Latest

Hot

GDP for the third quarter came in at 5.2% all said and done, after the Bureau of Economic Analysis posted the results Wednesday Morning.

2

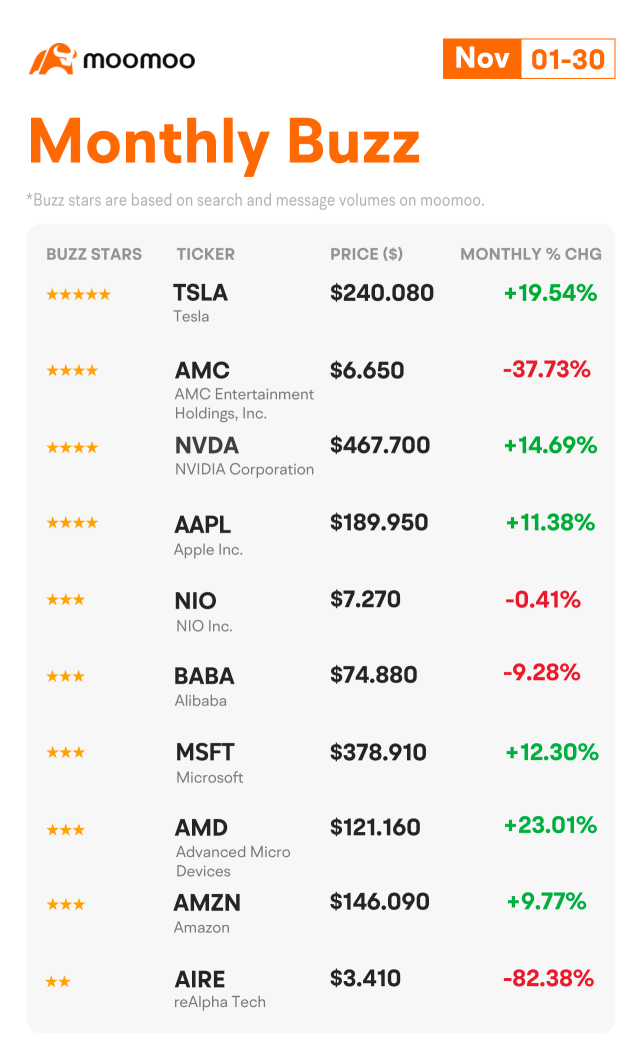

Hey, mooers! Welcome back to Monthly Buzz. ![]()

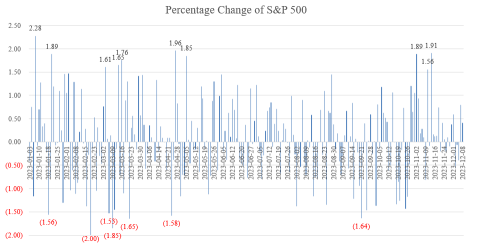

To sum up, the US stocks notched their best month this year.![]() The Dow closed out November with an 8.8% gain, breaking its three-month losing streak. The S&P 500 rose 8.9% in November, while the Nasdaq 100 advanced 10.7%. Both averages had their best monthly performance since July 2022, and were trading about 1% away from their respective 2023 highs.

The Dow closed out November with an 8.8% gain, breaking its three-month losing streak. The S&P 500 rose 8.9% in November, while the Nasdaq 100 advanced 10.7%. Both averages had their best monthly performance since July 2022, and were trading about 1% away from their respective 2023 highs.

After the Fed held interest rates steady for a second-s...

To sum up, the US stocks notched their best month this year.

After the Fed held interest rates steady for a second-s...

35

3

Markets are rejoicing the Fed is done with hikes, now bets skyrocket that the Fed can move to a cutting cycle. The 'bullish tone' seems validated for now, but before we 'pass go', with the December effect beckoning the best month for equity returns, markets need to pass through a few hoops this week. We cover the speed bumps to watch, but importantly why US equites, Bitcoin and Gold will likely continue to rally this...

31

The Bureau of Economic Analysis will release the Personal Consumption Expenditure and the price index at 8:30 ET on Thursday. The price index is expected to drop to 3.1% YoY in October from 3.4% in September, and the core PCE price index is expected to fall back to 3.5%.

