Latest

Hot

$SPDR S&P 500 ETF (SPY.US)$

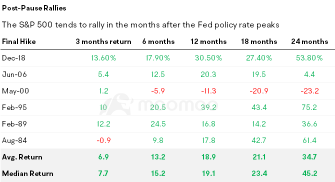

This is the movement of SPY before the first rate cut. Since 1980, all 4 flattening of fed funds rate pointed to a rise in SPX. So far, the rate cut cycle this round seems to exhibit the same pattern.

This is the movement of SPY before the first rate cut. Since 1980, all 4 flattening of fed funds rate pointed to a rise in SPX. So far, the rate cut cycle this round seems to exhibit the same pattern.

+1

3

1

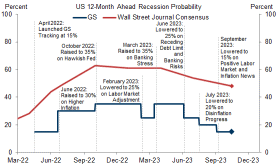

A benign U.S. inflation report for October is bolstering hopes that the Federal Reserve can bring down consumer prices without negatively impacting the economy, a so-called Goldilocks environment that investors believe will benefit stocks and bonds.

Both asset classes have ripped higher in November, fueled by hopes that the Fed was unlikely to increase interest rates any further.

Goldilocks hopes return to Wall St...

Both asset classes have ripped higher in November, fueled by hopes that the Fed was unlikely to increase interest rates any further.

Goldilocks hopes return to Wall St...

11

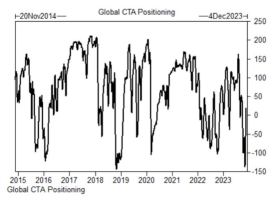

Global Equities Record Buying 🚨: CTAs purchased $153 billion of global equities over the last 10 days, the highest amount ever recorded. Santa came early this year 🎅

$SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$

$SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$

2

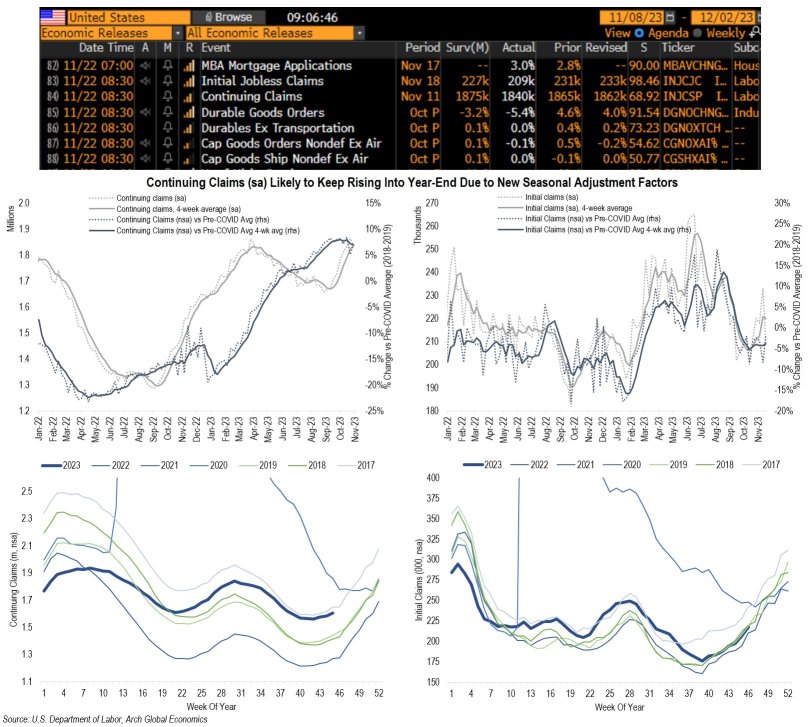

It's starting to become a wild ride in the claims data and most Wall Street economists still haven't caught on for some reason.

Both initial and continuing claims printed well below expectations and below even the lowest economist forecast.

However, both measures of claims were a bit above the breakeven figures I shared last week, implying a modest deterioration in the labor market or more likely due to noise given the holiday distortions.

Next w...

Both initial and continuing claims printed well below expectations and below even the lowest economist forecast.

However, both measures of claims were a bit above the breakeven figures I shared last week, implying a modest deterioration in the labor market or more likely due to noise given the holiday distortions.

Next w...

6

With high borrowing costs and potential stagnation of interest rates until 2024, the industrial sector is unlikely to see a significant rebound soon. This is due to suppressed consumer demand and discouraged business investment due to higher costs.

The $S&P 500 Index (.SPX.US)$ Technology Index is climbing 12.6% in November to lead the 11 main industry sectors that make up the benchmark index. S&P 500 Communications Services is gaining 10.1% in November, followed by Consumer Discretionary (9.8%), Real Estate (8.8%) and Financials (8.4%), all of which are beating the broader S&P 500's 8.2% advance.

