP data will test if stronger economic data will p...

Markets are playing a balancing act and tug of war. Here is what to watch and consider

On one side of markets, good news is good. Or is it?

1- The market will likely be contending with a round of hotter-than-expected economic news. This week's release of Aussie CPI and US GDP data will test if stronger economic data will p...

27

2

$WeWork (WE.US)$ plans to file for bankruptcy as early as next week as it struggles with a massive debt pile and significant losses, reported by the Wall Street Journal on Tuesday.

From a $47 billion private market valuation to a $9 billion IPO via a SPAC in 2021, and now trading at $1.22 a share, marking a 99% drop from its IPO price.

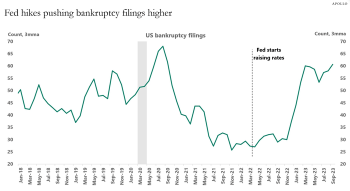

Bankruptcies are surging

The number of bankruptcy filings in t...

From a $47 billion private market valuation to a $9 billion IPO via a SPAC in 2021, and now trading at $1.22 a share, marking a 99% drop from its IPO price.

Bankruptcies are surging

The number of bankruptcy filings in t...

23

3

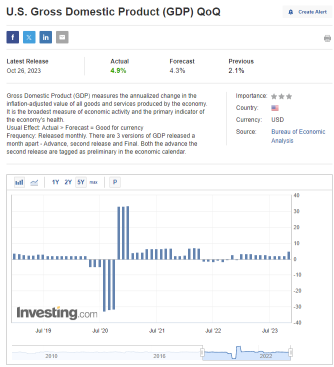

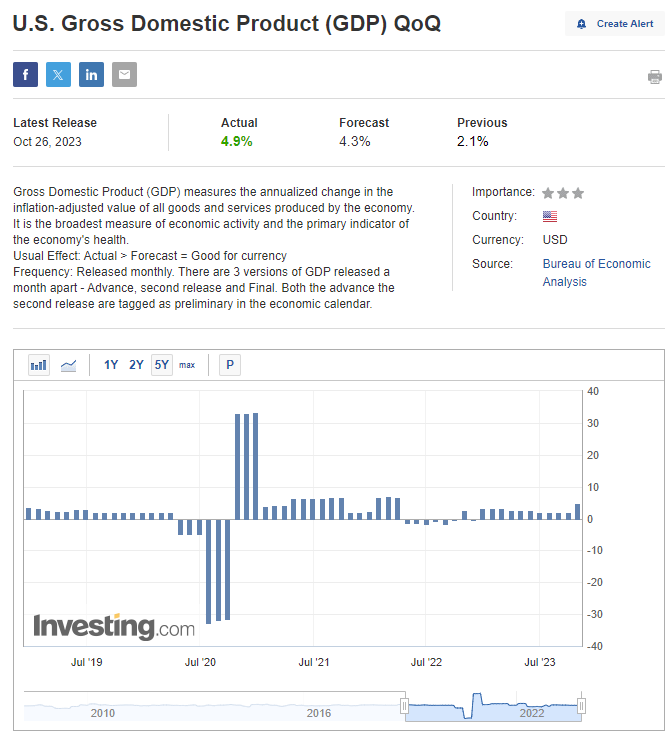

Today, the Bureau of Economic Analysisreleased updated GDP figures for Q3. The quarterly GDP is released every month throughout a quarter, becoming more accurate each release.

For example, Q2 started at 2.4% growth, then lowered as the summe went on to 2.1%.

We started this quarter there, and exploded upwards. If the high growth leads to price inflation, investors are worried the Fed may introduce further rate hikes.

Q:

Are you Bearish t...

For example, Q2 started at 2.4% growth, then lowered as the summe went on to 2.1%.

We started this quarter there, and exploded upwards. If the high growth leads to price inflation, investors are worried the Fed may introduce further rate hikes.

Q:

Are you Bearish t...

