Latest

Hot

1

The number of people working MULTIPLE jobs in the US hit a near-record of 8.4 MILLION in May 2024.

That's a jump of 3 MILLION people since the pandemic low in 2020. This probably explains why part-time employment is skyrocketing, up +286,000 in May. All while full-time employment fell by -625,000 over the last month.

The reality is that many Americans are struggling and working multiple jobs to "fight" inflatiion

$Vanguard S&P 500 ETF (VOO.US)$ $SPDR S&P 500 ETF (SPY.US)$ $iShares Core S&P 500 ETF (IVV.US)$ $Meta Platforms (META.US)$ $Amazon (AMZN.US)$ $Alphabet-C (GOOG.US)$ $NVIDIA (NVDA.US)$ $Tesla (TSLA.US)$

That's a jump of 3 MILLION people since the pandemic low in 2020. This probably explains why part-time employment is skyrocketing, up +286,000 in May. All while full-time employment fell by -625,000 over the last month.

The reality is that many Americans are struggling and working multiple jobs to "fight" inflatiion

$Vanguard S&P 500 ETF (VOO.US)$ $SPDR S&P 500 ETF (SPY.US)$ $iShares Core S&P 500 ETF (IVV.US)$ $Meta Platforms (META.US)$ $Amazon (AMZN.US)$ $Alphabet-C (GOOG.US)$ $NVIDIA (NVDA.US)$ $Tesla (TSLA.US)$

7

1

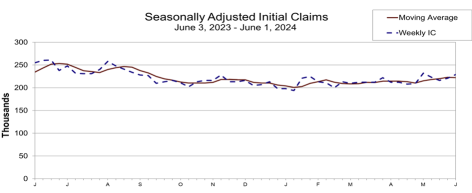

U.S. unemployment claims in the week ended June 1 remained below last year's level even amid a slight uptick, data from the Department of Labor showed Thursday morning.

Seasonally adjusted initial jobless claims rose 8,000 to 229,000 from the previous week's upwardly revised level. That compares with 255,000 claims filed in the same week a year ago, the Labor Department said in a press release.

The data came days after th...

Seasonally adjusted initial jobless claims rose 8,000 to 229,000 from the previous week's upwardly revised level. That compares with 255,000 claims filed in the same week a year ago, the Labor Department said in a press release.

The data came days after th...

3

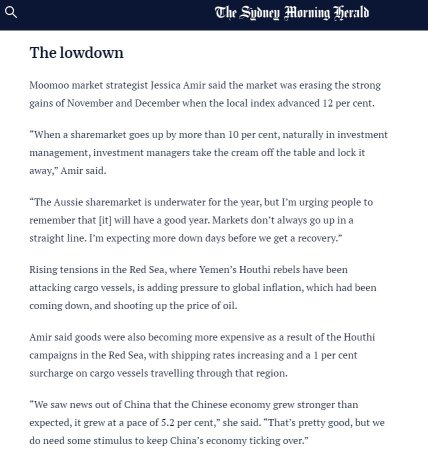

We are starting to see expectations for Fed rate cuts be kicked down the road

- Strong retail spending sales overnight saw the expectations for the Fed rate cut in March to be dropped to a 50% chance of a cut.

- Plus are seeing Fed speakers also say the Fed still needs to be cautionary

- I think that's because SOME inflation is creeping up – Plus we do have strong US eco news - Retails sales and Fed'beige book (another eco read)...

- Strong retail spending sales overnight saw the expectations for the Fed rate cut in March to be dropped to a 50% chance of a cut.

- Plus are seeing Fed speakers also say the Fed still needs to be cautionary

- I think that's because SOME inflation is creeping up – Plus we do have strong US eco news - Retails sales and Fed'beige book (another eco read)...