Underperforming sectors are S&P 500 Industrials, up 7.4%, S&P 500 Mater...

Underperforming sectors are S&P 500 Industrials, up 7.4%, S&P 500 Mater...

4

David Kostin, a strategist at Goldman Sachs, recommends looking for tactical opportunities with cyclicals that are pricing greater recession risk than the Goldman Sachs baseline. He identifies these cyclicals as promising investment targets if economic data outperform predictions.

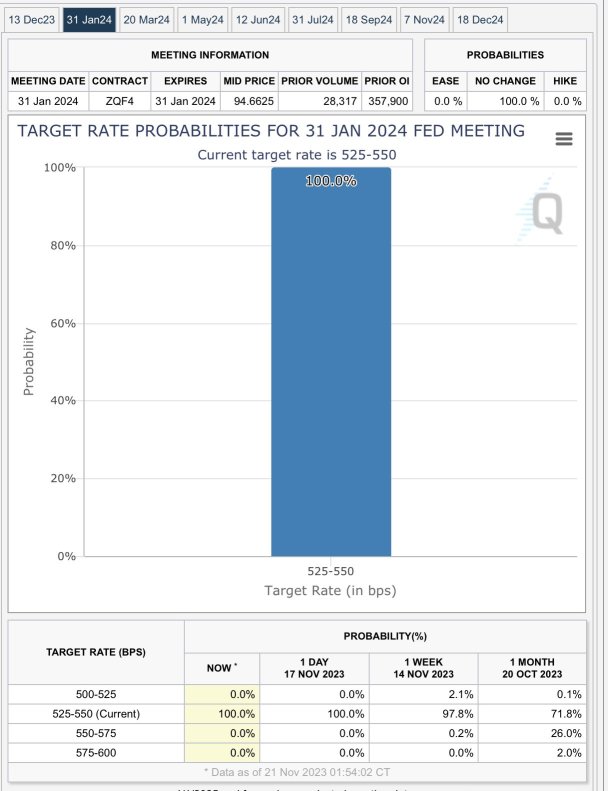

CME Fed futures are now pricing in a 100% probability that the Fed pauses at the next twoFOMCmeetings. I mean it’s probably accurate but I’m sure Powell isn’t happy the market is so confident. Stocks are ripping as a result and this is doing nothing to slow inflation. $SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$ $S&P 500 Index (.SPX.US)$ $Nasdaq Composite Index (.IXIC.US)$ $Dow Jones Industrial Average (.DJI.US)$

1

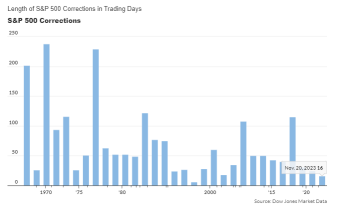

The almost vertical rally in the S&P 500 is the second shortest length of time since 1960! Wowza.

If the S&P 500 was a train:

In one hand you are thinking “wow, the train has actually left the station”— then you wonder if the train is going to hold up at this speed. 🚊

Navigating the last two years has been at an advanced level.

$S&P 500 Index (.SPX.US)$ $SPDR S&P 500 ETF (SPY.US)$

If the S&P 500 was a train:

In one hand you are thinking “wow, the train has actually left the station”— then you wonder if the train is going to hold up at this speed. 🚊

Navigating the last two years has been at an advanced level.

$S&P 500 Index (.SPX.US)$ $SPDR S&P 500 ETF (SPY.US)$

2

- $Microsoft (MSFT.US)$ rises as ousted OpenAI CEO set to join company

- $Bristol-Myers Squibb (BMY.US)$ down as Bayer's anti-clotting drug trial fails

- Indexes up: $Dow Jones Industrial Average (.DJI.US)$ 0.58%, $S&P 500 Index (.SPX.US)$ 0.74%, $Nasdaq Composite Index (.IXIC.US)$ 1.13%

Wall Street's three major stock averages closed higher on Monday with Nasdaq's 1% rally leading the charge as heavyweight Microsoft hit a record high afte...

- $Bristol-Myers Squibb (BMY.US)$ down as Bayer's anti-clotting drug trial fails

- Indexes up: $Dow Jones Industrial Average (.DJI.US)$ 0.58%, $S&P 500 Index (.SPX.US)$ 0.74%, $Nasdaq Composite Index (.IXIC.US)$ 1.13%

Wall Street's three major stock averages closed higher on Monday with Nasdaq's 1% rally leading the charge as heavyweight Microsoft hit a record high afte...

6

Noorullah Lodin : Nice