21

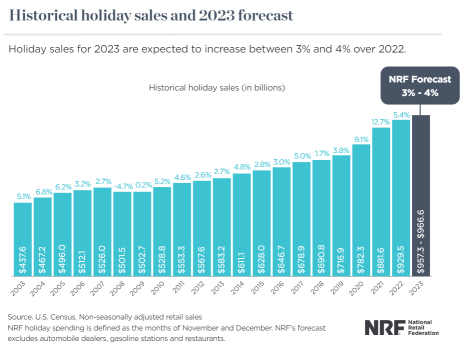

At 2 p.m. EDT on November 1st, the Federal Reserve will make the interest rate decision at the FOMC meeting. The Fed is widely expected to leave interest rates unchanged. Fed officials appear content to let higher long-term yields serve as a substitute for further rate hikes.

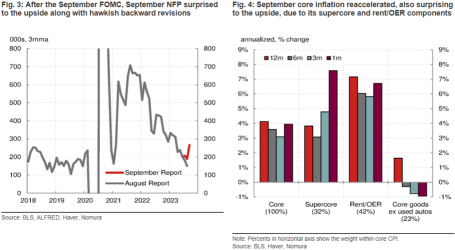

■ Developments since the September FOMC meeting

Data since the September meeting shows surprising strength in growth and inflation. Job ...

■ Developments since the September FOMC meeting

Data since the September meeting shows surprising strength in growth and inflation. Job ...

+1

20

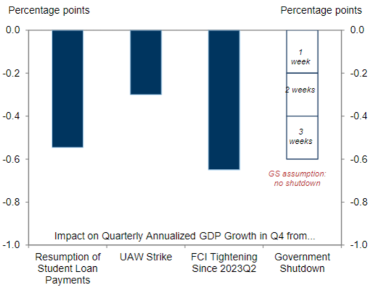

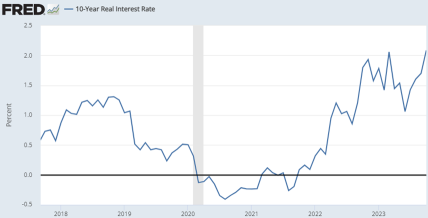

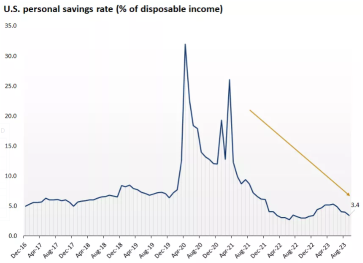

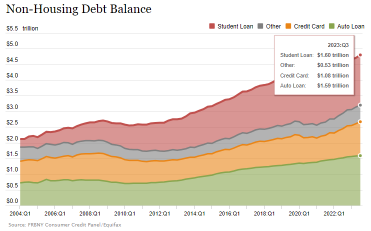

The U.S. economy has displayed remarkable resilience throughout the first three quarters of 2023, driven by strong consumer spending which comprises about 70% of U.S. GDP.

However, as the holiday shopping season is near, there are concerns about whether consumers can maintain their robust spending levels.

U.S. holiday sales in 2023 are expected to rise at the slowest pace in five years, data from the National Ret...

However, as the holiday shopping season is near, there are concerns about whether consumers can maintain their robust spending levels.

U.S. holiday sales in 2023 are expected to rise at the slowest pace in five years, data from the National Ret...

+2

16

1

Market Macro: How does higher-than-expected GDP growth affect the stock market?

On Thursday, October 26th, the US GDP for Q3 surpassed expectations with a YoY growth rate of 4.9%, exceeding the previous value of 2.1% and the market's anticipated 4.5%. This marks the fastest growth in two years. So, how will the GDP growth rate affect the stock market going forward?

Currently, the market is c...

On Thursday, October 26th, the US GDP for Q3 surpassed expectations with a YoY growth rate of 4.9%, exceeding the previous value of 2.1% and the market's anticipated 4.5%. This marks the fastest growth in two years. So, how will the GDP growth rate affect the stock market going forward?

Currently, the market is c...