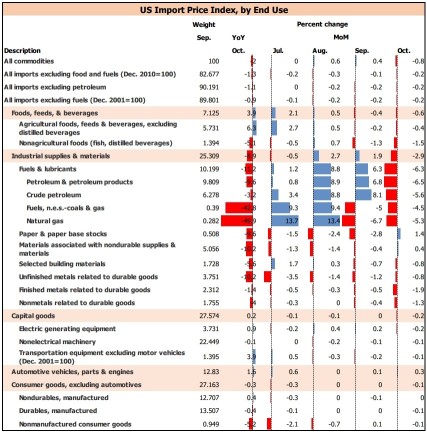

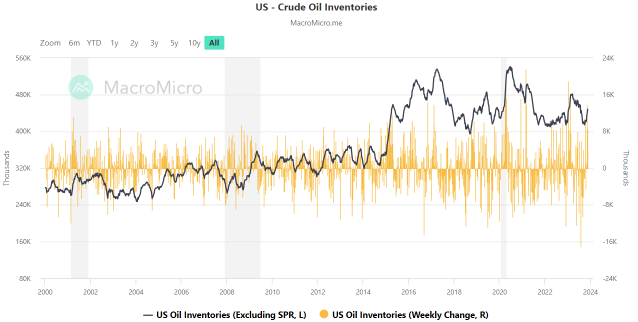

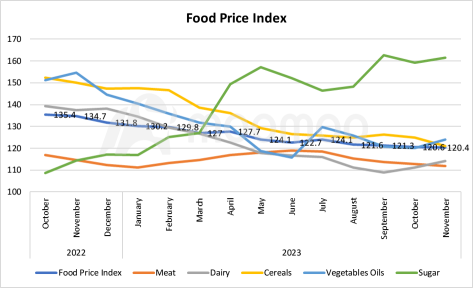

■ Import prices continue to ease inflationary pressures.

The decline in import prices in October was one of the key reasons that kept pushing...

■ Import prices continue to ease inflationary pressures.

The decline in import prices in October was one of the key reasons that kept pushing...

+2

15

9

Historically, December has been a month where investors need not worry about stock market performance, especially in pre-presidential election years. While the initial weeks may experience some instability due to tax loss selling and November's momentum, December generally yields positive results for investors, according to the Stock Trader's Almanac by Jeffrey Hirsch.

Check out key events in December here:

$S&P 500 Index (.SPX.US)$ $Dow Jones Industrial Average (.DJI.US)$ $NASDAQ 100 Index (.NDX.US)$ $Nasdaq Composite Index (.IXIC.US)$

Check out key events in December here:

$S&P 500 Index (.SPX.US)$ $Dow Jones Industrial Average (.DJI.US)$ $NASDAQ 100 Index (.NDX.US)$ $Nasdaq Composite Index (.IXIC.US)$

26

2

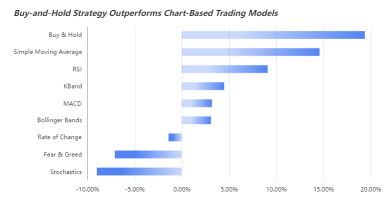

Columns Buy-and-Hold Strategy has Outshone Chart-Based Trading: Will it Continue to Dominate in 2024?

Despite facing a series of challenges such as aggressive interest rate hikes by the Federal Reserve, economic recession risks, banking crises, and geopolitical conflict, U.S. stocks have still delivered impressive results this year. The $S&P 500 Index (.SPX.US)$ has surged almost 20% so far, far surpassing its 20-year average annual return of nearly 10%. According to Bloomberg data, amidst the strong rall...