+2

5

1

👉🏻 US payrolls rose 199,000 in Nov

👉🏻 Unemployement rate falls to 3.7%

👉🏻 Unemployement rate falls to 3.7%

3

Hospital PMI shows slower growth in Oct w/ all indicators moving lower and employment index slipping into contraction territory; the subsector's margins have been severely squeezed by rising costs, despite overall strong performance post-covid:

1

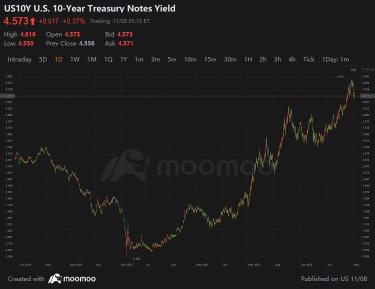

If the ten-year U.S. Treasury yield, the anchor of global asset pricing, declines, will the tide of biomedicine rise again?

Early biotechnology cannot support itself and relies heavily on external capital for blood transfusions. When the 10-year U.S. bond yield, the anchor of global asset pricing, rises to about 5%, it means that the risk-free rate of return reaches about 5%, and you can make money while si...

Early biotechnology cannot support itself and relies heavily on external capital for blood transfusions. When the 10-year U.S. bond yield, the anchor of global asset pricing, rises to about 5%, it means that the risk-free rate of return reaches about 5%, and you can make money while si...

1

The recent volatility in the U.S. 10-year Treasury yield has been significant, but the overall trend is expected to be a volatile downward trend. It is almost certain that this round of interest rate hikes is coming to an end, so preparing ahead and reviewing historical experience can help to be prepared for any situation.

By analyzing the experience of several interest rate hike cycles ending in the past few decades, some general ru...

By analyzing the experience of several interest rate hike cycles ending in the past few decades, some general ru...

25

5

The economy is great, why are people ''feeling'' so poor?

Well - how is this for a feeling?

Since April 2020:

1) Inflation up a cumulative 20%

2) But median wages up only 12%

3) Monthly mortgage installments to buy the median house: up from $1000 to $2300 (!) $Invesco QQQ Trust (QQQ.US)$ $SPDR S&P 500 ETF (SPY.US)$

Well - how is this for a feeling?

Since April 2020:

1) Inflation up a cumulative 20%

2) But median wages up only 12%

3) Monthly mortgage installments to buy the median house: up from $1000 to $2300 (!) $Invesco QQQ Trust (QQQ.US)$ $SPDR S&P 500 ETF (SPY.US)$

1

US economy added fewer jobs than expected. Unemployment came in higher than expected. Wage growth was slower than expected.

All these are considered bad news. But to the stock market, they are good news.

It’s the classic bad news is good news scenario, as the “bad news” give the Fed some room to scale back on their rate hike campaign.

But something to caution - the bad news cannot go too bad. Else the market may tank. Strange? But that’s how the market works

$SPDR S&P 500 ETF (SPY.US)$ $S&P 500 Index (.SPX.US)$ $Tesla (TSLA.US)$ $Apple (AAPL.US)$ $Invesco QQQ Trust (QQQ.US)$ $NVIDIA (NVDA.US)$ $Amazon (AMZN.US)$ $Arm Holdings (ARM.US)$ $McDonald's (MCD.US)$ $Starbucks (SBUX.US)$ $PayPal (PYPL.US)$ $Meta Platforms (META.US)$ $Palantir (PLTR.US)$ $Sea (SE.US)$

All these are considered bad news. But to the stock market, they are good news.

It’s the classic bad news is good news scenario, as the “bad news” give the Fed some room to scale back on their rate hike campaign.

But something to caution - the bad news cannot go too bad. Else the market may tank. Strange? But that’s how the market works

$SPDR S&P 500 ETF (SPY.US)$ $S&P 500 Index (.SPX.US)$ $Tesla (TSLA.US)$ $Apple (AAPL.US)$ $Invesco QQQ Trust (QQQ.US)$ $NVIDIA (NVDA.US)$ $Amazon (AMZN.US)$ $Arm Holdings (ARM.US)$ $McDonald's (MCD.US)$ $Starbucks (SBUX.US)$ $PayPal (PYPL.US)$ $Meta Platforms (META.US)$ $Palantir (PLTR.US)$ $Sea (SE.US)$

From YouTube

8

1