Latest

Hot

Hi mooers,

Ready to let your uninvested money work for you? With market fluctuations, having some liquid assets may be a move to consider—and we've got exciting news for you!

By joining the Moomoo Cash Sweep Program, you can earn a remarkable 5.1% APY on those funds.

Interested? Let's dive in!![]()

What's Moomoo Cash Sweep?

It's a cash management feature of the brokerage account from Moomoo Financial Inc. ("MFI"). When you enroll, ...

Ready to let your uninvested money work for you? With market fluctuations, having some liquid assets may be a move to consider—and we've got exciting news for you!

By joining the Moomoo Cash Sweep Program, you can earn a remarkable 5.1% APY on those funds.

Interested? Let's dive in!

What's Moomoo Cash Sweep?

It's a cash management feature of the brokerage account from Moomoo Financial Inc. ("MFI"). When you enroll, ...

162

54

The CPI will send alerts in two months. U have a magnetic compass being confused by all the elements that affect prices of commodities creating a rising CPI

I am still calling for a Recession by Bideconomics

I am still calling for a Recession by Bideconomics

$E-mini NASDAQ 100 Futures(DEC4) (NQmain.US)$ dam funny cpi goes up, PPI goes down. means it cost lesser to produce by the business but they charge more for the same thing to the customers, aka price gauge.

expect old man in diapers to come out and talk the inflation down.

expect old man in diapers to come out and talk the inflation down.

1

14

The US CPI data yesterday was a bit of a setback but even then, traders managed to pull a 180° to the reaction after.

That says a lot about the market appetite and which way the overwhelming bias in broader markets is leaning towards. We're not quite returning to the November and December sentiment just yet but all it would take is a little nudge to get this market going again.

For now, the fact that yiel...

That says a lot about the market appetite and which way the overwhelming bias in broader markets is leaning towards. We're not quite returning to the November and December sentiment just yet but all it would take is a little nudge to get this market going again.

For now, the fact that yiel...

2

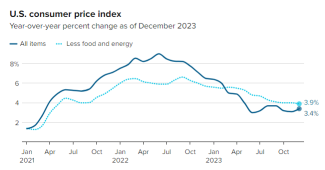

CPI y/y +3.4% versus 3.2% expected

Prior y/y 3.1%

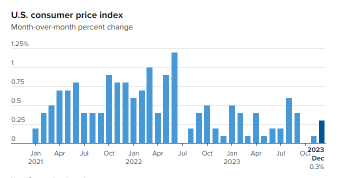

CPI m/m +0.3% versus +0.2% expected

Prior m/m 0.1%

Core measures:

Core CPI m/m +0.3% versus +0.3% expected. Last month 0.3%

Core CPI y/y 3.4% versus 3.8% expected. Last month was 4.0%

Shelter +0.4% versus +0.4% last month

Shelter y/y +6.2% vs +6.5% prior

Services less rent of shelter +0.6% m/m vs +0.6% prior (y/y vs +3.5% y/y prior)

Core services ex housing +0.4% vs +0.44% m/m prior

Real weekly earnings -...

Prior y/y 3.1%

CPI m/m +0.3% versus +0.2% expected

Prior m/m 0.1%

Core measures:

Core CPI m/m +0.3% versus +0.3% expected. Last month 0.3%

Core CPI y/y 3.4% versus 3.8% expected. Last month was 4.0%

Shelter +0.4% versus +0.4% last month

Shelter y/y +6.2% vs +6.5% prior

Services less rent of shelter +0.6% m/m vs +0.6% prior (y/y vs +3.5% y/y prior)

Core services ex housing +0.4% vs +0.44% m/m prior

Real weekly earnings -...

2

The consumer price index increased 0.3% in December and 3.4% from a year ago, compared with respective estimates of 0.2% and 3.2%

Excluding volatile food and energy prices, the so-called core CPI also rose 0.3% for the month and 3.9% from a year ago, compared with respective estimates of 0.3% and 3.8%.

Much of the increase came due to rising shelter costs. The category rose 0.5% for the month and accounte...

Excluding volatile food and energy prices, the so-called core CPI also rose 0.3% for the month and 3.9% from a year ago, compared with respective estimates of 0.3% and 3.8%.

Much of the increase came due to rising shelter costs. The category rose 0.5% for the month and accounte...

2

RECAP

Stocks Struggle to Find a Direction

US stocks fluctuated before closing little changed Thursday as investors gauge how the latest data on inflation and jobless claims would influence the path of interest rates in the US.

The $S&P 500 Index (.SPX.US)$ index traded between 4,739.58 and 4,798.50 before ending the day down 0.07%. The $Nasdaq Composite Index (.IXIC.US)$ closed flat while the $Dow Jones Industrial Average (.DJI.US)$ ...

Stocks Struggle to Find a Direction

US stocks fluctuated before closing little changed Thursday as investors gauge how the latest data on inflation and jobless claims would influence the path of interest rates in the US.

The $S&P 500 Index (.SPX.US)$ index traded between 4,739.58 and 4,798.50 before ending the day down 0.07%. The $Nasdaq Composite Index (.IXIC.US)$ closed flat while the $Dow Jones Industrial Average (.DJI.US)$ ...

19

$NVIDIA (NVDA.US)$ higher inflation than expected - although still not bad. I think the market will rebound once it tempers emotions

2

$Tesla (TSLA.US)$ the Dec cpi data only lowers the anticipation of rate cut in Mar, but Fed never confirmed any schedule yet, so don’t fall in the trap and panic sell, wait for the strong bounce once the market digested the fearful sentiment, happened many times before. remember the rate cut will happen this year, Fed’s job is beating inflation and maximizing employment rate, not killing the economy.

1

S&P 500 Futures have not looked favorably on the Dec CPI release, selling off the minor gains of the morning. The market was likely looking for more easing in shelter/services inflation which did not materialize.

$SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$

$SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$

1

1

Kenkkk : 5.1% APY is amazing! I will invite my friends to Moomoo to start the plan. It's a good deal.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

crazypeter1019 : Sounds sweet

jhon7 : handy

Tware47 :

Piggy Bank Trader : If I’m a moomoo customer already, why am I not automatically enrolled? Why as a LOYAL customer whom already is and has been with a company always asked to do more?

Why do I have to refer a friend or deposit an additional $500 to participate? This is a slap in the face for loyalty. Neither of the two are requirements are difficult, but still a requirement.

View more comments...