+1

21

4

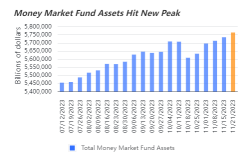

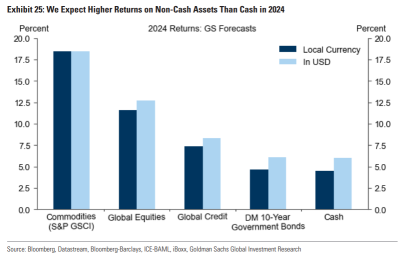

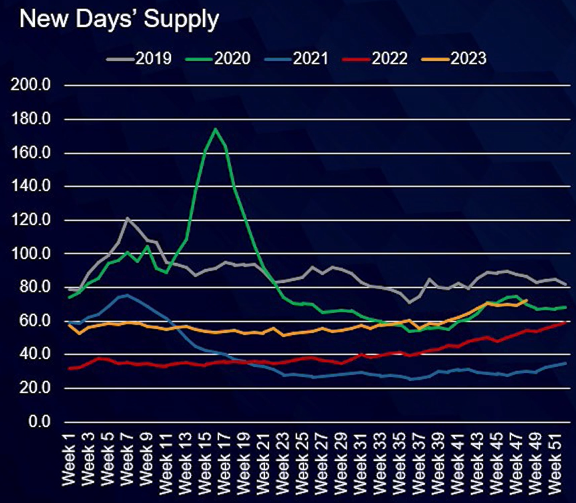

Columns Is Cash No Longer King? Record Money-Market Fund Assets Poised to Drive Up Risk Asset Prices

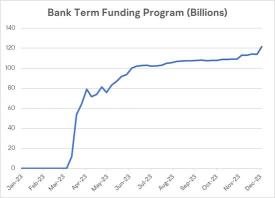

More than a year after the Fed's tightening monetary policy, more and more money has flowed into attractive money market funds, and the regional banking crisis that broke out in March accelerated the pace. The latest data from the Investment Company Institute (ICI) shows that investors now hold $5.7 trillion in money market funds, marking another milestone high.

With optimistic expectations for easing mon...

With optimistic expectations for easing mon...

24

2

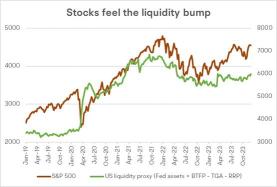

As of December 11th, the Dow Jones hit its highest level since January last year, and the S&P 500 index surged to 4622.44, reaching a new high in at least 20 months.

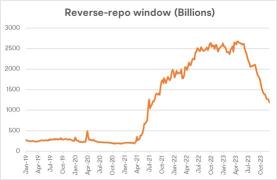

We can all see that interest rates are peaking, inflation is slowing down, profits are rising, and sentiment is improving.But there is another way to explain the rebound in stocks: liquidity.

Source: FRED, S&P 500

US liquidity proxy...

We can all see that interest rates are peaking, inflation is slowing down, profits are rising, and sentiment is improving.But there is another way to explain the rebound in stocks: liquidity.

Source: FRED, S&P 500

US liquidity proxy...

24

The Bureau of Labor Statistics will release the US November CPI at 8:30 ET on Tuesday. Bloomberg data shows YoY CPI inflation will fall to 3.1% (vs. 3.2% prior), with annual core inflation remaining at 4.0%. On a month-on-month basis, headline CPI inflation may remain unchanged, and core CPI may register a 0.3% increase.

■ Year-ahead inflation expectations fell to lowest since 2021

In the latest University of Michigan consumer ...

■ Year-ahead inflation expectations fell to lowest since 2021

In the latest University of Michigan consumer ...

+3

24

RECAP

The Dow Jones Industrial Average shot higher Thursday, hitting its highest intraday level of 2023, while the S&P 500 and Nasdaq wavered in the final trading day of November.

The $Dow Jones Industrial Average (.DJI.US)$ raised 520 points, or 1.47% to end the month on a high note. Though wavering to just a 0.38% gain Thursday, the $S&P 500 Index (.SPX.US)$ rose 8.9% in November. The $Nasdaq Composite Index (.IXIC.US)$ fell 0.23%, an...

The Dow Jones Industrial Average shot higher Thursday, hitting its highest intraday level of 2023, while the S&P 500 and Nasdaq wavered in the final trading day of November.

The $Dow Jones Industrial Average (.DJI.US)$ raised 520 points, or 1.47% to end the month on a high note. Though wavering to just a 0.38% gain Thursday, the $S&P 500 Index (.SPX.US)$ rose 8.9% in November. The $Nasdaq Composite Index (.IXIC.US)$ fell 0.23%, an...

22

1