+3

11

2

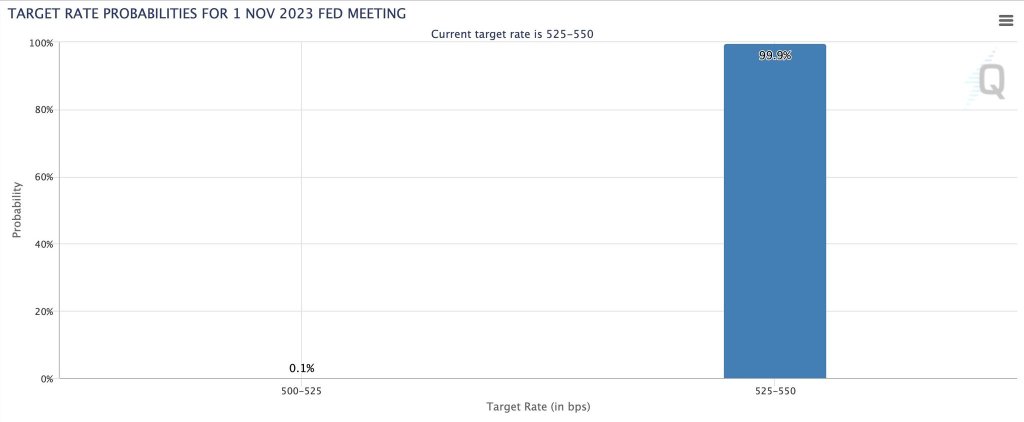

FOMC going to be extra spooky this week. 👻

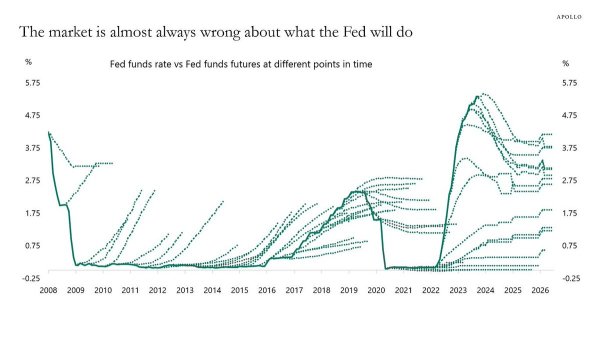

Here's a chart showing market expectations about where interest rates will go at different points in time.

Currently, rate CUTS are expected to begin in June 2024 with a 36% chance of another HIKE ahead.

Next FOMC rate hike probabilities:

No hike → 99.9%

25 bps cut → 0.1%

Economists say the Fed will likely leave interest rates alone when its next rate-setting meeting concludes on Nov. 1, so Fed Chair Jerome Powell & Co. can keep asses...

Here's a chart showing market expectations about where interest rates will go at different points in time.

Currently, rate CUTS are expected to begin in June 2024 with a 36% chance of another HIKE ahead.

Next FOMC rate hike probabilities:

No hike → 99.9%

25 bps cut → 0.1%

Economists say the Fed will likely leave interest rates alone when its next rate-setting meeting concludes on Nov. 1, so Fed Chair Jerome Powell & Co. can keep asses...

12

All you hear are Bears saying there will be a recession soon! But GDP was 4.9%. Where is the negative GDP?

Here’s the thing. The recession already happened. It’s not something they want to say, but it’s true. We’re at the tail end of the recession going into a bull market. We had 2 negative GDP quarters last year. That was the recession. The data is sitting right in front of your eyes, but you refuse to believe it.

2024-2025 will be fu...

Here’s the thing. The recession already happened. It’s not something they want to say, but it’s true. We’re at the tail end of the recession going into a bull market. We had 2 negative GDP quarters last year. That was the recession. The data is sitting right in front of your eyes, but you refuse to believe it.

2024-2025 will be fu...

4

4

$E-mini NASDAQ 100 Futures(DEC4) (NQmain.US)$ all eyes on yield. if GDP hit near 4.7% or anything positive. you watch those yields explode at higher. how much? here you go:

+2

2

16

Moon fairy 大炮仙 ❤ :